United States governments at all levels redistributed more than $2 trillion in wealth from the top 40 percent to the bottom 60 percent in 2012.

Gerald Prante and Scott Hodge present all the findings in our new study on redistribution in the United States in 2012.

On average, the top 20 percent earners lost $87,076 per person due to redistribution while the bottom 20 percent earners gained $27,071. Most of this is due to policy at the federal level, but in whole it results in a large amount of spending on behalf of the taxpayers.

In the United States, the average amount of government spending by quintile is relatively equal at around $30,000, but the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burden is significantly progressive, with taxpayers in the top quintile paying an average of $122,217.

For every dollar in taxes, the bottom 60 percent receive more in government spending than they pay in taxes. The bottom quintile receives $5.28 in government spending for every tax dollar, the top quintile receives $0.29, and the top 1 percent receives $ 0.06. Looking strictly at federal policy, the bottom quintile receives $8.13 for every dollar in taxes. The top quintile receives $ 0.25 and the top 1 percent, again, receives $ 0.06.

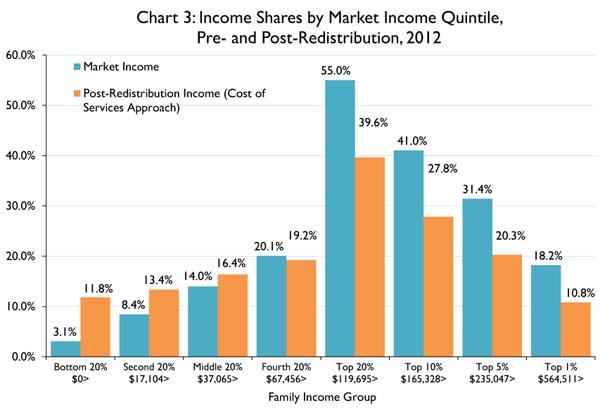

Tax and redistribution policy in the United States significantly alters the distribution of income. Before redistribution, the bottom quintile makes 3.1 percent of the nation’s income. After redistribution that share rises to 11.8. On the other end, those in the top 1 percent earn 18.2 percent of the nation’s income before redistribution and 10.8 percent after.

In all, tax and spending policies in the United States redistribute $2.018 trillion from the top 40 percent to the bottom 60 percent, with an amount that has increased since 2000 going to the second and middle quintiles.

This is a lot of money. The $2 trillion in redistribution is the equivalent of about one-eighth of the economy. The average income for the top quintile drops over $87,000. That is a number larger than the average market income to begin with.

Perhaps more troubling than the shear dollar amount of redistribution is the fact that those in the bottom quintile have an average income after redistribution of over $36,000, yet if you asked them, they wouldn’t believe it.

This is because the current redistribution policy in the U.S. is more focused on taking money from the wealthy than giving money to those in need. Instead of promoting progressivity through the tax code as we currently do, we should move redistribution to the spending ledger.

As redistribution policy currently exists, government spending is fairly equal across the income groups, but the income tax system is highly progressive and also has more than $480 billion worth of social welfare spending through the tax code. This damages economic growth and investment, which leads to lower wages and fewer jobs.

Instead, redistributing wealth through government spending instead of tax policy would provide an opportunity to reform the tax code in a way that promotes economic growth, while maintaining society’s desired level of progressivity, and doing so in a way that actual helps those in need.

Share this article