Blog Articles

The Health Impact of Alcohol Taxes

A proposal in the Senate tax reform bill to reduce alcohol taxes wouldn’t create the negative health consequences that some claim.

2 min read

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

Key Changes in Senate Tax Reform Bill Heading into the Vote-a-Rama

A brief summary of the most notable provisions of the Senate Tax Cuts and Jobs Act in the form in which it enters the “vote-a-rama.”

3 min read

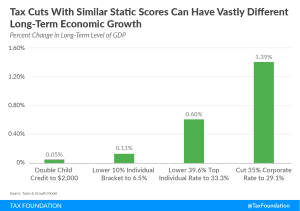

JCT’s Dynamic Score is Positive But Underestimates Economic Benefits

The Joint Committee on Taxation (JCT) dynamic scoring estimate of the Senate’s Tax Cuts and Jobs Act confirms that tax changes impact economic growth. While JCT’s estimates are positive, there is reason to believe that the tax plan would produce even greater dynamic effects than its analysis shows.

3 min read

International Provisions in the Senate Tax Cuts and Jobs Act

The Senate’s version of the Tax Cuts and Jobs Act (TCJA) includes several important changes to the taxation of multinational corporations.

5 min read

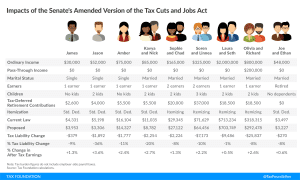

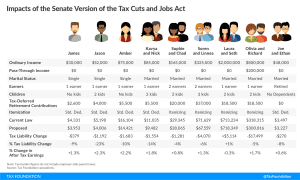

Who Gets a Tax Cut Under the Amended Senate Tax Cuts and Jobs Act?

Here’s how the individual income tax provisions of the amended Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

NCSL May Revisit Stance Fighting State & Local Tax Deduction Repeal

The National Conference of State Legislatures may revisit a decision to reject tax reform that repeals the state and local tax deduction.

2 min read

Federal Tax Reform Might Push New Jersey to Reform Tax System

New Jersey has the worst state business tax climate of the 50 states and the third highest state and local tax burden. If federal tax reform prompts New Jersey to overhaul its tax code, it’s long overdue.

3 min read

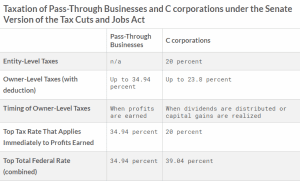

Are Pass-Through Businesses Treated Fairly Under the Senate Version of the Tax Cuts and Jobs Act?

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

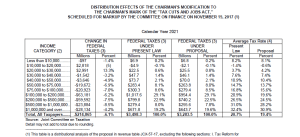

Understanding JCT’s New Distributional Tables for the Senate’s Tax Cuts and Jobs Act

Much attention is being paid to distributional tables released by JCT on the Senate’s Tax Cuts and Jobs Act, but their results don’t quite seem to show what some are suggesting. While the results appears to show a tax increase for some lower-income filers, this is due to the unique nature of the individual mandate and the premium tax credits available under the Affordable Care Act.

2 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

The Economics of Permanent Corporate Rate Cuts Must Outweigh the Optics of Sunsetting Individual Tax Cuts

The Senate Tax Cuts and Jobs Act is right to make the most pro-growth policies permanent and sunset the ones that will do less economic harm.

6 min read

Overview of the Senate’s Amendment to the Tax Cuts and Jobs Act

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

Who Gets a Tax Cut Under the Senate Tax Cuts and Jobs Act?

Here’s how the individual income tax provisions of the Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read