Over the last few years, concerns have been raised that the existing international taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals generally pay corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. where production occurs rather than where consumers or, specifically for the digital sector, users are located. However, some argue that through the digital economy, businesses (implicitly) derive income from users abroad but, without a physical presence, are not subject to corporate income tax in that foreign country.

To address these concerns, the Organisation for Economic Co-operation and Development (OECD) has been hosting negotiations with more than 140 countries to adapt the international tax system. The proposal, referred to as Pillar One, would require some of the world’s largest multinational businesses to pay some of their income taxes where their consumers are located.

Pillar One would replace some existing norms for taxing multinationals and run counter to some policies that countries have put in place to tax digital companies in recent years. The most common form is a digital services tax (DST), which is a tax on selected gross revenue streams of large digital companies.

Because Pillar One is focused on changing where profits are taxed, including for many large digital companies, DSTs are expected to be repealed. While the OECD hasn’t completely dropped Pillar One, the negotiations have failed to result in an agreement that would eliminate DSTs. Additionally, in March 2024, the US Treasury held a public hearing where a Joint Committee on Taxation staff report was discussed showing that Pillar One would result in a loss in US federal receipts of $1.2 billion. More recently, President Trump has revived trade threats against foreign DSTs and included them in his “Fair and Reciprocal Plan” for US trade relations.

On October 21, 2021, a joint statement from Austria, France, Italy, Spain, the United Kingdom, and the United States laid out a plan to roll back DSTs and retaliatory tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. threats once the Pillar One rules were implemented. Turkey subsequently agreed to the same terms. However, this agreement has also lapsed.

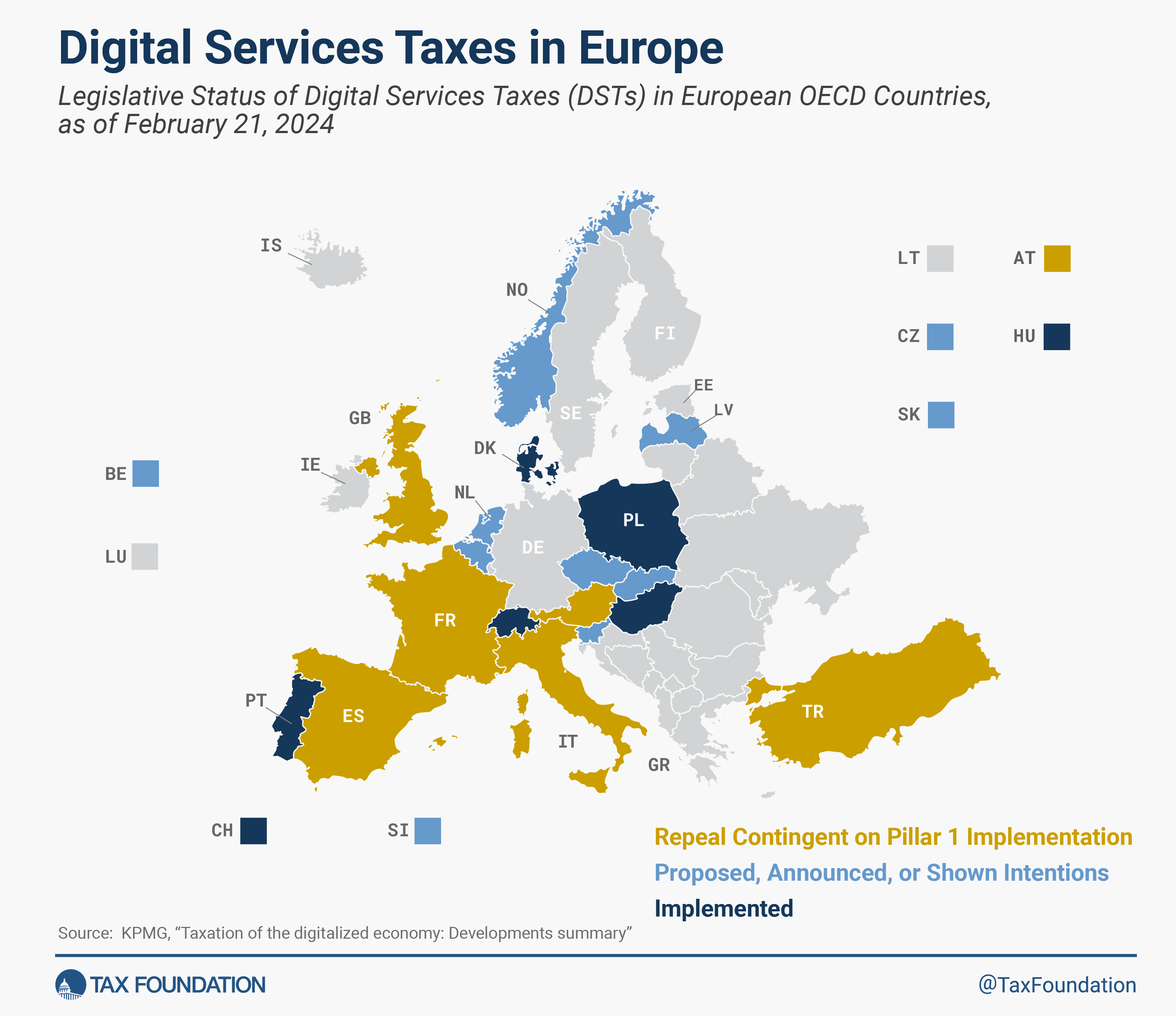

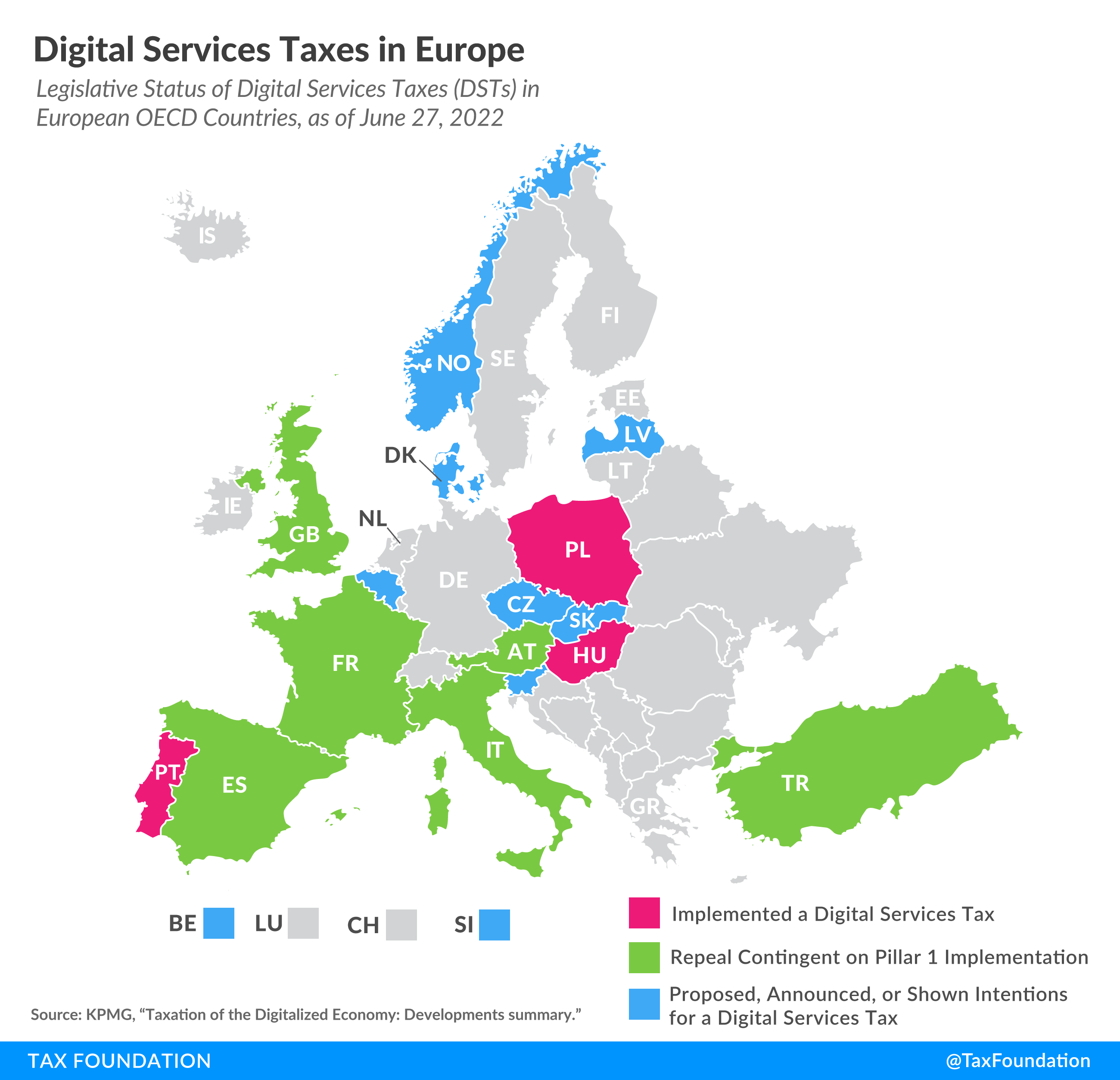

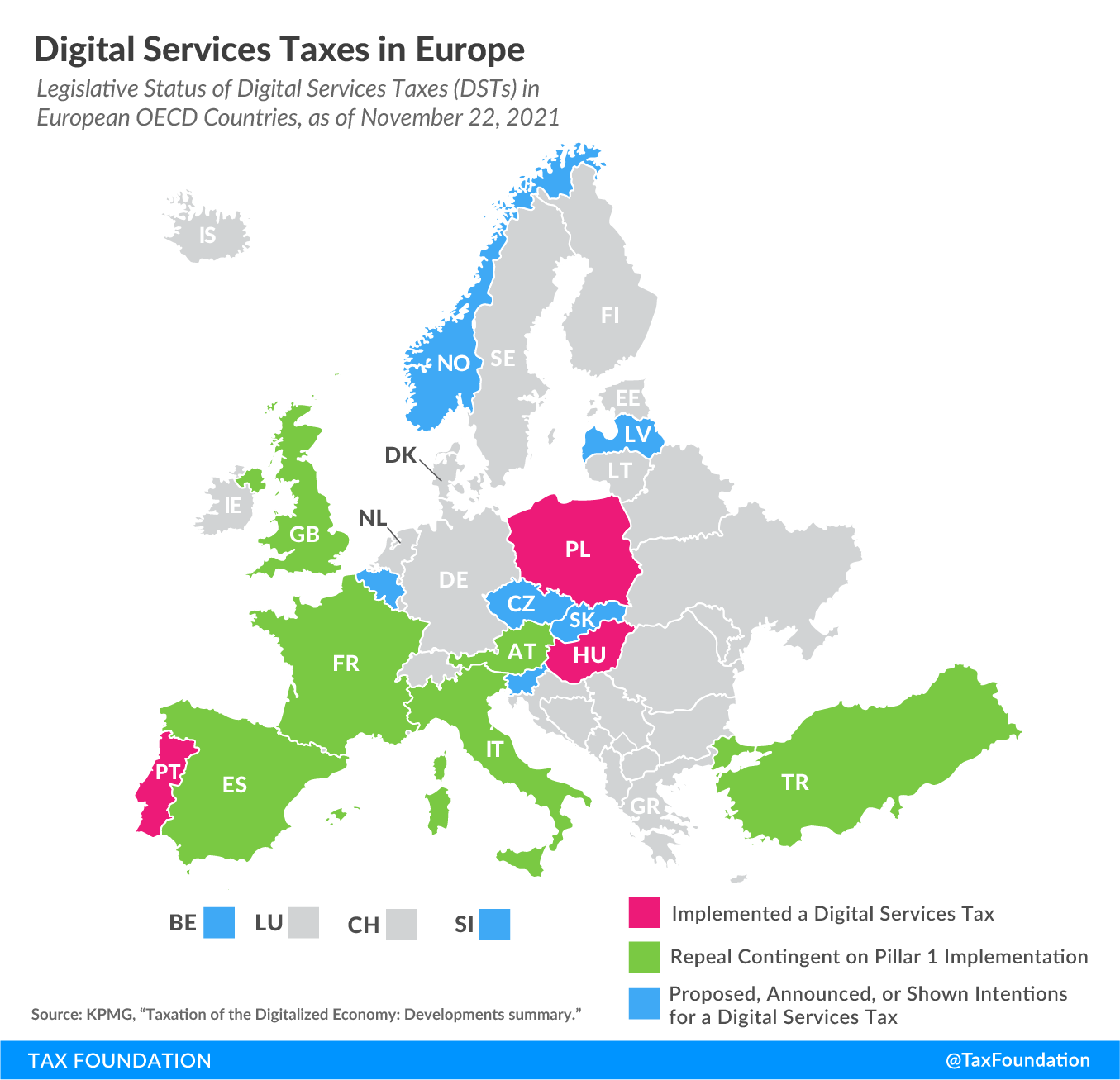

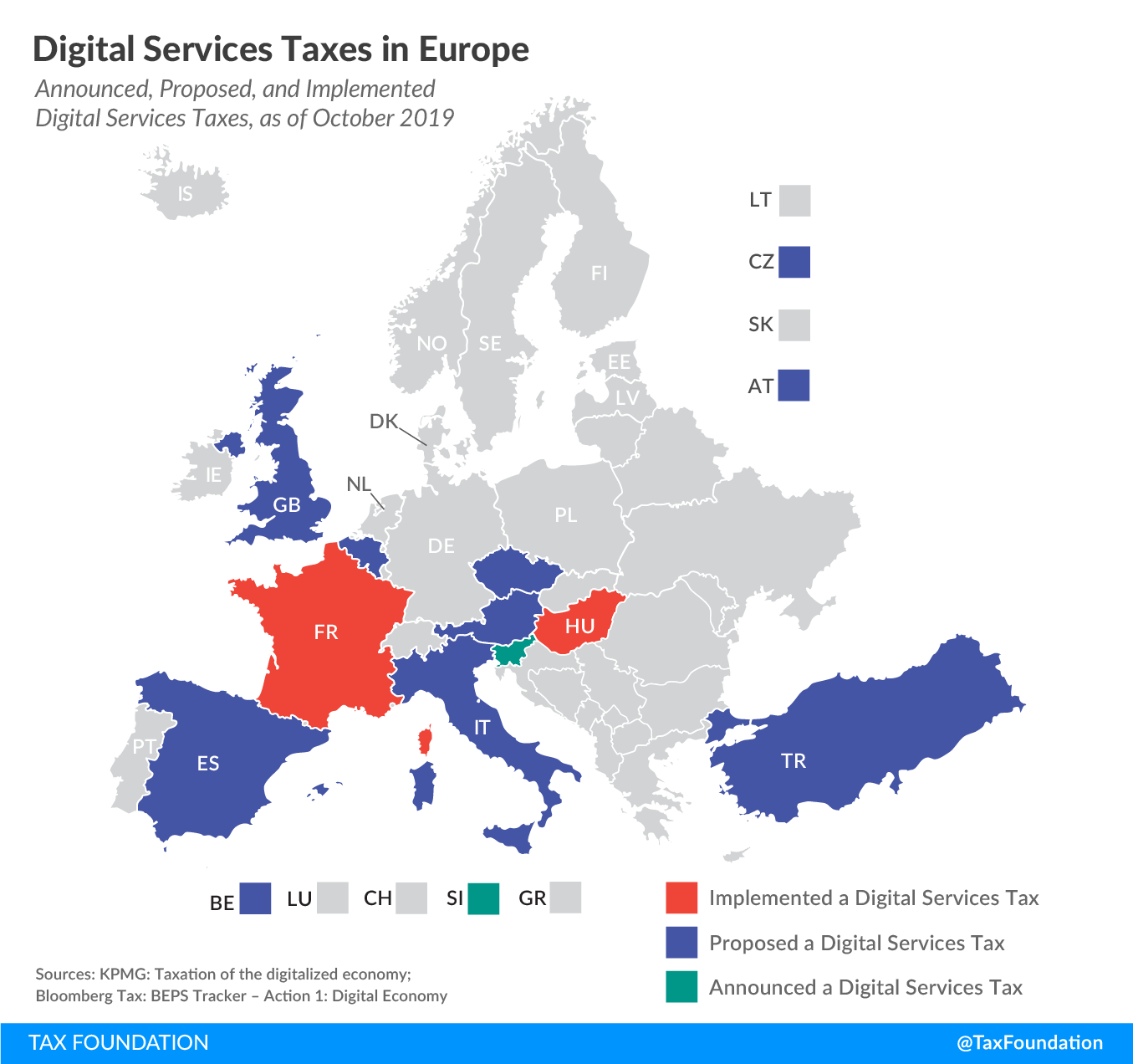

Currently, about half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the United States responded with retaliatory tariff threats, urging countries to abandon their DSTs.

Digital Taxes in Europe, 2025

Announced, Proposed, and Implemented Digital Services Taxes, as of May 2025

| Country | Tax Rate | Scope | Global Revenue Threshold | Domestic Revenue Threshold | Status |

|---|---|---|---|---|---|

| Austria (AT) | 5% | Online advertising | EUR 750 million (USD 801 million) | EUR 25 million (USD 27 million) | Implemented (Effective from January 1, 2020); joined statement on October 21, 2021, that repeal of the DST would be contingent on Pillar One implementation. |

| Belgium (BE) | 3% | · Selling of user data · Selling advertising space on a digital platform · Digital intermediation services facilitating the exchange of supplies of goods or services | EUR 750 million (USD 801 million) | EUR 5 million (USD 5.3 million) | Announced/Shows Intention (A DST was first introduced in January 2019 but was rejected in March 2019; an adjusted DST proposal was reintroduced in June 2020. On January 31, 2025, five Belgian political parties agreed on a coalition program outlining their position on a DST). Expected to introduce one if global or European consensus is not reached by 2027. |

| Czech Republic (CZ) | 5% | · Online advertising · Transmission of user data · Digital interface to facilitate the provision of supplies of goods and services among users | EUR 750 million (USD 801 million) | CZK 100 million (USD 4.2 million) | Proposed/Stalled (There was a proposed amendment to reduce the tax rate from 7% to 5%. However, the discussion on the bill has stalled and there is support for a DST solution at the OECD level). |

| Denmark (DK) | 2% (3% surcharge) | On-demand, audio-visual media service providers | DKK 15 million (USD 2.2 million) or audience constituting more than 1% of the total number of users of streaming services in Denmark | Implemented (Effective from January 1, 2024. There is an additional 3% surcharge for companies that invest less than 5% of their Danish revenues in Danish content. As of May 20, 2024, Denmark has introduced a revised version of its Digital Services Tax (DST). The bill is expected to be fully implemented by early 2025, allowing companies to adapt to the new regulations). | |

| Finland (FI) | The Finance Ministers of Denmark, Finland, and Sweden released a joint statement on digital tax, indicating that the digital and traditional economy should be taxed where value is created, and any solution reached should be a consensus-based OECD solution. | ||||

| France (FR) | 3% 1.20% | · Provision of a digital interface · Advertising services based on users’ data Paid and free access to recorded music and online music videos | EUR 750 million (USD 801 million) | EUR 25 million (USD 27 million) EUR 20 million (USD 21.4 million) | Implemented (Retroactively applicable as of January 1, 2019. The 2020 DST collection was delayed to the end of 2020); joined statement on October 21, 2021, that repeal of the DST would be contingent on Pillar One implementation. Implemented (January 1, 2024. Due on amounts exceeding EUR 20 million). |

| Hungary (HU) | 7.50% | Advertising revenue | HUF 100 million (USD 271,810) | Implemented (As a temporary measure, the advertisement tax rate has been reduced to 0%, effective from July 1, 2019, through December 31, 2024). | |

| Italy (IT) | 3% | · Advertising on a digital interface · Multilateral digital interface that allows users to buy/sell goods and services · Transmission of user data generated from using a digital interface | Implemented (Effective from January 1, 2020. In November 2022; on October 15, 2024, the Italian government approved the draft 2025 Budget Law, which eliminated from January 2025 the revenue thresholds, which required companies to have worldwide revenues of at least EUR 750 million and at least EUR 5.5 million from digital services in Italy to be liable for DST). Joined statement on October 21, 2021, that repeal of the DST would be contingent on Pillar One implementation. On March 20, 2024, the Italian Economy Minister announced that Italy might retain and modify its DST if Pillar One is not implemented. | ||

| Latvia (LV) | 3% | - | - | - | Announced/Shows Intention (The Latvian government commissioned a study to determine the increase of tax revenue based on the assumption that the country levies a 3% DST. However, no further action has been taken for now). |

| Netherlands (NL) | On October 24, 2023, the Dutch State Secretary wrote to the Dutch Parliament saying that an EU DST should be considered as an alternative to the OECD’s Pillar One, Amount A if a global agreement is not reached. | ||||

| Norway (NO) | - | - | - | - | Announced/Shows Intention (Norway plans to introduce a unilateral measure if the OECD does not reach a consensus solution; no announcements since the inclusive framework agreement). |

| Poland (PL) | 1.50% | Audiovisual media service and audiovisual commercial communication | - | - | Implemented (Effective from July 2020; there is a separate proposal to introduce a 7% levy on digital sector enterprises with a significant digital presence in the territory of Poland. Additionally, a 5% levy on advertisement revenues is also discussed). |

| Portugal (PT) | 4%, 1% | Audiovisual commercial communication on video-sharing platforms (4%), subscriptions for video-on-demand services | Implemented (Effective from February 2021). | ||

| Slovakia (SK) | - | - | Announced/Shows Intention (The Ministry of Finance opened a consultation on a proposal to introduce a DST on revenue of nonresidents from provision of services such as advertising, online platforms, and sale of user data. However, there were no further steps taken). | ||

| Slovenia (SI) | - | - | - | - | Announced/Shows Intention (The Ministry of Finance announced a government proposal to submit a draft bill to the National Assembly introducing a digital services tax by April 1, 2020; however, there has been no development so far). |

| Spain (ES) | 3% | · Online advertising services · Sale of online advertising · Sale of user data | EUR 750 million (USD 801 million) | EUR 3 million (USD 3.2 million) | Implemented (Effective from January 16, 2021); joined statement on October 21, 2021, that repeal of the DST would be contingent on Pillar One implementation. |

| Sweden (SE) | The Finance Ministers of Denmark, Finland, and Sweden released a joint statement on digital tax, indicating that the digital and traditional economy should be taxed where value is created, and any solution reached should be a consensus-based OECD solution. | ||||

| Switzerland (CH) | 4% | Gross income generated in Switzerland from streaming or television services | CHF 2.5 million (USD 2.75 million) | Implemented (Effective from January 1, 2024). | |

| Turkey (TR) | 7.50% | Online services including advertisements, sales of content, and paid services on social media websites | EUR 750 million (USD 801 million) | TRY 20 million (USD 615,896) | Implemented (Effective from March 1, 2020; the president can reduce the DST rate as low as 1% or increase it as much as 15%); agreed to same terms of the joint statement on October 21, 2021, that repeal of the DST would be contingent on Pillar One implementation. |

| United Kingdom (GB) | 2% | · Social media platforms · Internet search engine · Online marketplace | GBP 500 million (USD 623 million) | GBP 25 million (USD 31.2 million) | Implemented (Retroactively applicable as of April 1, 2020); joined statement on October 21, 2021, that repeal of the DST would be contingent on Pillar One implementation. The UK Treasury agreed to develop a contingency plan if the country’s DST needs to be extended beyond 2025. |

Source: KPMG, “Taxation of the digitalized economy: Developments summary,” last updated Apr. 14, 2025, https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2023/digitalized-economy-taxation-developments-summary.pdf.

Data compiled by Cristina Enache

Austria, Denmark, France, Hungary, Italy, Poland, Portugal, Spain, Switzerland, Turkey, and the United Kingdom have implemented a DST. Belgium, the Czech Republic, Latvia, Norway, Slovakia, and Slovenia have either officially announced or shown intentions to implement such a tax.

The proposed and implemented DSTs differ significantly in their structure. For example, while Austria and Hungary only tax revenues from online advertising (to similarly tax online and offline advertising) and Denmark’s DST applies only to streaming services, France’s tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. is much broader, including revenues from the provision of a digital interface, targeted advertising, and the transmission of data collected about users for advertising purposes. The tax rates range from 1.5 percent in Poland to 7.5 percent in both Hungary and Turkey (although Hungary’s tax rate was reduced to 0 percent up to December 2024, at which point it reverted to 7.5 percent).

These DSTs were generally considered to be interim measures until an agreement could be reached at the OECD level. However, following President Trump’s opposition to the OECD global tax deal, discussions have resurfaced around the European Commission’s proposal for an EU DST, while some countries are considering repealing their DSTs. At the same time, the United Nations has added special provisions for income from automated digital services to the UN Model Tax Convention (see Article 12B), which would apply to treaty parties who agree to its inclusion. Additionally, the terms of reference approved last November commit the UN to begin talks on a treaty to enhance tax cooperation and wrap up negotiations by 2027.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe