In the United States and across Organisation for Economic Co-operation and Development (OECD) countries, the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code provides de minimis exemptions and compliance relief for small firms. Firms may be eligible for these provisions if they remain under a threshold for sales, revenue, or payroll, depending on the provision. These tax breaks are partly intended to help small firms avoid compliance costs, which may pose a disproportionate burden on them. However, they also create an incentive for firms to remain under the threshold to take advantage of these tax benefits.

New evidence suggests that lowering compliance requirements for small firms has a larger impact on their behavior than providing a de minimis exemption or related tax relief. Policymakers should consider prioritizing simplification when designing tax relief provisions for small firms, including for entrepreneurs and startups.

Economists Jarkko Harju, Tuomas Matikka, and Timo Rauhanen find that tax compliance costs play a key role in the decision-making of small firms and startups. Using administrative data on all Finnish firms and their owners from 2000 to 2015, the authors examine the effect of changes to Finland’s value-added tax (VAT) on the economic output of small firms.

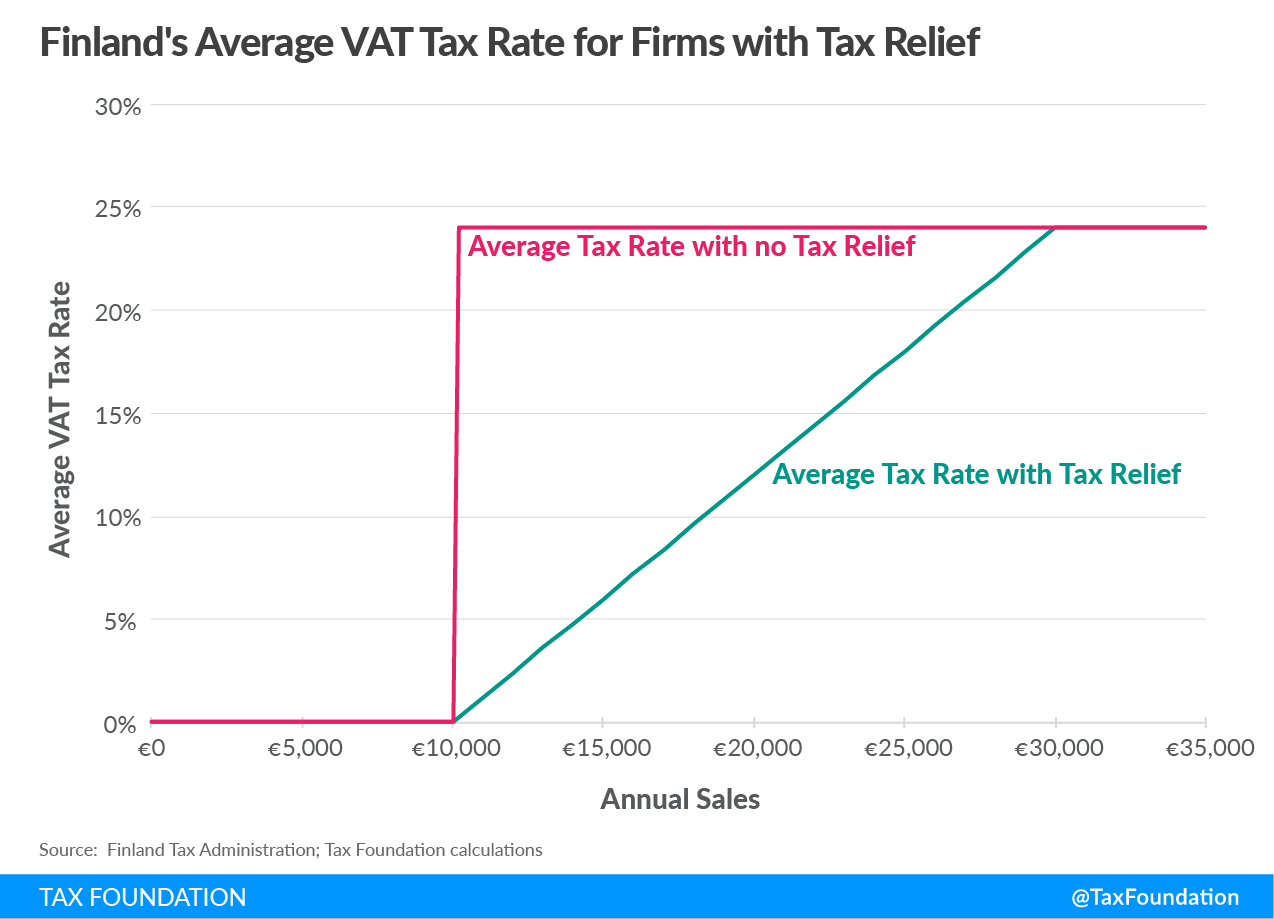

In Finland, firms with less than €10,000 in annual sales are exempted from the country’s VAT. This de minimis exemption is intended to lower compliance costs for small firms, which would have to use disproportionate resources to comply with the tax. The de minimis threshold exempts firms from tax if they have sales below the threshold but subjects the entirety of a firm’s sales to tax after the firm exceeds the threshold. While the exemption helped firms below the threshold, firms faced a high marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. when they exceed it, as they would owe value-added tax for their previously exempt sales.

Starting in 2004, Finland offered tax relief for firms with sales above the de minimis threshold, which is currently set at €10,000. The tax relief phases down between €10,001 and €30,000 in sales and phases out completely at €30,000. This reduces a firm’s average VAT tax rate, which alleviates some of the costs associated with losing the de minimis exemption (see Figure 1).

Figure 1.

Finland also simplified compliance requirements for firms with less than €25,000 in sales by reducing reporting requirements and streamlining the process of applying for tax relief. The authors find that the small firms are more likely to expand their output in the face of lower compliance requirements than tax relief for the de minimis threshold. This suggests that lowering the cost of complying with the VAT is more valuable to firms on average than the tax relief provision. As the authors argue, “Reducing and simplifying reporting and other compliance procedures reduce the distortions caused by various size-based rules among small firms and entrepreneurs.”

Providing a de minimis exemption and lowering compliance requirements for small firms come with a trade-off. Firms may adjust their behavior to remain below the de minimis exemption or compliance relief threshold, scaling down their activity and avoiding new investment opportunities. On the margin, firms may judge that the tax benefits outweigh the expected return from additional investment above the de minimis threshold.

The authors confirm that some firms remain below the de minimis threshold to avoid incurring tax liability before and after Finland provided tax relief for firms earning between €10,000 and €30,000 in annual sales. The tax code treats firms in a nonneutral manner by providing tax benefits depending on the size of their sales, leading to firms making economic decisions based on the tax code.

Policymakers should weigh the trade-offs created by de minimis exemptions and lower compliance requirements for small firms. These provisions reduce the burden of the tax system on startups and entrepreneurs but may also incentivize them to remain below the threshold where the tax benefits phase out. The recent research suggests that lowering compliance requirements should be a priority for policymakers for spurring economic output from small firms.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe