Fixing Tax Treatment of Capital Investments Could Improve Supply Chain Resiliency

While taxes are not at the root of supply chain disruptions, improvements to the tax code could make supply chains more resilient in the future.

3 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

While taxes are not at the root of supply chain disruptions, improvements to the tax code could make supply chains more resilient in the future.

3 min read

When examining how tax policy impacts the economy, researchers typically look at labor supply and investment responses. One other channel through which taxes impact the economy has been less studied: innovation.

3 min read

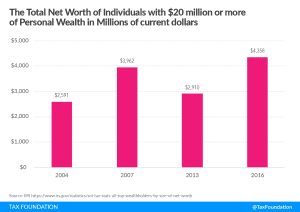

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

The legislation put forward by Democratic members of the House of Representatives would reverse many of the 2017 reforms while increasing burdens on businesses and workers.

2 min read

On May 4th, Gov. Jay Inslee (D) signed legislation creating a 7 percent capital gains tax, to take effect next year. On November 2nd, Washington lawmakers will learn what voters think about it.

5 min read

With corporate and individual rate hikes potentially out of the Build Back Better (BBB) reconciliation package, lawmakers are weighing alternative options to raise revenue. Rather than come up with untested proposals and complicated changes to the tax base, they should prioritize options that raise revenue while improving the structure of the tax code.

4 min read

Raising taxes on stock-based compensation through a book income tax will disadvantage this form of compensation and produce more complexity in the tax system without providing benefits to workers.

5 min read

One has to wonder how stable or sustainable the Democrats’ spending program can be if it must rely so heavily on the taxes paid by such a small number of taxpayers as in the top 1 percent.

5 min read

Passage of Louisiana Amendments 1 and 2, which are aimed at the sales tax and individual and corporate income taxes, respectively, would substantially simplify the Pelican State’s tax code and provide tax relief in both the short and long term.

8 min read

The Index provides lessons for policymakers when they are thinking of ways to remove distortions from their tax systems and remain competitive against their peers. The further up a country moves on the Index, the more likely it is to have broader tax bases, relatively lower rates, and policies that are less distortionary to individual or business decisions. Going the other way reveals a policy preference for narrow tax bases, special tax policy tools, and rules that make it difficult for compliance.

5 min read

Reducing the tax gap is a good idea, but the reporting requirements for financial institutions could be better-targeted at the problem at hand.

4 min read

President Biden expanded and fundamentally changed the Child Tax Credit (CTC) for one year in the American Rescue Plan (ARP) passed in March 2021. Policymakers are now deciding the future of the expansion as part of the proposed reconciliation package, but a wide range of estimates for the effects of a permanent expansion is confusing the debate.

7 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

Two major provisions in the federal tax code have been limited since the Tax Cuts and Jobs Act (TCJA) of 2017: the state and local tax (SALT) deduction and the home mortgage interest deduction (MID).

3 min read

Under the House Ways and Means plan to raise taxes on corporations and individuals, the integrated tax rate on corporate income would rise to the third highest in the OECD. To reduce this burden, policymakers could explore integrating the individual and corporate tax systems.

8 min read

This year’s robust corporate tax collections calls into question efforts by the administration and congressional Democrats to increase the corporate tax rate and raise other corporate taxes based on claims of relatively low tax collections following the Tax Cuts and Jobs Act (TCJA) in 2017.

2 min read

In an effort to raise roughly $100 billion, the House proposal would double cigarette taxes and increase all other tobacco and nicotine taxes to comparable rates—a strategy with severe unintended consequences.

5 min read

If Congress wants to reduce profit shifting, the proposal from the Ways and Means Committee is not an effective tool for this.

7 min read

Tax competition has proven to be key in keeping tax hikes under control in some regions of Spain as regional governments look to copy Madrid’s tax reforms.

6 min read