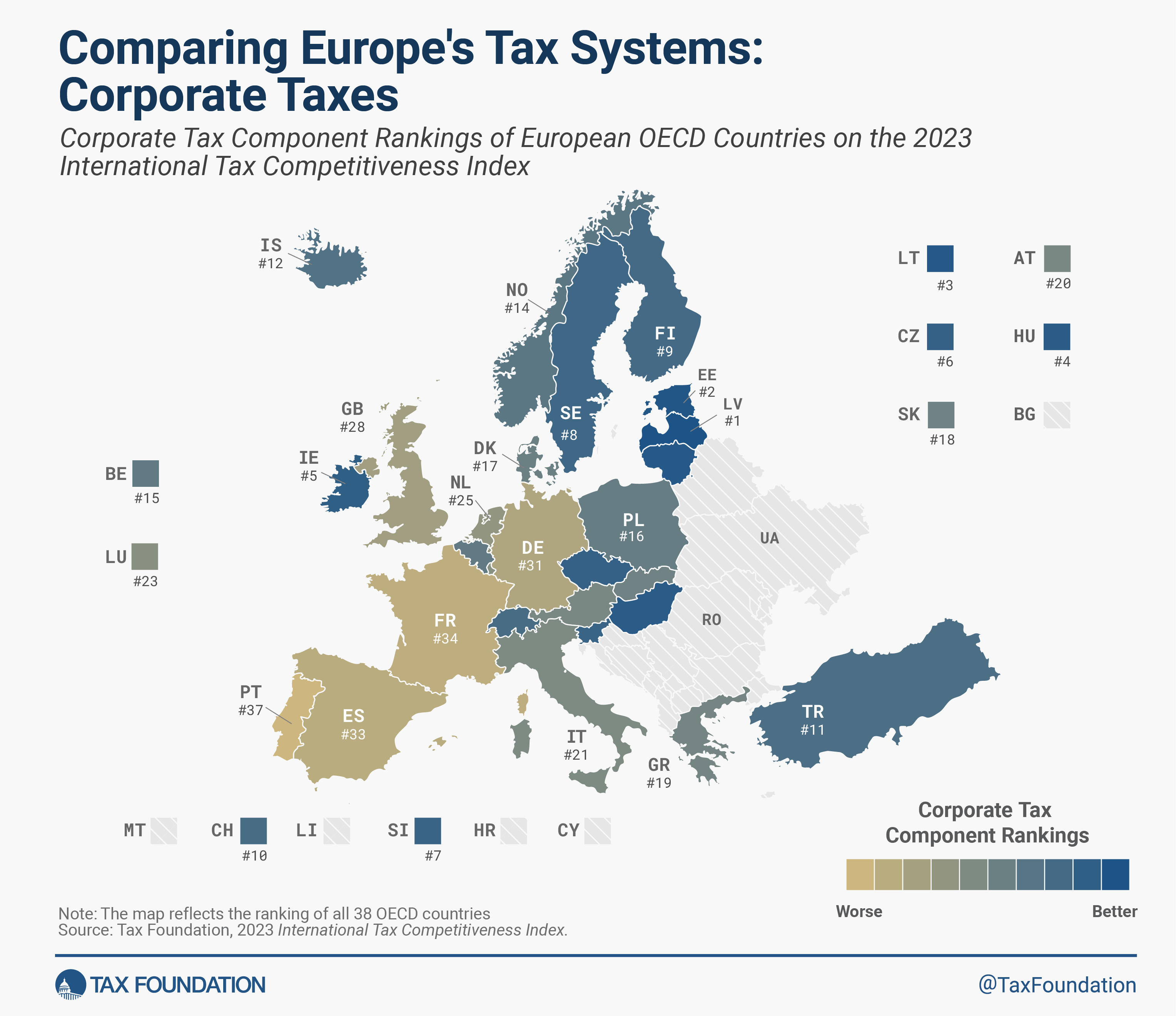

Comparing Europe’s Tax Systems: Corporate Taxes

3 min readBy:On October 19, we released the International TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Competitiveness Index 2023, a study that measures and compares the competitiveness and neutrality of all 38 Organisation for Co-operation and Development (OECD) countries’ tax systems. In the coming weeks, we will illustrate how European OECD countries rank on each of the five components of the Index: corporate income taxes, individual taxes, consumption taxes, property taxes, and cross-border rules. Today, we look at how European countries’ corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. systems compare within the OECD.

Unlike other studies that compare tax burdens, the Index measures how well a country structures its tax code. A tax code that is competitive and neutral promotes sustainable economic growth and investment and raises revenue for government priorities with minimal distortions. Our corporate income tax component scores countries not only on their corporate tax rates but also on how they handle net operating losses, capital allowances, inventory valuation, and allowances for corporate equity; whether and to what extent distortionary patent boxes and research and development (R&D) tax incentives are granted; the application of digital services taxes; and the complexity of the corporate income tax.

Click here to see an interactive version of OECD countries’ corporate tax rankings, then click on your country for more information about its tax system’s strengths and weaknesses.

Latvia and Estonia have the best corporate tax systems in the OECD. Both countries have a cash-flow tax on business profits. This means that profits only get taxed when they are distributed to shareholders. If a business decides to retain or reinvest its profits instead of paying dividends to shareholders, there is no tax on such profits.

In contrast, Portugal has the least competitive and neutral corporate income tax system in Europe (Colombia ranks the lowest in the OECD). At 31.5 percent, Portugal levies one of the highest combined corporate tax rates on business profits, including multiple surtaxes. Only limited net operating losses can be carried forward and carried back; purchases of machinery, buildings, and intangibles cannot be fully expensed.

To see whether your country’s corporate tax rank has improved in recent years, check out the table below. To learn more about how we determined these rankings, read our full methodology here.

Comparing Corporate Tax Systems in the OECD, 2023

Corporate Tax Component Rankings on the International Tax Competitiveness Index between 2020 and 2023 (for all OECD countries)

| Country | 2023 Rank | 2022 Rank | Change from 2022 to 2023 | 2021 Rank |

|---|---|---|---|---|

| Australia | 32 | 30 | -2 | 30 |

| Austria | 20 | 23 | 3 | 22 |

| Belgium | 15 | 14 | -1 | 14 |

| Canada | 24 | 27 | 3 | 26 |

| Chile | 35 | 12 | -23 | 18 |

| Colombia | 38 | 38 | 0 | 35 |

| Costa Rica | 36 | 37 | 1 | 37 |

| Czech Republic | 6 | 6 | 0 | 6 |

| Denmark | 17 | 18 | 1 | 17 |

| Estonia | 2 | 2 | 0 | 2 |

| Finland | 9 | 9 | 0 | 9 |

| France | 34 | 35 | 1 | 36 |

| Germany | 31 | 32 | 1 | 32 |

| Greece | 19 | 19 | 0 | 16 |

| Hungary | 4 | 4 | 0 | 5 |

| Iceland | 12 | 17 | 5 | 15 |

| Ireland | 5 | 5 | 0 | 4 |

| Israel | 13 | 16 | 3 | 12 |

| Italy | 21 | 25 | 4 | 27 |

| Japan | 30 | 33 | 3 | 31 |

| Korea | 26 | 29 | 3 | 29 |

| Latvia | 1 | 1 | 0 | 1 |

| Lithuania | 3 | 3 | 0 | 3 |

| Luxembourg | 23 | 24 | 1 | 24 |

| Mexico | 27 | 28 | 1 | 28 |

| Netherlands | 25 | 26 | 1 | 25 |

| New Zealand | 29 | 31 | 2 | 33 |

| Norway | 14 | 15 | 1 | 13 |

| Poland | 16 | 13 | -3 | 11 |

| Portugal | 37 | 36 | -1 | 38 |

| Slovak Republic | 18 | 21 | 3 | 20 |

| Slovenia | 7 | 7 | 0 | 7 |

| Spain | 33 | 34 | 1 | 34 |

| Sweden | 8 | 8 | 0 | 8 |

| Switzerland | 10 | 10 | 0 | 10 |

| Turkey | 11 | 20 | 9 | 23 |

| United Kingdom | 28 | 11 | -17 | 19 |

| United States | 22 | 22 | 0 | 21 |

Source: Tax Foundation, 2023 International Tax Competitiveness Index

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe