(Click on the map to enlarge it. Reposting policy)

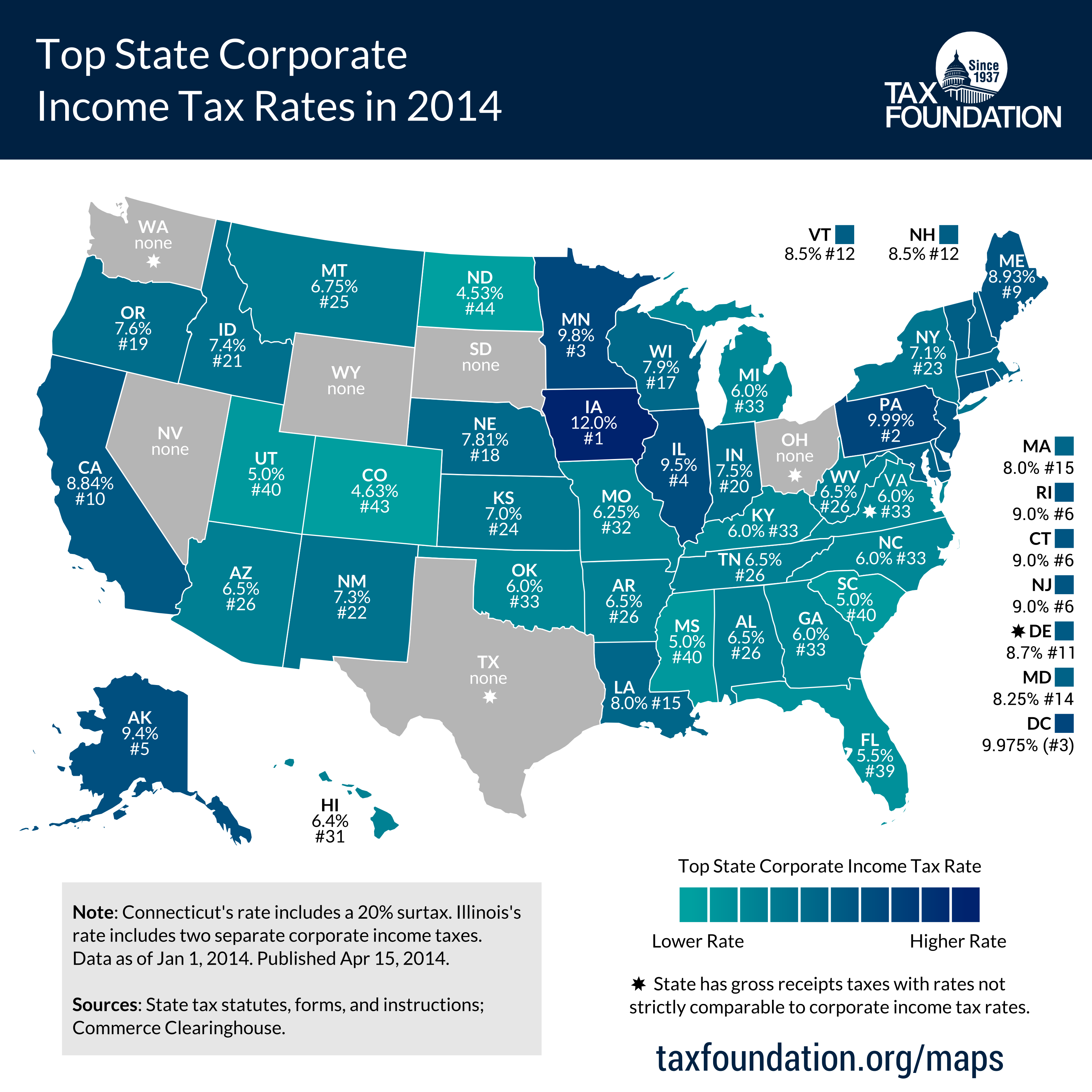

This week’s map shows top corporate marginal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

rates in each state. Corporate income taxes vary widely, with Iowa taxing corporate income at a top rate of 12 percent (though the state allows deductibility of federal taxes paid), followed by Pennsylvania (9.99 percent), Minnesota (9.8 percent), Illinois (9.5 percent), and Alaska (9.4 percent). On the other end of the spectrum, North Dakota taxes corporate income at a top rate of 4.53 percent, followed by Colorado (4.63 percent), Georgia, Mississippi, and Utah (5 percent).

Some states do not levy a corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

at all, and instead levy gross receipts taxes, which are more harmful. Ohio levies the Commercial Activities Tax (CAT), Texas levies the Margin Tax, and Washington levies the Business and Occupation (B&O) tax. Virginia and Delaware levy both gross receipts taxes and corporate income taxes. Nevada, South Dakota, and Wyoming do not levy a corporate income tax or a gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

.

Economic studies find that corporate income taxes are among the most harmful to economic growth, while sales and property taxes are found to be less damaging to growth.

For more information on state tax rates, check out the 2014 edition of Facts and Figures: How does your state compare?

Follow @ScottDrenkard and @RichardBorean on Twitter.

Share