States compete with each other in a variety of ways. Competing to attract and retain new residents is just one example.

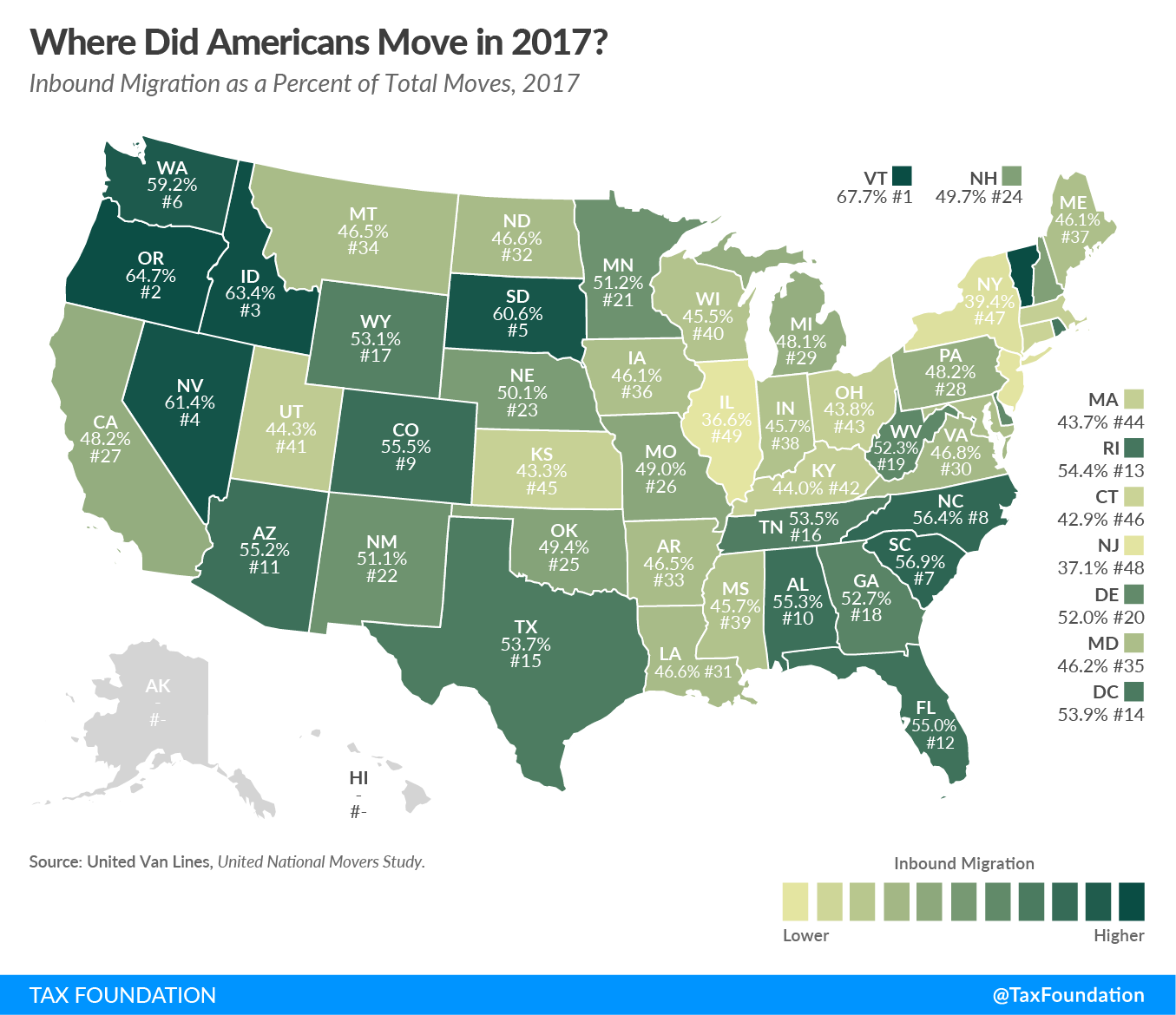

United Van Lines tracks its customers’ state-to-state migration and releases the data yearly. By comparing the number of inbound moves to the number of outbound moves, United Van Lines data gives us early insights into annual interstate migration, available much sooner than government data sources.

Vermont, Oregon, Idaho, Nevada, and South Dakota had the most inbound migration in 2017, while Illinois, New Jersey, New York, Connecticut, and Kansas had the highest outbound migration. Nebraska and New Hampshire were balanced, having essentially equal inbound and outbound moves.

There are many reasons why an individual may move, but taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es do play a role. As my colleague Nicole has written in the past,

[T]here is a relationship between taxes and migration. Individuals move for a variety of factors. Climate, job opportunities, family, among others, impact the decision to relocate. Taxes can influence the decision too.

Tax rates and structure affect a state’s economy; states with less burdensome tax structures and lower rates tend to have better economic growth. Increased job opportunities can result from the better economic growth.

It is also possible to envision specific instances where tax rates matter directly. Someone moving to Chicago for a new job could decide to live in Illinois or commute from Indiana. Indiana’s 3.3 percent individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate could be an encouragement to locate in that state over Illinois’ 3.75 percent rate. An individual moving to the Washington, D.C., area could decide to live in Virginia instead of the District because income taxes are lower. By contrast, of course, an individual moving to Austin, Texas, has limited options for daily commuting outside of Texas.

There are many ways that states can compete with one another for residents, and tax rates and structures should certainly be part of the conversation for states looking to attract new residents.

For more information on how state tax climates compare, explore our 2018 State Business Tax Climate Index.

Share