How Biden’s Tax Plans Could Negatively Impact Housing

While President Biden has many proposals aimed at increasing the supply of affordable housing, including tax credits, his plans to raise business taxes could hinder that goal.

4 min read

Jeremy Ashe is a 2021 summer intern with the Tax Foundation’s Center for Federal Tax Policy.

While President Biden has many proposals aimed at increasing the supply of affordable housing, including tax credits, his plans to raise business taxes could hinder that goal.

4 min read

Last month, the Supreme Court turned back a challenge to the Affordable Care Act (ACA), allowing to stand the Individual Mandate it created that penalizes taxpayers for not having proper health insurance and opening the way for President Biden and Congress to reimplement it.

2 min read

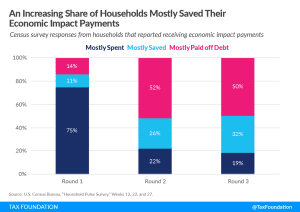

In 2020 and 2021, Congress enacted three rounds of economic impact payments (EIPs) for direct relief to households amidst the pandemic-induced downturn. Survey data from the U.S. Census Bureau indicates that households increasingly saved their EIPs or used them to pay down debt rather than spend them.

5 min read