Trade and Capital Flow Consequences of Tax Reform: A Means to a Faster Expansion of U.S. Capital Formation and Employment

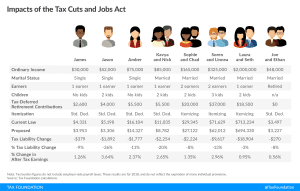

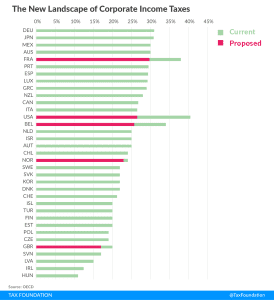

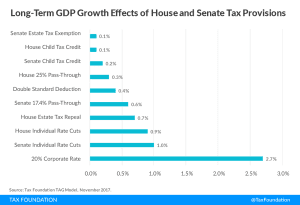

The tax bill will boost investment and incomes in the United States, and make the country a better place to locate production and hiring. There will be a transitory rise in the trade deficit, but in the context of a stronger, faster-growing economy.

5 min read