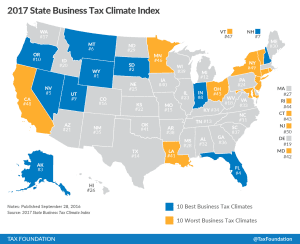

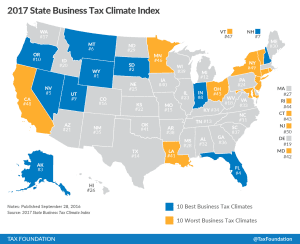

Scott was an economist and the Director of State Projects for the Tax Foundation until 2018. He was co-author of the annual State Business Tax Climate Index and editor of the 2012 and 2013 editions of the popular handbook, Facts & Figures: How Does Your State Compare? He has co-authored books on North Carolina, Nebraska, and Louisiana tax policy which laid the groundwork for fundamental tax reforms in each state. Scott and the Center for State Tax Policy were highlighted in State Tax Notes‘ “most influential in state tax policy” feature in 2011, 2012, and 2013.

His analysis of tax and spending policy has been featured hundreds of times in media outlets across the country, including the Economist, the Wall Street Journal, USA Today, the Daily News, the Washington Post, the New York Post, CNN.com, Yahoo News, the Huffington Post, Kiplinger, Reuters, the Associated Press, CNN, ABC, CBS, Fox News, NPR, the trade publication State Tax Notes, and the peer-reviewed Journal of State Taxation.

Scott has given legislative testimony or presented to officials in 26 states and before the U.S. Senate Finance Committee. He has also served as an expert witness in court on tax issues. In 2015, he was appointed by the Louisiana legislature to serve on the state’s Sales Tax Streamlining & Modernization Commission.

Prior to joining the Tax Foundation, Scott held research positions at the Institute for Humane Studies and the Goldwater Institute. He holds a B.S. in Economics from the University of Mary Washington and an M.A. in Economics from George Mason University.

In 2014, he was briefly featured as a staffer to the First Lady in the second season of House of Cards. Scott lives in Southeast Washington, D.C. with his wife, Molly.

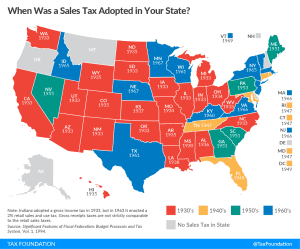

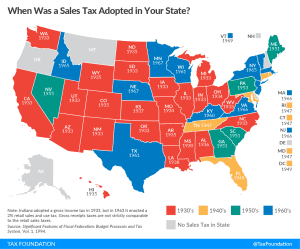

Retail sales taxes are one of the more transparent ways to collect tax revenue. While graduated income tax rates and brackets are complex and confusing to many taxpayers, sales taxes are easier to understand; consumers can see their tax burden printed directly on their receipts.

11 min read