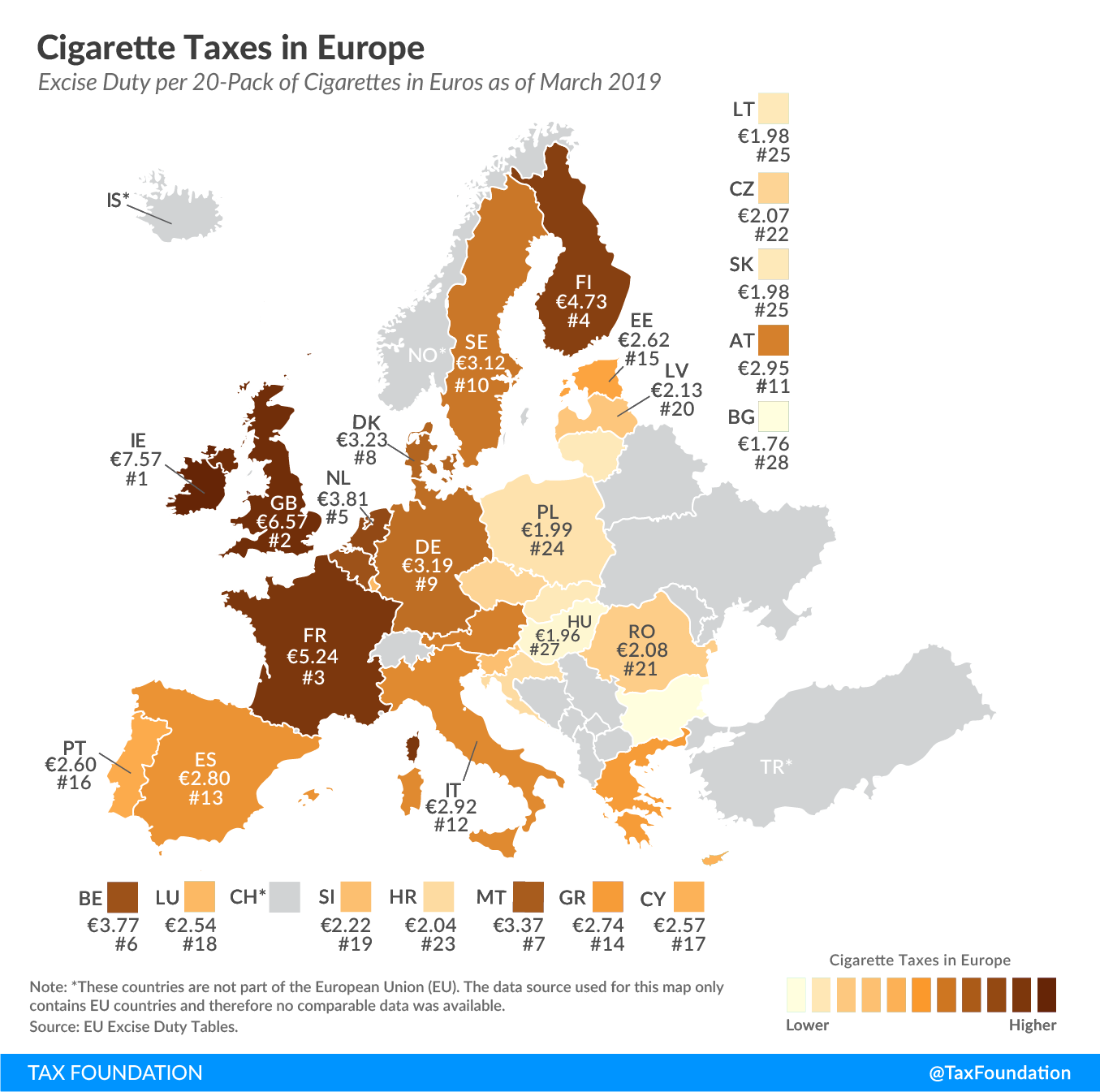

Cigarette Taxes in Europe, 2019

3 min readBy:King James I, King of England and Ireland, imposed the first levy on tobacco in 1604, an import taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of 6 shillings 10 pence to the pound. Today, Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €7.57 (US $8.93) and €6.57 ($7.75) per 20-cigarette pack, respectively. This compares to an EU average of €3.09 ($3.64). In contrast, Bulgaria (€1.76 or $2.07) and Hungary (€1.96 or $2.31) levy the lowest excise duties.

To ensure the functioning of its internal market, the EU sets a minimum excise duty on cigarettes. It consists of a specific component and an ad valorem component, resulting in a minimum overall excise duty of €1.80 ($2.12) per 20-cigarette pack and 60 percent of an EU country’s weighted average retail selling price (certain exceptions apply). On top of excise duties, all EU countries levy a value-added tax (VAT) on cigarettes.

Taking into account both excise duties and VAT, the average share of taxes paid on a 20-pack of cigarettes ranges from 91.6 percent in the United Kingdom to 69.3 percent in Luxembourg (as a percent of the weighted average retail sales price).

|

Notes: The excise duties were converted into USD using the average 2018 USD-EUR exchange rate (0.848); see IRS, “Yearly Average Currency Exchange Rates,” https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates. Source: European Commission, “Excise Duty Tables: Part III – Manufactured Tobacco,” https://ec.europa.eu/taxation_customs/sites/taxation/files/resources/documents/taxation/excise_duties/tobacco_products/rates/excise_duties-part_iii_tobacco_en.pdf. |

|||||||

|

Excise Duty |

Total Tax (Excise Duty and VAT) |

Weighted Average Retail Sale Price (Including Excise Duty and VAT) |

Tax as a Share of the Weighted Average Retail Sales Price | ||||

|---|---|---|---|---|---|---|---|

| EUR | USD | EUR | USD | EUR | USD | ||

| Austria (AT) | €2.95 | $3.47 | €3.74 | $4.41 | €4.76 | $5.62 | 78.5% |

| Belgium (BE) | €3.77 | $4.45 | €4.83 | $5.70 | €6.10 | $7.19 | 79.2% |

| Bulgaria (BG) | €1.76 | $2.07 | €2.18 | $2.58 | €2.57 | $3.03 | 85.1% |

| Croatia (HR) | €2.04 | $2.41 | €2.71 | $3.19 | €3.35 | $3.95 | 80.9% |

| Cyprus (CY) | €2.57 | $3.03 | €3.26 | $3.85 | €4.33 | $5.11 | 75.4% |

| Czech Republic (CZ) | €2.07 | $2.45 | €2.68 | $3.16 | €3.48 | $4.11 | 76.9% |

| Denmark (DK) | €3.23 | $3.80 | €4.30 | $5.07 | €5.39 | $6.35 | 79.9% |

| Estonia (EE) | €2.62 | $3.08 | €3.21 | $3.78 | €3.55 | $4.19 | 90.3% |

| Finland (FI) | €4.73 | $5.58 | €6.02 | $7.10 | €6.70 | $7.90 | 89.9% |

| France (FR) | €5.24 | $6.18 | €6.54 | $7.71 | €7.78 | $9.17 | 84.1% |

| Germany (DE) | €3.19 | $3.76 | €4.09 | $4.82 | €5.64 | $6.65 | 72.5% |

| Greece (GR) | €2.74 | $3.23 | €3.55 | $4.18 | €4.18 | $4.93 | 84.8% |

| Hungary (HU) | €1.96 | $2.31 | €2.69 | $3.18 | €3.46 | $4.08 | 77.8% |

| Ireland (IE) | €7.57 | $8.93 | €9.70 | $11.43 | €11.37 | $13.41 | 85.3% |

| Italy (IT) | €2.92 | $3.44 | €3.80 | $4.48 | €4.90 | $5.78 | 77.5% |

| Latvia (LV) | €2.13 | $2.51 | €2.69 | $3.17 | €3.20 | $3.77 | 84.0% |

| Lithuania (LT) | €1.98 | $2.33 | €2.53 | $2.98 | €3.18 | $3.75 | 79.5% |

| Luxembourg (LU) | €2.54 | $3.00 | €3.22 | $3.79 | €4.64 | $5.47 | 69.3% |

| Malta (MT) | €3.37 | $3.97 | €4.17 | $4.92 | €5.25 | $6.19 | 79.4% |

| Netherlands (NL) | €3.81 | $4.50 | €4.89 | $5.76 | €6.19 | $7.30 | 79.0% |

| Poland (PL) | €1.99 | $2.35 | €2.60 | $3.06 | €3.26 | $3.84 | 79.8% |

| Portugal (PT) | €2.60 | $3.06 | €3.44 | $4.05 | €4.49 | $5.30 | 76.5% |

| Romania (RO) | €2.08 | $2.45 | €2.62 | $3.09 | €3.40 | $4.01 | 77.0% |

| Slovakia (SK) | €1.98 | $2.33 | €2.52 | $2.97 | €3.23 | $3.81 | 77.9% |

| Slovenia (SI) | €2.22 | $2.62 | €2.85 | $3.36 | €3.51 | $4.14 | 81.3% |

| Spain (ES) | €2.80 | $3.30 | €3.58 | $4.23 | €4.52 | $5.33 | 79.3% |

| Sweden (SE) | €3.12 | $3.67 | €4.24 | $5.00 | €5.61 | $6.61 | 75.5% |

| United Kingdom (GB) | €6.57 | $7.75 | €8.03 | $9.47 | €8.77 | $10.34 | 91.6% |

| Average | €3.09 | $3.64 | €3.95 | $4.66 | €4.89 | $5.76 | 80.3% |

Note: This is part of a map series in which we examine excise taxes in Europe.