All Related Articles

Tax Reforms in Georgia 2004-2012

9 min read

State Tax Changes as of July 1, 2019

15 min read

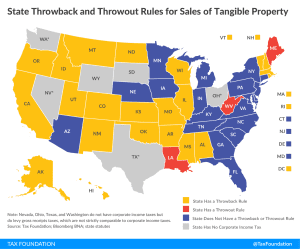

State Throwback and Throwout Rules: A Primer

38 min read

The “Cadillac” Tax and the Income Tax Exclusion for Employer-Sponsored Insurance

The Cadillac tax offers one way that policymakers can work to rein in our tax code’s subsidization of the health-care industry, which has increased the price of health-care services.

18 min read

Summary and Analysis of the OECD’s Work Program for BEPS 2.0

From a broad standpoint, agreement at the OECD will require countries to give up some measure of their own tax sovereignty on policies they have designed to minimize the distortionary effects of the corporate income tax. Over the years tax competition has led to some countries adopting policies that are attractive to businesses because they have a more neutral rather than distortionary approach to taxing corporate income. This project could directly undermine that progress by introducing new levels of complexity and distortion that would ultimately have a negative impact on global trade and growth.

34 min read

Switzerland Referendum Approves Tax Reform

15 min read

Modernizing Utah’s Sales Tax: A Guide for Policymakers

By almost any measure, Utah is, and deserves to be, the envy of its peers. Utah leads the country in job growth, and the state’s economy has grown at twice the rate of the nation at large. Utah’s income tax reforms adopted in 2007 established a model for other states to follow. But today, some of these gains are being undone—not by conscious policy choices, but by their absence.

6 min read

Measuring Opportunity Zone Success

16 min read