Blog Articles

Two Years After Passage, Treasury Regulations for the Tax Cuts and Jobs Act Surpass 1,000 Pages

Treasury released final regulations on the base erosion and anti-abuse tax (BEAT), which is meant to dissuade firms from engaging in profit shifting abroad. Other high-profile releases from 2019 include final regulations guiding enforcement of Section 199A, commonly known as the pass-through deduction; final regulations on enforcing the new tax on global intangible low-tax income (GILTI); and final regulations on state-level workarounds to the $10,000 limit on the state and local tax deduction (SALT).

5 min read

Comparing Wealth Taxation and Income Taxes

A low wealth tax rate is equivalent to a high-rate income tax. The interaction between wealth taxes and the existing income taxes must be considered when analyzing a wealth tax plan.

6 min read

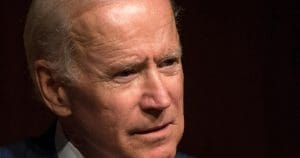

Comparing Capital Gains Tax Proposals by 2020 Presidential Candidates

Biden, Sanders, and Warren have staked out similar plans to increase capital gains taxes on the wealthiest Americans. While all three candidates have called for taxing capital gains at ordinary income rates, the phase-in levels and top marginal tax rates vary.

5 min read

Understanding Why Full Expensing Matters

Understanding the channel through which a tax policy change is expected to affect the economy is crucial. Absent this understanding, we are likely to reach the wrong conclusions on what sound tax policy looks like and what changes would improve the tax code.

4 min read