Tax Burden on Labor in Europe, 2019

2 min readBy:Related Research

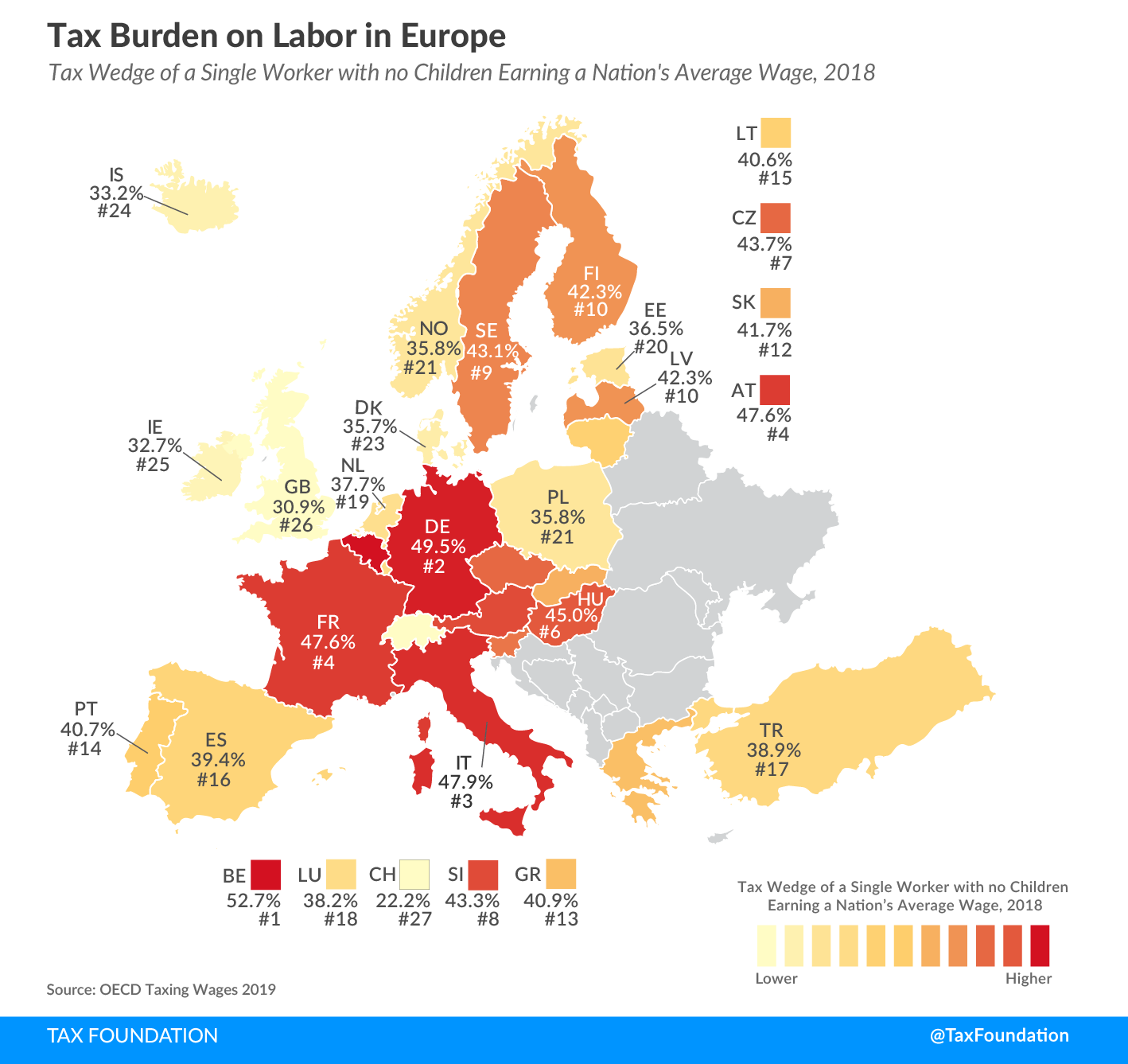

A recent report compares the extent to which labor is taxed in OECD countries. This so-called taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. burden on labor reflects the difference between an employer’s total cost of an employee and the employee’s net disposable income. In 2018, the average tax wedge of the 27 countries covered in this Europe map was 40.2 percent for a single worker without children, compared to an OECD average of 36.1 percent.

The tax burden was calculated by adding together the income tax payment, employee-side payroll tax payment, and employer-side payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. payment of a single worker without children earning the average wage in a country. This figure was then divided by the total labor cost of this average worker.

Belgium had the highest tax burden on labor in 2018, at 52.7 percent of total labor cost, which is also the highest of all OECD countries. Germany and Italy were next, at 49.5 percent and 47.9 percent, respectively.

Switzerland had the lowest tax burden in 2018, at only 22.2 percent of total labor cost. The United Kingdom and Ireland had the second and third lowest tax burdens, at 30.9 percent and 32.7 percent, respectively.

Importantly, families face a different tax burden than shown on the map above. All European countries provide some targeted tax relief for families with children, typically through lower income taxes. In 2018, the average tax burden on labor for a married one-earner couple with two children earning an average wage was only 29.9 percent in the European countries covered, 10.3 percentage-points lower than for single workers without children.

Share this article