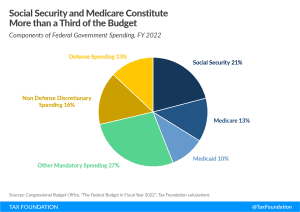

Why Congress Is More to Blame than IRS for $26 Billion in Refundable Tax Credit Overpayments

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read