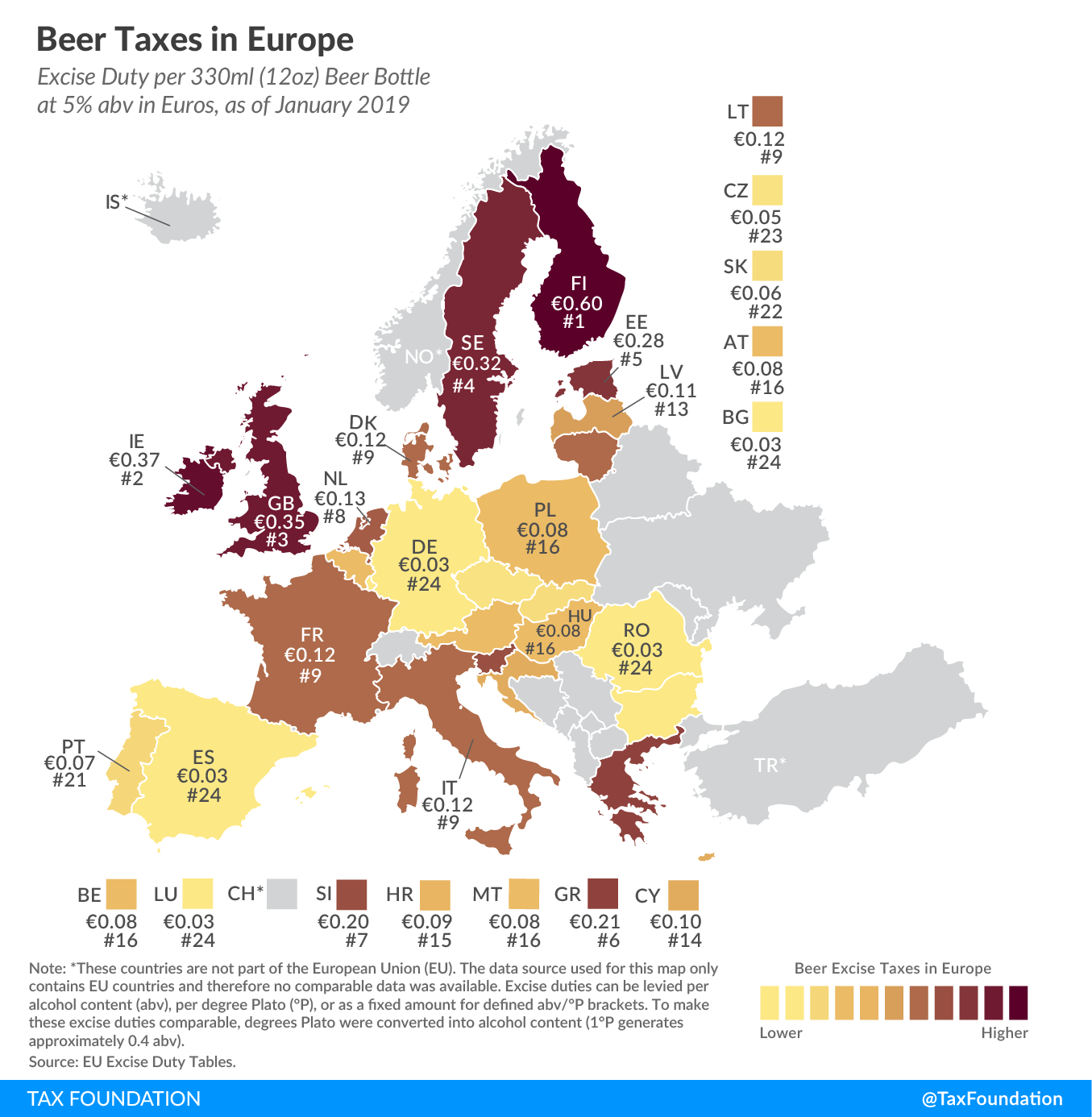

Beer Taxes in Europe, 2019

2 min readBy:According to EU law, every EU country is required to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content (abv), translating to approximately €0.03 per 330ml (12oz) beer bottle at 5% abv. As today’s map shows, only a few EU countries stick to the minimum rate, while most countries have decided to levy much higher excise duties.

As is the case with wine taxes, Finland, Ireland, and the United Kingdom are the EU countries levying the highest excise duties on beer. You’ll find the highest beer tax in Finland, at €0.60 per 330ml beer bottle. Ireland and the United Kingdom are second and third, at €0.37 and €0.35, respectively.

Bulgaria, Germany, Luxembourg, Romania, and Spain are the only countries levying EU’s minimum rate of €0.03 per beer bottle.

All European countries also levy a value-added tax (VAT) on beer. The excise amounts shown in the map above relate only to excise taxes and do not include the VAT, which is charged on the sales value of a beer bottle.

Note: This is part of a map series in which we examine excise taxes in Europe.