taxfoundation.org/biden-budget-taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. /” target=”_blank” rel=”noopener noreferrer”>FY 2023 Biden Budget Would Raise Income Tax Rates to Highest in Developed World

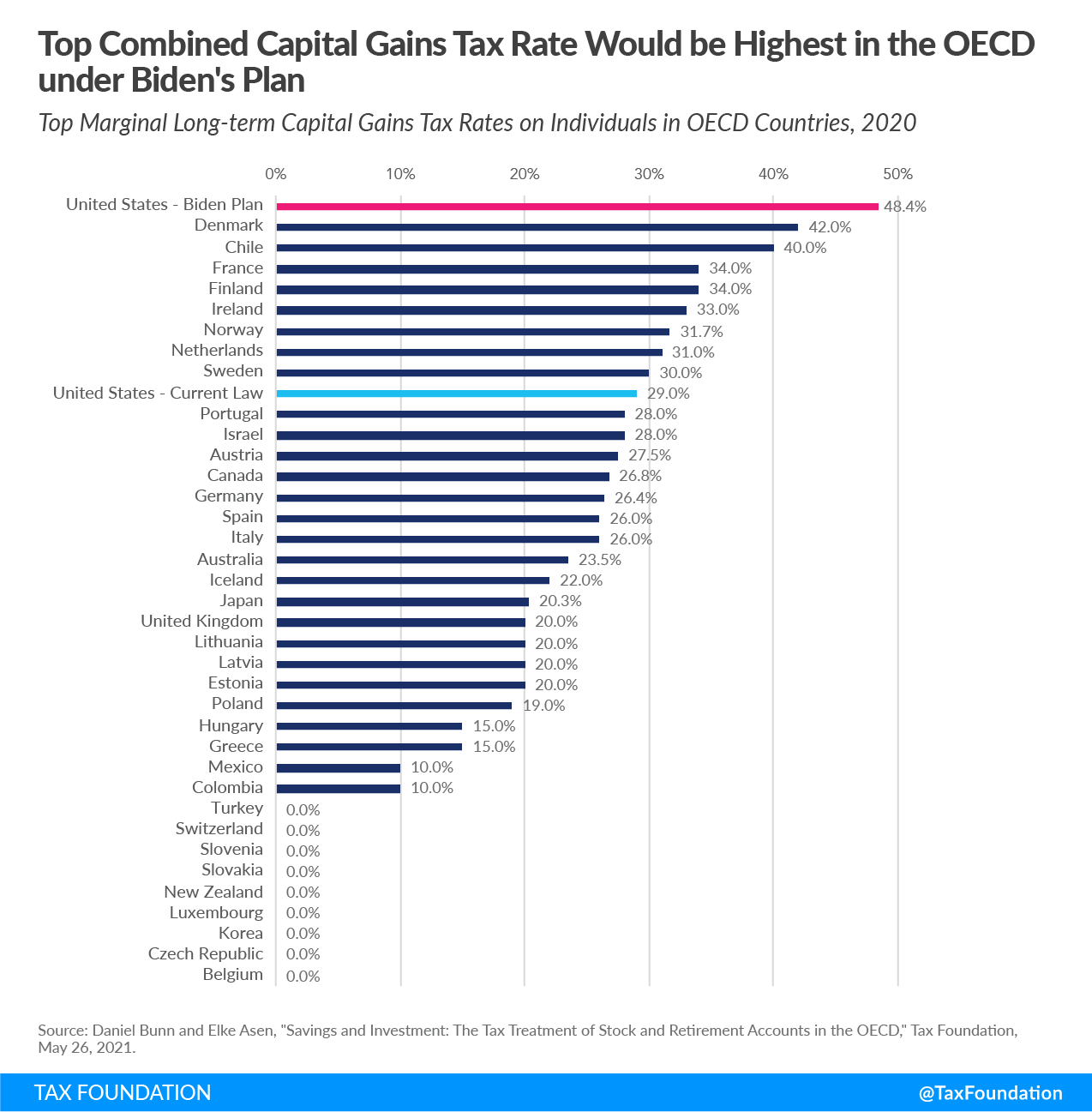

President Biden’s proposal to tax capital gains at higher, ordinary income tax rates would lead the U.S. to have the highest top marginal tax rate on capital gains in the Organisation for Economic Co-operation and Development (OECD). The proposal would tax long-term capital gains as ordinary income for taxpayers with taxable income above $1 million and raise the top marginal income tax rate to 39.6 percent.

When combined with the 3.8 percent net investment income tax (NIIT) and average top state capital gains tax rates, the proposal would lead to a top combined rate of 48.4 percent—significantly higher than the current 29 percent rate.

Most OECD countries, including the U.S, levy taxes on capital gains when the gain is realized, or when an asset is sold for a profit. Capital gains taxes vary based on an investment’s holding period, type of asset held, and taxpayer’s income level. Many countries seek to incentivize long-term saving by providing a lower tax rate or a partial exemption on long-term gains.

In the U.S, short-term capital gains (held for less than one year) are taxed as ordinary income. Long-term capital gains (held for more than one year) are taxed at lower rates, ranging from 0 percent to 20 percent, plus a 3.8 percent NIIT, depending on an investor’s income. In addition to these federal taxes, states tax capital gains at an average rate of 5.2 percent, resulting in the 29 percent top combined rate.

The top marginal tax rate on long-term capital gains in the OECD is 19.1 percent. Eight OECD countries levy higher rates than the U.S, while Denmark applies the highest top rate of 42 percent.

The Biden administration’s proposal would make the U.S. top capital gains rate an outlier within the OECD at 48.4 percent, joining only two other countries with rates at or above 40 percent.

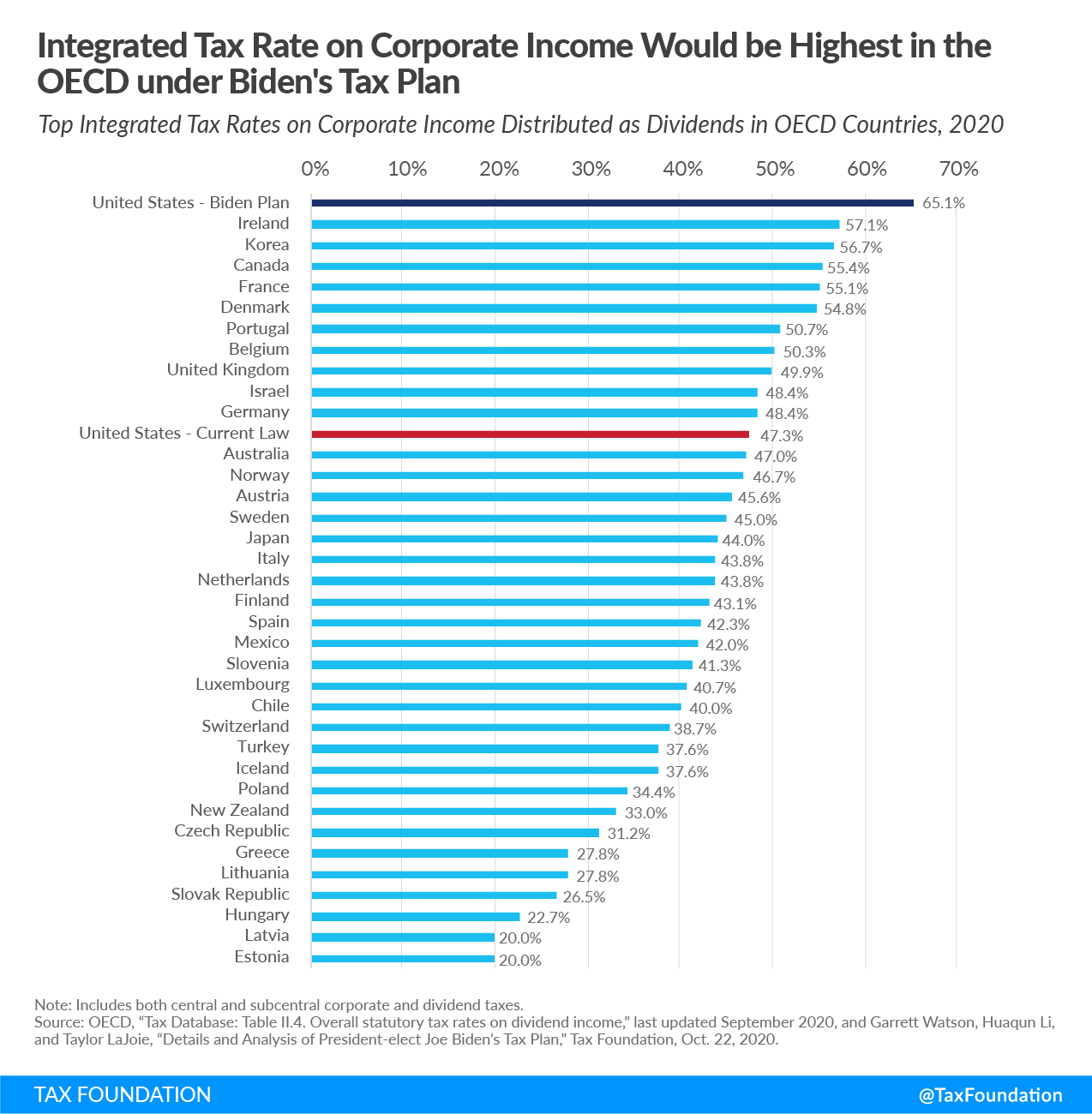

Investment income from corporations can be subject to corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. in addition to capital gains taxes. A business must first pay corporate income tax, and therefore, investors see their gains from after-tax profits. The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. —the total tax levied on corporate income. The integrated tax rate on corporate income distributed as dividends would rise from 47.3 percent to 65.1 percent under Biden’s tax plan, which would be highest in the OECD.

Higher tax rates on individual shareholders reduce the return to saving and higher taxes on corporations raise the cost of investment, reducing saving and investment. Lower investment levels and reductions in capital stock translate to lower work productivity, reduced wages, and lower economic output.

Launch Resource Center: President Biden’s Tax Proposals

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe