Kyle Pomerleau is a resident fellow at the American Enterprise Institute (AEI), where he studies federal tax policy.

Before joining AEI, Mr. Pomerleau was chief economist and vice president of economic analysis at the Tax Foundation, where he led the macroeconomic and tax modeling team and wrote on various tax policy topics, including corporate taxation, international tax policy, carbon taxation, and tax reform.

The author of many studies, Mr. Pomerleau has been published in trade publications and policy journals including Tax Notes and the National Tax Journal. He is frequently quoted in major media outlets such as The New York Times, The Wall Street Journal, and The Washington Post. He has also testified before Congress and state legislators.

Mr. Pomerleau has an MPP in economic and social policy from Georgetown University’s McCourt School of Public Policy and a BA in history and political science from the University of Southern Maine.

Latest Work

2018 International Tax Competitiveness Index

The structure of a country’s tax code is an important determinant of its economic performance. Our 2018 international tax rankings provide a road map for each of the 35 OECD countries to improve the structure of their tax codes and achieve a more neutral, more competitive tax system.

11 min read

Responding to the NYT’s Stock Buybacks Analysis

The increase in stock buybacks isn’t surprising nor a sign that the Tax Cuts and Jobs Act won’t increase domestic investment.

2 min read

Decomposing a Dynamic Revenue Estimate

4 min read

State-by-State Job Impacts of the Tax Cuts and Jobs Act in 2018

Our updated analysis of the state-by-state impact of the Tax Cuts and Jobs Act shows that the new federal tax law will create 215,000 full-time equivalent jobs in 2018. Here’s how each state will be affected.

2 min read

The Economics of 1986 Tax Reform, and Why It Didn’t Create Growth

In contrast, the Tax Cuts and Jobs Act lowered the corporate tax rate and allows immediate and full expensing for the next five years.

3 min read

Making the Tax Cuts and Jobs Act Individual Income Tax Provisions Permanent

If extended, the individual income tax provisions in the Tax Cuts and Jobs Act would increase long-run GDP by 2.2 percent, long-run wages by 0.9 percent, and add 1.5 million new jobs.

8 min read

The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade

Taxpayers in every income level will receive a tax cut in 2018 and for most of the next decade. See how the size of that tax cut will vary for each income group over the next decade with our new, long-term distributional analysis.

33 min read

A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act moved the U.S. toward more of a territorial corporate tax system used by most other OECD countries. However, the U.S. law contains key differences in the treatment of foreign profits.

24 min read

Modeling the Impact of President Trump’s Proposed Tariffs

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min read

Inversions under the New Tax Law

The Tax Cuts and Jobs Act was meant to boost growth and deter corporate inversions. What does it mean that an Ohio company is still moving its HQ to the UK?

5 min read

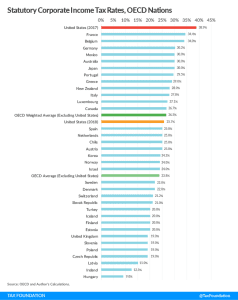

The United States’ Corporate Income Tax Rate is Now More in Line with Those Levied by Other Major Nations

The Tax Cuts and Jobs Act significantly reduced the federal statutory corporate income tax rate. When combined with state and local taxes, it put the U.S.’s corporate tax rate in line with the average among OECD nations.

4 min read

The U.S.’s New Ranking on the International Tax Competitiveness Index

The TCJA is projected to improve the United States’ current ranking from 30th among the 35 Organisation for Economic Co-operation and Development (OECD) countries to 25th, an improvement of five places.

4 min read

2017 International Tax Competitiveness Index

Hampered by high marginal tax rates and complex business tax rules, the United States again ranks towards the bottom of the pack on our 2017 International Tax Competitiveness Index, placing 30 out of 35 OECD countries.

11 min read