Scott Hodge is President Emeritus & Senior Policy Advisor at the Tax Foundation, which he led as President for over two decades, between 2000 and 2022. Scott Hodge is recognized as one of Washington’s leading experts on tax policy, the federal budget, and government spending. After taking over the Tax Foundation, he grew the organization from a modest, six-person group with a storied brand into a national powerhouse with a staff of over 30, informing smarter tax policy at the federal, state, and global levels.

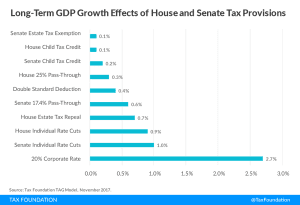

Scott led the development of the Tax Foundation’s most successful programs, the Taxes and Growth Dynamic Tax Modeling project and the State Business Tax Climate Index, two projects that have changed the terms of the tax debate, encouraged competition towards pro-growth tax policies, and demonstrated to policymakers and taxpayers alike the impact of the tax code on our daily lives. Combined with his experience in tax policy of more than 35 years, Scott was one of the driving forces of tax reform that culminated in the historic 2017 Tax Cuts and Jobs Act (TCJA). Congress and the White House turned to Scott and the Tax Foundation for guidance in crafting the once-in-a-generation legislation.

The TCJA was just the latest in a string of developments in tax policy that Scott helped foster. During the 1990s, he helped design the major tax components of the Contract with America that became the eventual centerpieces of the 1997 tax bill and the Bush tax cuts in 2001 and 2003.

Scott has written and edited three books on the federal budget and streamlining the government and has authored hundreds of studies on tax policy and government spending. He has also written dozens of editorials and opinion pieces for publications such as The Wall Street Journal, The Washington Post, USA TODAY, the New York Post and The Washington Times. And he has conducted more than 1,000 radio and television interviews—including with NBC Nightly News, CBS Evening News, CNN, Fox, Hardball with Chris Matthews, and C-SPAN.

Before joining the Tax Foundation, Scott was Director of Tax and Budget Policy at Citizens for a Sound Economy. He also spent ten years at The Heritage Foundation as a fellow analyzing budget and tax policy. He holds a degree in political science from the University of Illinois at Chicago.