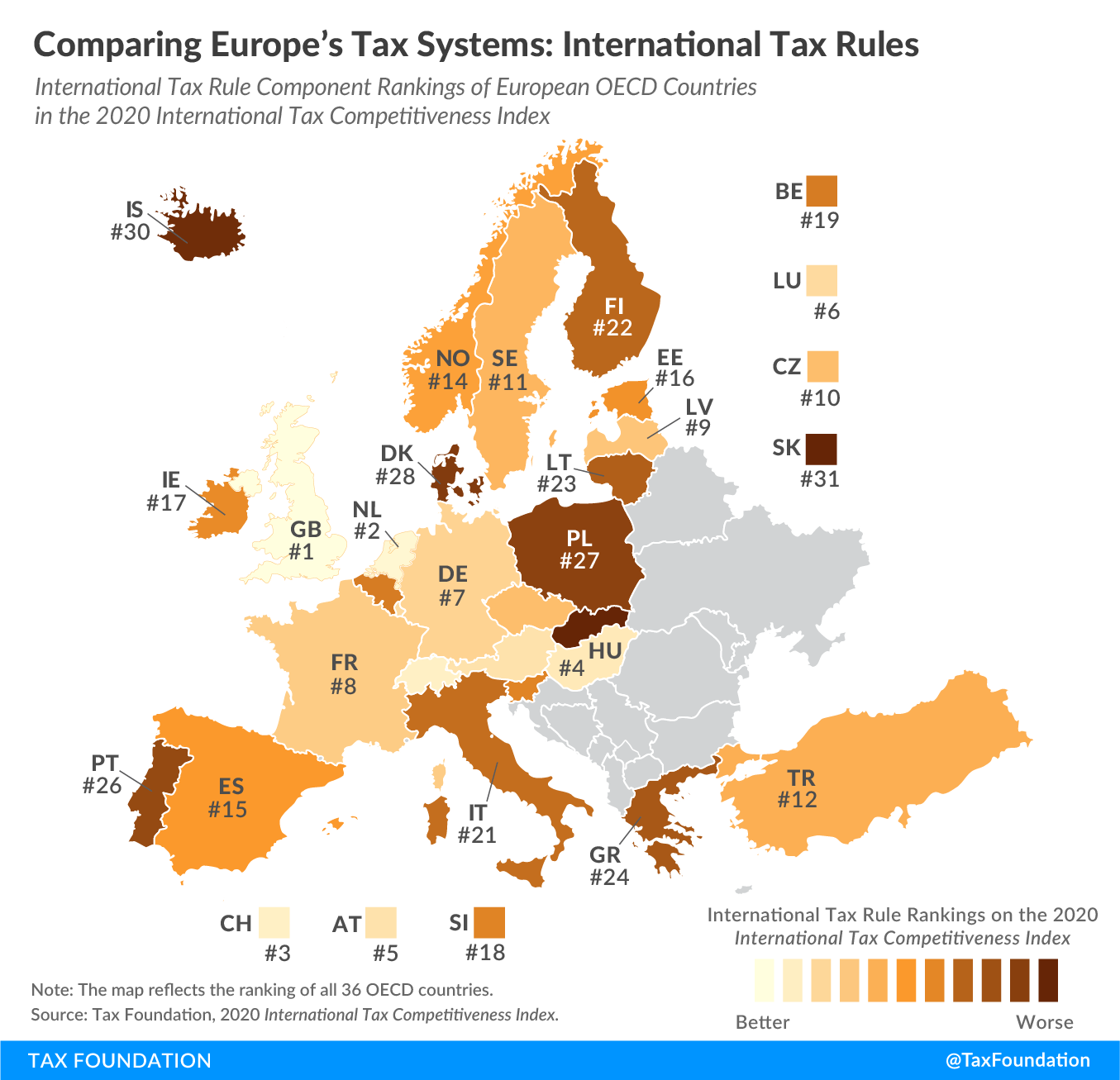

Comparing Europe’s Tax Systems: International Tax Rules

3 min readBy:Today’s map looks at how European OECD countries rank on international tax rules and is the last in our series examining each of the five components of our 2020 International Tax Competitiveness Index (ITCI). International tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code.

The ITCI’s international tax rules component compares various aspects of OECD countries’ international tax systems, namely territoriality, withholding taxes, tax treaties, and international tax regulations such as controlled foreign corporations (CFC) rules and thin-capitalization rules.

Territoriality defines the extent to which foreign-earned dividends and capital gains are included in the domestic tax base. Tax treaties align many tax laws between two countries and attempt to reduce double taxation, partly by reducing or eliminating withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount the employee requests. taxes on dividends, interest, and royalties earned by foreign individuals and businesses. CFC and thin-capitalization rules seek to prevent multinational businesses from minimizing their tax liability through base erosion and profit shifting.

The United Kingdom’s international tax system ranks highest in the OECD. Like most OECD countries, the UK operates a territorial tax system, fully exempting foreign-earned dividends and capital gains from domestic taxation. The UK has the broadest tax treaty network in the OECD, at around 130 countries. As a result, depending on the tax treaty, foreign entities from these countries are either not subject to the 20 percent withholding tax on interest and royalties earned in the UK or pay a reduced rate. There is no withholding tax on dividends. The UK has relatively strict CFC rules and thin-capitalization rules.

Among European OECD countries, Slovakia has the least competitive international tax system (Chile ranks the lowest in the OECD). While Slovakia excludes foreign-earned dividends and capital gains from its domestic tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , it levies a relatively high withholding tax of 35 percent on dividends (interest and royalties are subject to a 19 percent withholding tax). Slovakia’s tax treaty network consists of approximately 70 countries, and its CFC and thin-capitalization rules are relatively strict.

Click here to see an interactive version of OECD countries’ international tax rules rankings, then click on your country for more information about what the strengths and weaknesses of its tax system are and how it compares to the top and bottom five countries in the OECD.

To see whether your country’s international tax rules rank has improved in recent years, check out the table below. To learn more about how we determined these rankings, read our full methodology here.

| OECD Country | 2018 Rank | 2019 Rank | 2020 Rank | Change from 2019 to 2020 |

|---|---|---|---|---|

| Australia (AU) | 27 | 24 | 25 | -1 |

| Austria (AT) | 5 | 5 | 5 | 0 |

| Belgium (BE) | 10 | 8 | 19 | -11 |

| Canada (CA) | 18 | 15 | 13 | 2 |

| Chile (CL) | 36 | 36 | 36 | 0 |

| Czech Republic (CZ) | 7 | 11 | 10 | 1 |

| Denmark (DK) | 25 | 27 | 28 | -1 |

| Estonia (EE) | 12 | 17 | 16 | 1 |

| Finland (FI) | 21 | 21 | 22 | -1 |

| France (FR) | 13 | 10 | 8 | 2 |

| Germany (DE) | 9 | 7 | 7 | 0 |

| Greece (GR) | 32 | 29 | 24 | 5 |

| Hungary (HU) | 3 | 3 | 4 | -1 |

| Iceland (IS) | 31 | 30 | 30 | 0 |

| Ireland (IE) | 16 | 18 | 17 | 1 |

| Israel (IL) | 34 | 34 | 34 | 0 |

| Italy (IT) | 22 | 20 | 21 | -1 |

| Japan (JP) | 26 | 25 | 29 | -4 |

| Korea (KR) | 29 | 33 | 33 | 0 |

| Latvia (LV) | 11 | 9 | 9 | 0 |

| Lithuania (LT) | 19 | 23 | 23 | 0 |

| Luxembourg (LU) | 2 | 6 | 6 | 0 |

| Mexico (MX) | 35 | 35 | 35 | 0 |

| Netherlands (NL) | 1 | 2 | 2 | 0 |

| New Zealand (NZ) | 24 | 22 | 20 | 2 |

| Norway (NO) | 15 | 14 | 14 | 0 |

| Poland (PL) | 28 | 26 | 27 | -1 |

| Portugal (PT) | 30 | 28 | 26 | 2 |

| Slovak Republic (SK) | 23 | 31 | 31 | 0 |

| Slovenia (SI) | 20 | 19 | 18 | 1 |

| Spain (ES) | 17 | 16 | 15 | 1 |

| Sweden (SE) | 8 | 12 | 11 | 1 |

| Switzerland (CH) | 6 | 4 | 3 | 1 |

| Turkey (TR) | 14 | 13 | 12 | 1 |

| United Kingdom (GB) | 4 | 1 | 1 | 0 |

| United States (US) | 33 | 32 | 32 | 0 |

Note: This is part of a map series in which we examine each of the five components of our 2020 International Tax Competitiveness Index.