New OECD Study: Consumption Tax Revenues during Economic Downturns

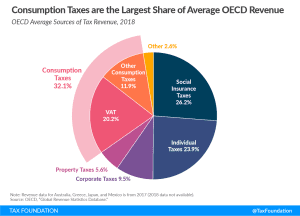

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

Seemingly unconcerned about how the digital project could impact the economy at this crisis moment, officials at the OECD recently released a statement boasting that they are continuing to work “full steam” on their global digital tax project.

5 min read

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

5 min read

Some policymakers are proposing a payroll tax holiday for businesses and individuals for 2020 and a complete delay in filing deadlines for tax year 2019 and 2020 to April 2021. What are the pros and cons of doing so?

4 min read

The small business provisions in the CARES Act support small businesses and nonprofits seeking economic relief during this downturn. However, creating multiple programs with overlapping purposes and differing qualification requirements makes relief more complicated, vague, and not neutral.

6 min read

Due to a quirk of some state tax codes, the recovery rebates in the CARES Act could increase your income tax liability in six states: Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon.

4 min read

What could the next phase of relief look like and what role does tax policy play in ensuring the U.S. and countries around the world make a strong economic recovery?

1 min read

While much of the fiscal conversation surrounding the current pandemic has focused on tax relief and tax deferrals, another significant angle needs to be explored: the question of economic nexus.

3 min read

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

4 min read

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

Congress recently passed the largest economic relief bill in American history (CARES Act). We’ve created a FAQ portal to better inform policymakers, journalists, and taxpayers across the country on the new law.

13 min read

Many small business owners are seeking guidance as they apply for loans backed by the Small Business Administration (SBA) to help maintain cash flow and retain workers even as more states announce new quarantine and shelter-in-place orders.

5 min read

Every state with an individual income tax has made some adjustment to its filing or payment deadlines, but three—Idaho, Mississippi, and Virginia—have not followed the federal government’s date of July 15th or later.

3 min read

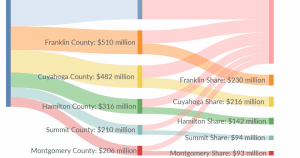

State and local governments across the country split $150 billion in federal aid under a provision of the Coronavirus Aid, Relief and Economic Security (CARES) Act, passed on March 30th.

7 min read

As Congress and the White House consider ways to shore up the economy in the face of a public health crisis, President Trump has suggested suspending the entire payroll tax for the duration of the year. That would cost about $950 billion, according to our analysis.

6 min read

House Speaker Nancy Pelosi (D-CA) has suggested that a retroactive repeal of the cap on State and Local Tax (SALT) deductions should be included in any future stimulus plans.

3 min read

Fewer people driving means fewer people buying gasoline, which may have positive effects on air pollution but could be detrimental to motor fuel excise tax revenue for federal and state governments.

4 min read