The state of South Dakota currently has a cigarette taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. that is the 26th highest in the country at $1.53 per pack. However, Initiated Measure 25, which will appear before South Dakota voters in November, would increase the cigarette tax to $2.53 per pack while increasing the wholesale tax on other tobacco products from 35 to 55 percent.

Although well-intentioned, this measure will run into three problems: 1) the new taxes are likely to encourage cigarette smuggling, 2) tobacco taxes will still largely go into the general fund as opposed to toward smoking cessation efforts, and 3) the revenue estimate of this measure is disputed by economists in the state.

First, the more underpublicized issue: because of its increase, this cigarette tax is likely to lead to a growth in cigarette smuggling, an unintended consequence of high cigarette taxes. Cigarette smuggling entails buying cigarettes in states with lower cigarette taxes and then selling them in states where there is a higher cigarette tax. The issue is especially prevalent where there are large differentials in cigarette taxes between nearby states.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe phenomenon is much greater than most people imagine: in 2016 South Dakota had the 20th highest cigarette smuggling rate in the country at 13.79 percent. It is estimated that the smuggling resulting from this tax cost the state $9 million in forgone revenue.

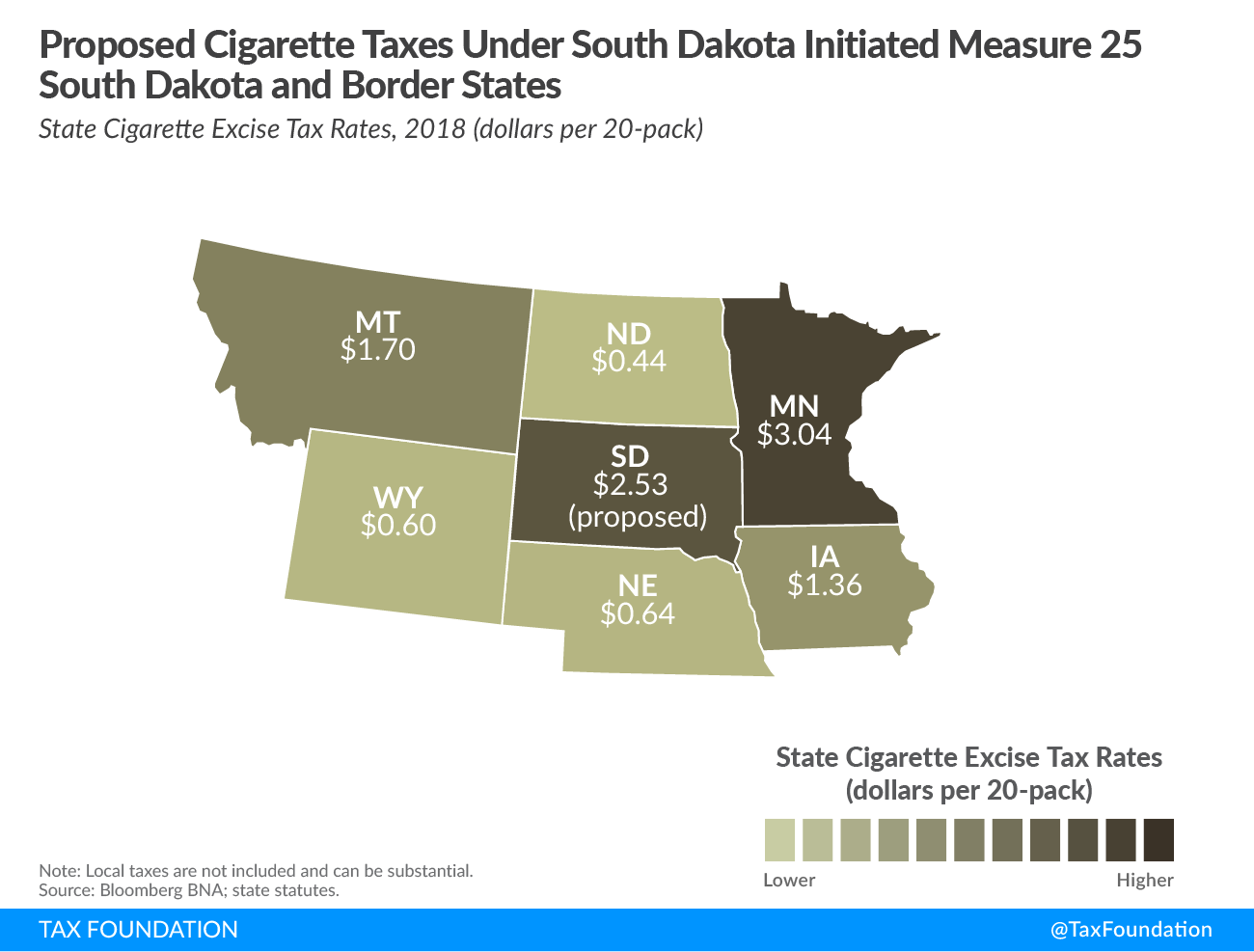

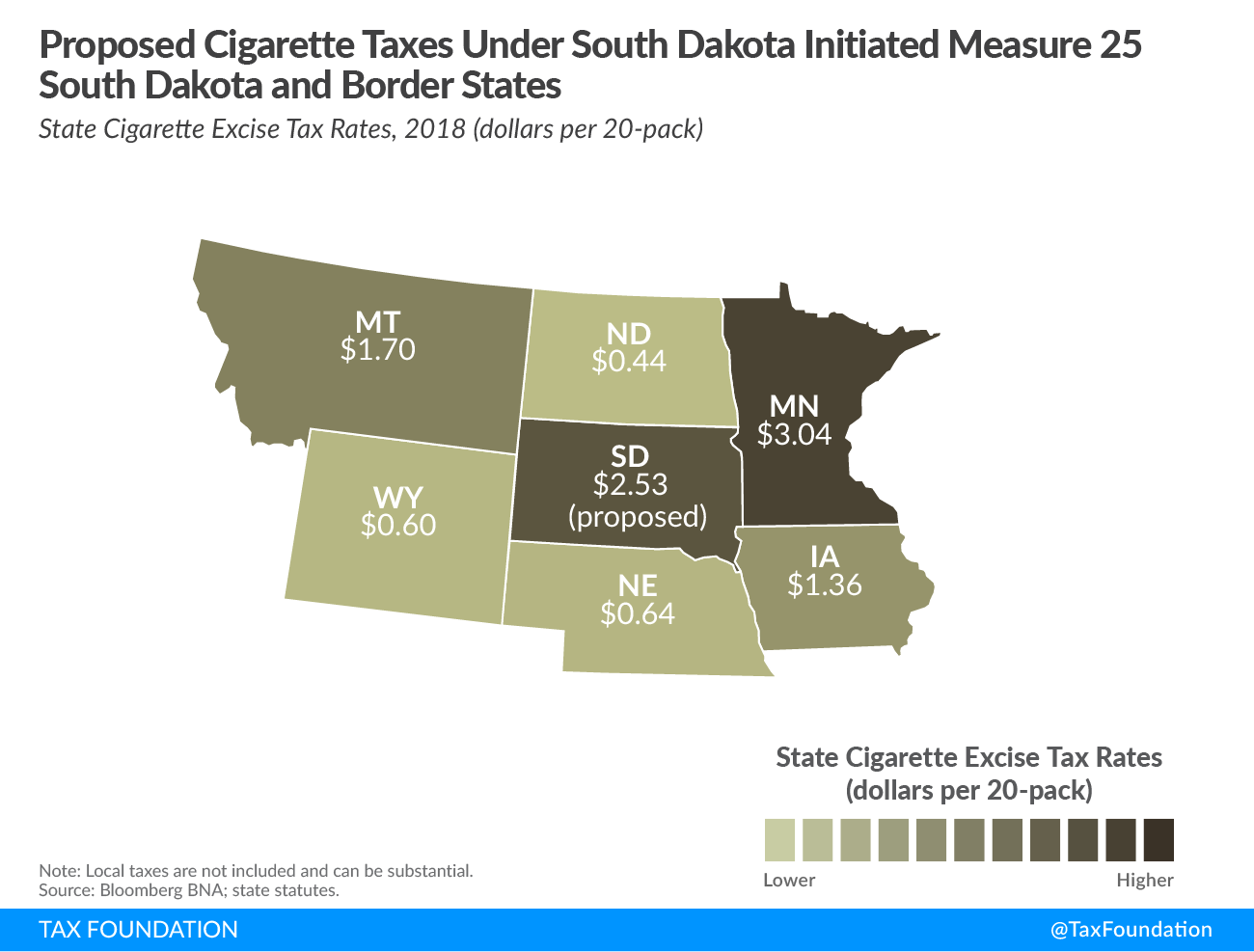

Should this measure pass, it is likely that the volume of illicit cigarette traffic will increase. There are six states that border South Dakota, and of those six only Minnesota ($3.04) would have a higher cigarette tax per pack. South Dakota’s new cigarette tax rate of $2.53 per pack would be the 12th highest in the country.

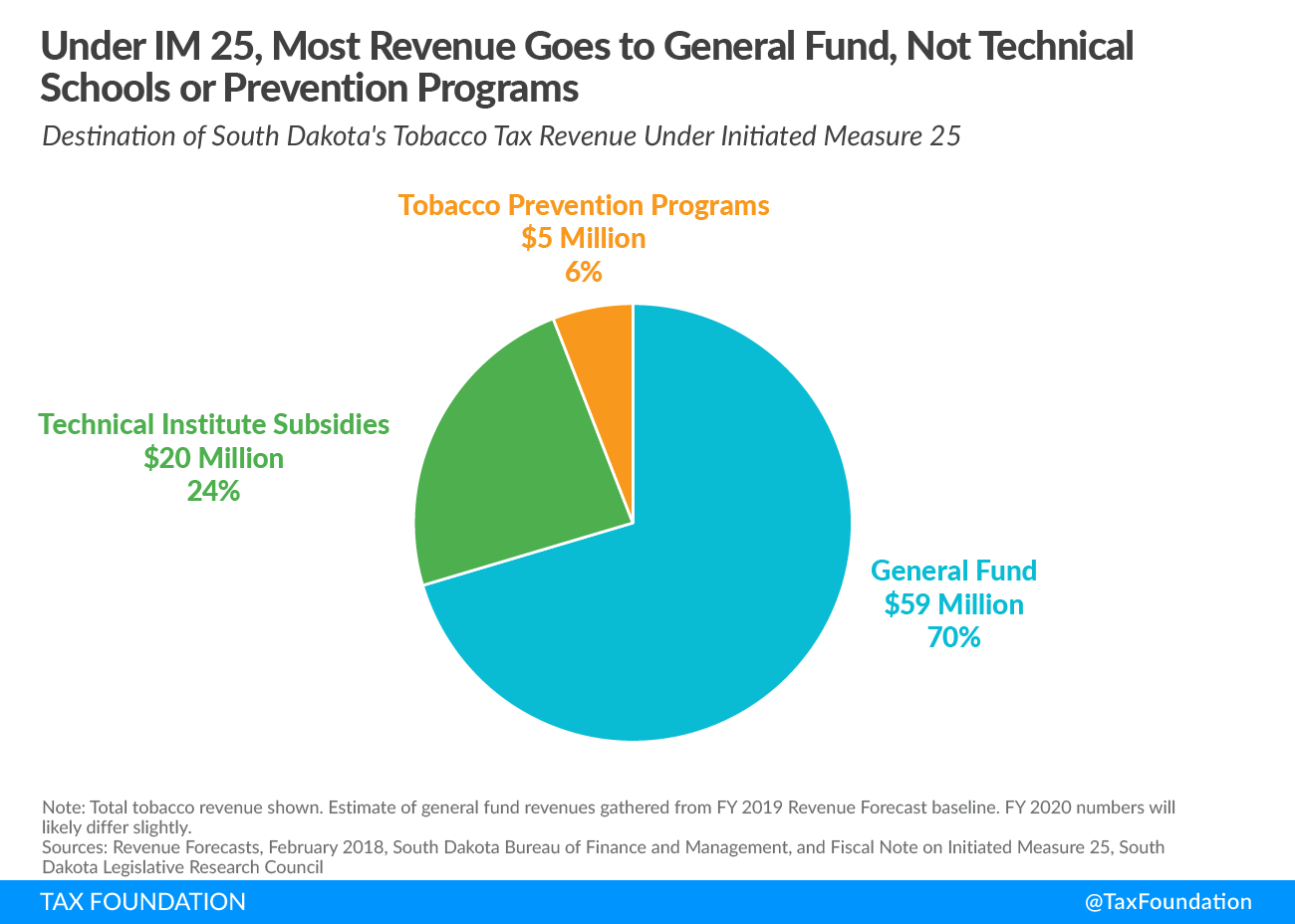

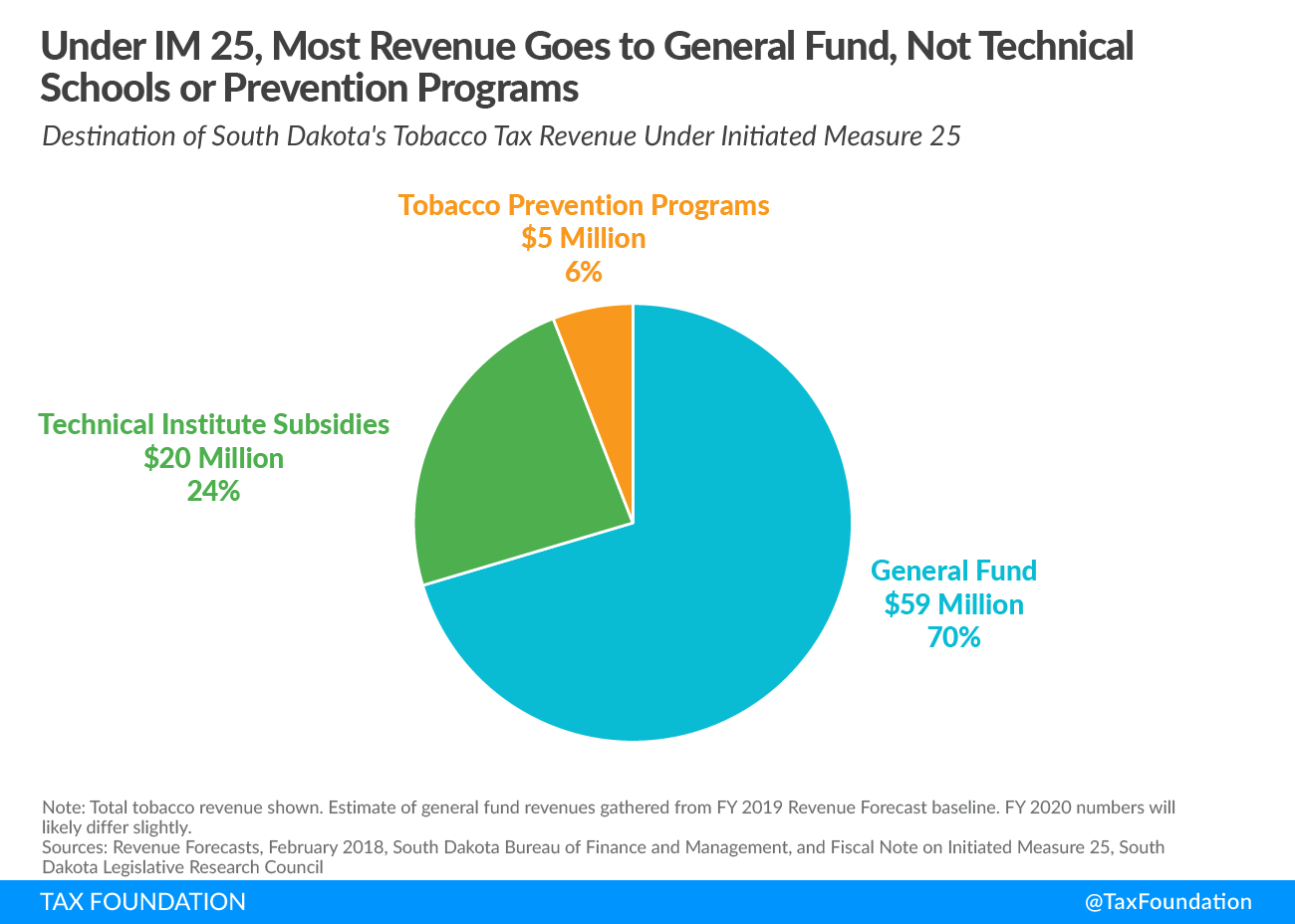

Second, while the initiative language mentions revenue from this tax increase flowing to subsidies for postsecondary education at technical institutes, the vast majority (70 percent) of cigarette tax revenue in South Dakota will still go to the general fund (Figure 2).

Further, a surprisingly small amount of cigarette tax revenue in South Dakota would go to tobacco prevention and reduction programs, just 6 percent. The technical colleges’ subsidy (which doesn’t really have anything to do with smoking at all) would represent 23 percent of cigarette taxes collected.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeFinally, this measure could run into issues with revenue performance, as the revenue estimates for the ballot measure are under dispute. Recently, an economics professor at the University of South Dakota found problems with how the fiscal bureau predicts consumers will react to the new hefty tax bill:

“Their assumptions will probably not bring in anywhere near $20 million because they are assuming people will not change their behavior by raising taxes,” [Prof. Travis] Letellier said. “They are assuming they will still be getting all this revenue, the same amount of revenue that they got the last time they raised the taxes on cigarettes.”

This revenue misbehavior could result in less revenue going to technical colleges than voters might anticipate. We have noted elsewhere that cigarette tax revenue is particularly unstable and does not mix well with long-term budgeting needs.

While technical college assistance is a laudable goal, it is likely to be a long-term expense going forward, and so should be paid for by stable broad-based taxes going forward. Cigarette tax revenue is poorly suited to raise money for this type of program.

More entries in our series on Top State Ballot Initiatives to Watch in 2018.

Share