Carbon Taxes in Europe, 2025

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

The worldwide average statutory corporate tax rate has consistently decreased since 1980 but has leveled off in recent years. In the US, the 2017 Tax Cuts and Jobs Act brought the country’s statutory corporate income tax rate from the fourth highest in the world closer to the middle of the distribution.

18 min read

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

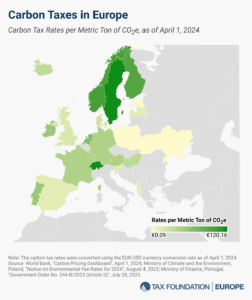

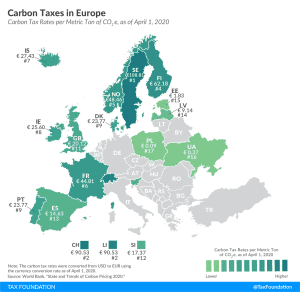

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min read

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

5 min read

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

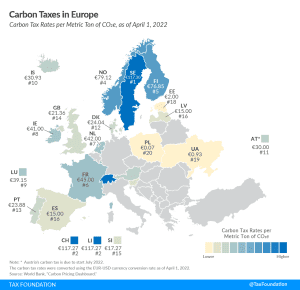

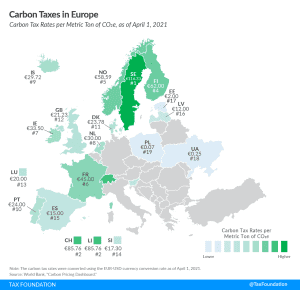

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read

Given the uncertainty surrounding the war in Ukraine, future trade relations with Russia, and the overall CBAM revenue structure. The EU will need to adjust policy when challenges arise as it looks to increase its role in fiscal affairs through new own resources.

5 min read

The unified EU signing of the “Versailles Declaration” is a historic break from the past. Russia’s war against Ukraine has made energy (and related tax policies) an even more urgent focus for the EU.

6 min read

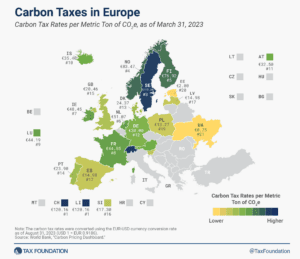

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

17 European countries have implemented a carbon tax, ranging from less than €1 per metric ton of carbon emissions in Ukraine and Poland to over €100 in Sweden.

3 min read

Countries around the world are implementing emergency tax measures to support their economies under the coronavirus (COVID-19) threat.

51 min read