Rep. Thaddeus McCotter (R-MI) has introduced H.R. 3501, the “Humanity and Pets Partnered Through the Years” (HAPPY) Act, which would allow taxpayers to deduct up to $3,500 per year in pet expenses from their federal taxes.

Ruh ro! As an organization that put a sad-looking puppy on its newsletter recently, we can’t very well criticize policy efforts that take advantage of Americans’ love of man’s-best-friend. And yes, those expenses quickly add up: a friend of mine this past week shelled out $700 after Sweet Pea swallowed a pill that fell on the floor.

Pets are good and caring for pets is good, but doing it through the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code is problematic. MSN catalogues some of the problems associated with this bill:

“Qualified pet expenses” appears to include a wide variety of undefined things involved in providing care, with the exception of acquisition costs. Thus, the adoption fee at the pound would not be included. But would you get a tax break for the grooming session that includes nail polish for FiFi, or every can of Fancy Feast or each new toy? Or how about the little castle you buy for the fish tank?

Kathy at Blogging For Michigan also notes that people can deduct expenses for their own medical care only if those costs exceed 7.5% of adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” , so the bill would give your pet’s medical bills better tax treatment than your own.

No doubt the IRS will spend an inordinate amount of time coming up with what a “qualified pet expense” is, and it will be either so broad to be ridiculous or so narrow as to be useless. Either way it’ll be a mess of government micromanagement.

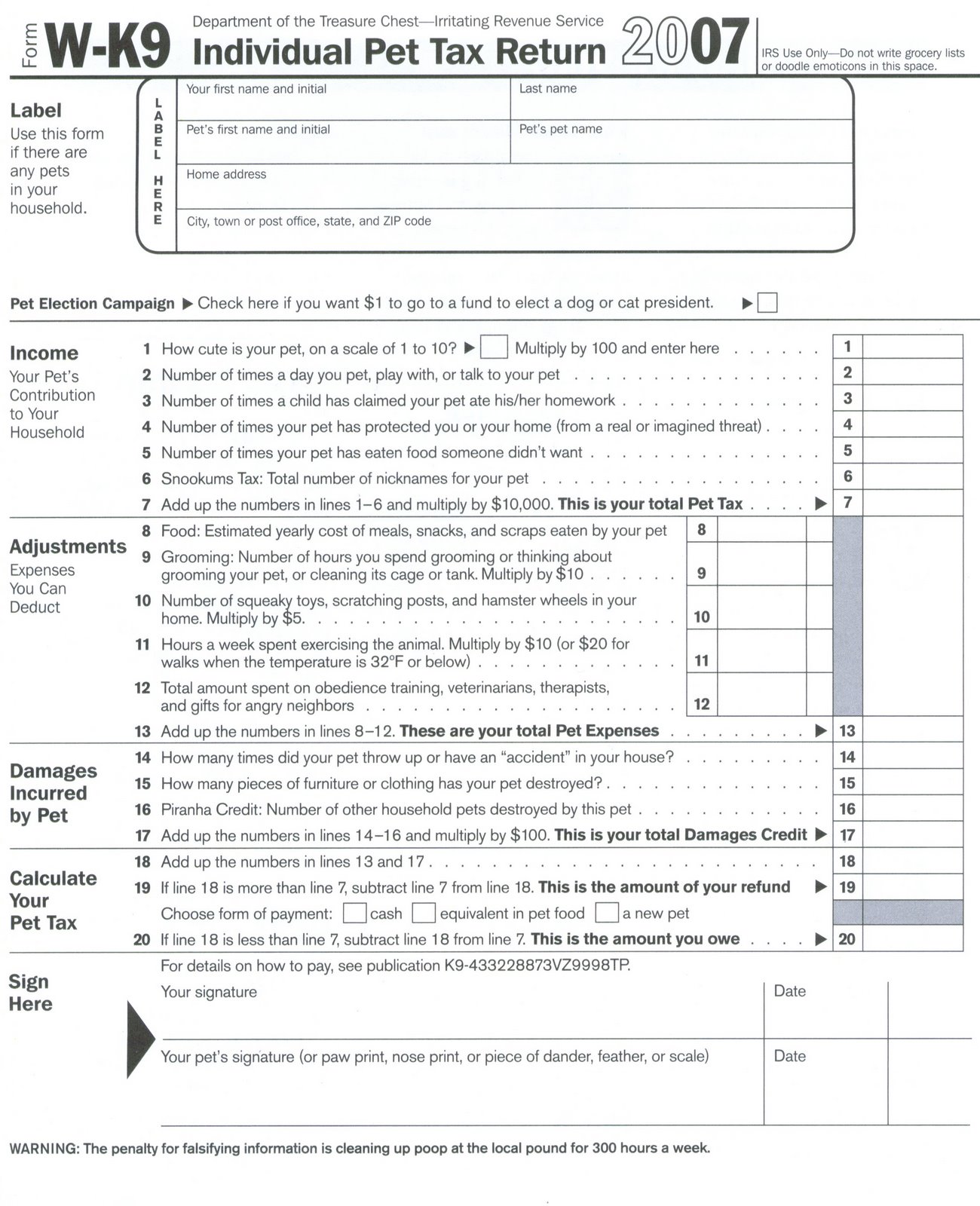

If you want to cut taxes, cut taxes. But this type of targeted tax break is precisely the thing that mucks up the tax code and adds complexity and uncertainty. (Check out the mocked-up Individual Pet Tax Return (Form W-K9) for some insight as to why.) A federal government program for pet expenses would never fly, yet this bill would achieve the same thing via a less-scrutinized tax deduction. And the acronym is ridiculous. TTH: Trying Too Hard.

People shouldn’t get pets just because the tax code encourages them to do so. In fact, such people would probably be the worst pet owners. I’d hate to see loving pet owners become dependent on the government for their pet care.

Politicians should use the tax code to raise revenue, not to shape people’s behavior in ways they think is nice.

Share this article