There is a news story floating around called “Little-Known Tax Funding Obamacare,” from My9NJ news. The story reports on an Affordable Care Act taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on those who sell their home: “if you are single with an adjusted gross incomeFor individuals, gross income is the total pre-tax earnings from wages, tips, investments, interest, and other forms of income and is also referred to as “gross pay.” For businesses, gross income is total revenue minus cost of goods sold and is also known as “gross profit” or “gross margin.” of $200,000 or file jointly with an income of $250,000 or more, you may be impacted. Once you sell your home, any profits over the first $500,000 are already subject to a capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. . And now those profits will have an additional 3.8% tax to fund Obamacare.”

While it is true that the media has not discussed this at length, the existence of the tax was well-known late last year and earlier this year.

This “net investment tax” is an additional 3.8 percent tax levied on the sale of any asset that results in a capital gain as long as your adjusted gross income is over $200,000 for singles and $250,000 for married couples. This includes the sale of homes over a certain value.

In a report we published in February of this year, we outlined the effect of this tax plus the expiration of parts of the Bush Tax Cuts on marginal tax rates on capital gains.

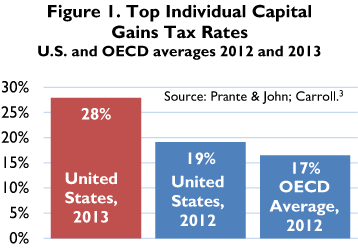

On January 1st, 2013, the Senate passed H.R. 8, the American Taxpayer Relief Act of 2012. Among a number of major changes to the tax code in 2013, America’s top capital gains tax rate increased from 15 percent to 20 percent. On top of this, the healthcare law introduced a 3.8 percent net investment tax. Combined with state and local taxes on capital gains, the average top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. in the United States increased to 27.9 percent from 19.1 percent.

While this tax does hit the sale of your home a little harder, there are broader implications of this tax for the economy.

It creates a bias against saving, reduces investment in the economy and thus results in slower economic growth and lower wages.

Read more about capital gains taxes and their effects on the economy:

The High Burden of State and Federal Capital Gains Taxes

Case Study #3: Reduced Tax Rates on Capital Gains and Qualified Dividends

Share this article