What would you say if I offered you a policy change that would increase both taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenues and economic growth? That’s right, something for everybody. It’s called cutting the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate. Here’s how.

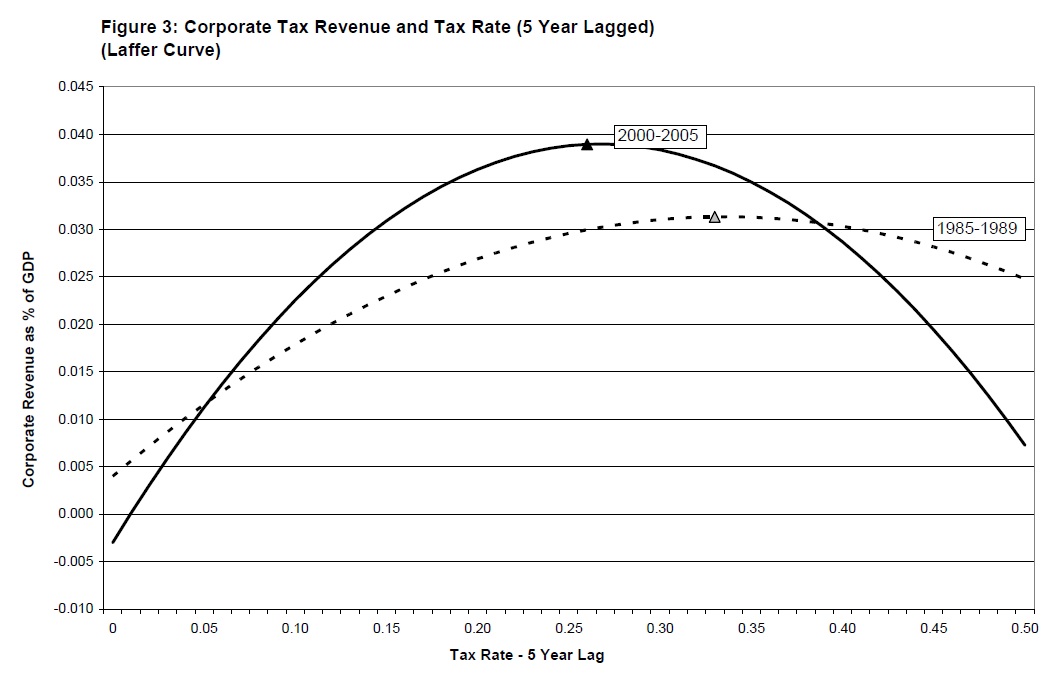

This is the Laffer Curve for corporate taxes, as estimated by Alex Brill and Kevin Hassett. They find that revenues are maximized at a corporate rate of about 26 percent, at the national level, based on OECD countries from 2000 to 2005. This maximizing rate has been coming down over time, as the graph shows, from about 34 percent in the late 1980s.

The trend downwards is driven by the increasing mobility of capital combined with the fact that tax competition has pushed statutory corporate rates steadily lower among OECD countries. The total statutory rate, including national and sub-national rates, among OECD countries has fallen from an average of about 45 percent in the 1980s to 25 percent today. Meanwhile, the U.S. has stood still at about 40 percent. Among OECD countries, only Japan is (slightly) higher, and there are 24 U.S. states where the total statutory rate is higher than in any other country. Additionally, some 60 countries have lowered their rates in the last 4 years, suggesting that the revenue maximizing rate is now lower than 26 percent.

Moving on to growth, the OECD finds that corporate income taxes are the most damaging to economic growth, followed by personal income taxes, consumption, and property taxes. Lee and Gordon find that cutting the corporate income tax rate by 10 percentage points raises GDP growth by 1 to 2 percentage points.

There you have it. By cutting the federal corporate rate from 35 to 25 percent we could move from a slow growth to a high growth economy, and simultaneously boost tax revenue. Could we please make this our first priority?

Share this article