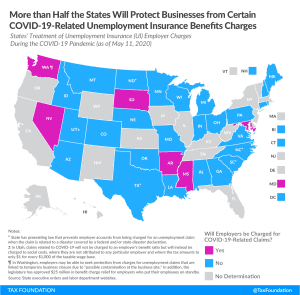

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes

Lawmakers can help expedite their state’s economic recovery by protecting employers from facing higher unemployment insurance tax rates at a time when they can least afford to pay them.

8 min read