Introduction

There has been a flurry of sensational press accounts in recent months about the taxes paid by large corporations. These stories have reignited an ongoing debate over the different ways in which a company’s profits and taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability are presented to shareholders on financial statements and what is reported to the IRS on a company’s tax return.

While the differences between book and tax accounting are no doubt confusing to many, it is entirely reasonable that there be considerable differences between the two practices. After all, corporate accounting standards are typically set by the independent Financial Accounting Standards Board (FASB), while the Internal Revenue Code is a product of the political process between Congress and the While House. Tax rules are driven by broader public policy concerns rather than adherence to formal accounting practices.

So while Generally Accepted Accounting Principles[1] (GAAP) are intended to insure uniformity of companies’ financial statements and accounting methods, similar activities may be treated very differently for tax purposes.[2] Therefore, it is possible for the financial reports of a company to differ from the tax returns prepared for the IRS because of the different accounting methods.

The following are just three of the most common textbook differences between book and tax accounting:

1) Cash-Based vs. Accrual-Based Accounting

While certain activities of a corporation may be recorded on a cash basis for tax accounting, most activities accounted for in its financial statements are done so using what is known as the accrual method. For example, when a company receives payment for a service or product, it is immediately taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. in the view of the IRS (unless it is deferred income[3]). However, on a financial statement, the matching principle must be used under U.S. GAAP rules. This principle, used in book accounting, ensures that the income generated by an output and the expense incurred for that output are recognized in the same period. The following simple example is illustrative:

A magazine company is selling year-long subscriptions to its publication. The cost of printing each issue is $2 and the revenue generated by each issue sold is $5. A consumer buys a year-long subscription on August 1st and the company immediately receives $60. In the eyes of the IRS, this is immediately taxable income in the current year. However, for book accounting purposes, the company (using US GAAP) matches the revenue of each month’s issue with the cost associated with that copy. In this manner, the company will only have made a $15 profit by the end of the year. They must, however, pay income tax on the full $36 profit of the initial transaction.

In this case, a $21 difference exists between book and tax profit. This difference results in a lower income tax liability on the company’s financial statement than what is actually owed to the IRS. Accrual-based accounting can be used by any company for internal bookkeeping; however, it is mandatory if a business has sales of more than $5 million or inventory and sales of $1 million on an annual basis.[4]

2) Treatment of Depreciation

DepreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. is technically defined as “a method of allocating the cost of a tangible asset over its useful life. Businesses depreciate long-term assets for both tax and accounting purposes.”[5]

Companies generally use two main types of depreciation, although variations of each exist: straight line[6] and accelerated.[7] Table 1 gives examples of straight line and accelerated depreciation of an asset originally valued at $100,000, with an expected salvage value (the price for which it can reasonably be sold at the end of its use by the firm) of $10,000 after 10 years.

In the case of straight-line depreciation, an identical percentage of the difference between initial and salvage value is depreciated every year (in this case $9,000/year, 10 percent of ($100,000-$10,000=$90,000)), resulting in a book value equal to salvage value at the end of the asset’s useful period. On the right side of the table is an example using double-declining depreciation (a specific type of accelerated depreciation). Using this method, 20 percent of the asset’s book value is depreciated each year. As the table shows, this leads to higher depreciation (which is tax-deductible) during the initial years of the asset’s life than in the final years. Both methods, however, yield the same book and salvage value of $10,000 after 10 years.

| Straight-Line (10% of beginning minus salvage value every year) | Double-Declining (20% of year’s beginning book value every year) | |||||

|---|---|---|---|---|---|---|

| Number of Years | Depreciation | Book | Accumulated Depreciation | Depreciation | Book | Accumulated Depreciation |

| 1 | $9,000 | $91,000 | $9,000 | $20,000 | $80,000 | $20,000 |

| 2 | $9,000 | $82,000 | $18,000 | $16,000 | $64,000 | $36,000 |

| 3 | $9,000 | $73,000 | $27,000 | $12,800 | $51,200 | $48,800 |

| 4 | $9,000 | $64,000 | $36,000 | $10,240 | $40,960 | $59,040 |

| 5 | $9,000 | $55,000 | $45,000 | $8,192 | $32,768 | $67,232 |

| 6 | $9,000 | $46,000 | 54,000 | $6,554 | $26,214 | $73,786 |

| 7 | $9,000 | $37,000 | $63,000 | $5,243 | $20,972 | $79,028 |

| 8 | $9,000 | $28,000 | $72,000 | $4,194 | $16,777 | $83,223 |

| 9 | $9,000 | $19,000 | $81,000 | $3,355 | $13,422 | $86,578 |

| 10 | $9,000 | $10,000 | $90,000 | $3,422 | $10,000 | $90,000 |

The U.S. tax code and GAAP allow both of these methods. However, GAAP rules require that the rate of depreciation be consistent with the expected wear and tear of the asset depending on its characteristics. This difference allows corporations to depreciate these assets on their financial statements in a way that truly reflects the use and growing obsolescence of some capital investments.

Congress frequently enacts temporary depreciation allowances in hopes of spurring economic growth via capital investment. For instance, bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. was allowed as part of the original and amended versions of the Economic Growth and Tax Relief Reconciliation Act in 2001 and 2003.[8] It was also enacted as part of the American Recovery and Reinvestment Act in 2009 and 2010, allowing firms to immediately depreciate and expense 50 percent and 100 percent on qualifying property expenses, respectively.[9]

This method currently allows businesses to legally deduct a much larger percentage of an asset in the first year than U.S. GAAP allows under the rules’ “period of usefulness” provision. This capital investment is theoretically incentivized because depreciation is tax-deductible; thus when a proprietor can use 100 percent of a capital outlay to reduce their tax liability, the investment immediately becomes more attractive. This is one clear example of how changes in tax law can cause differences between book and tax numbers.

3) Treatment of Inventory

Two principal methods are used when accounting for inventory for book and tax purposes. The first is the last-in, first-out (LIFO) method. Using this method, the cost of inputs purchased for production in a given period is matched with the revenues generated by items sold in the same period. This method is used regardless of whether the inputs are physically used to produce anything during that time. The IRS has stipulated that businesses using LIFO to account for inventory on their tax returns must also use LIFO when reporting taxable income on financial statements:

Section 472(c) of the [Internal Revenue] Code imposes the condition that a taxpayer electing the LIFO method for income tax reporting purposes must also use the LIFO method for financial reporting to shareholders, partner, other proprietors, or beneficiaries, or for credit purposes.[10]

U.S. GAAP allow businesses to claim income using either the LIFO or FIFO (first-in, first-out) system. Contrary to LIFO, FIFO matches the cost of the oldest inputs with the revenue of goods sold in a given period.

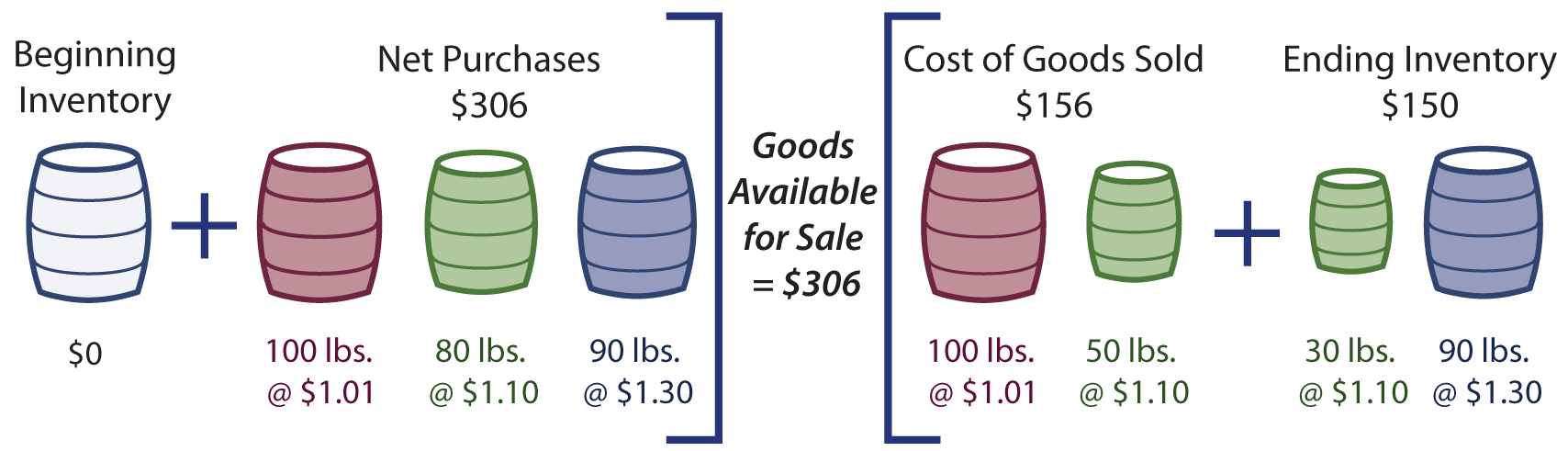

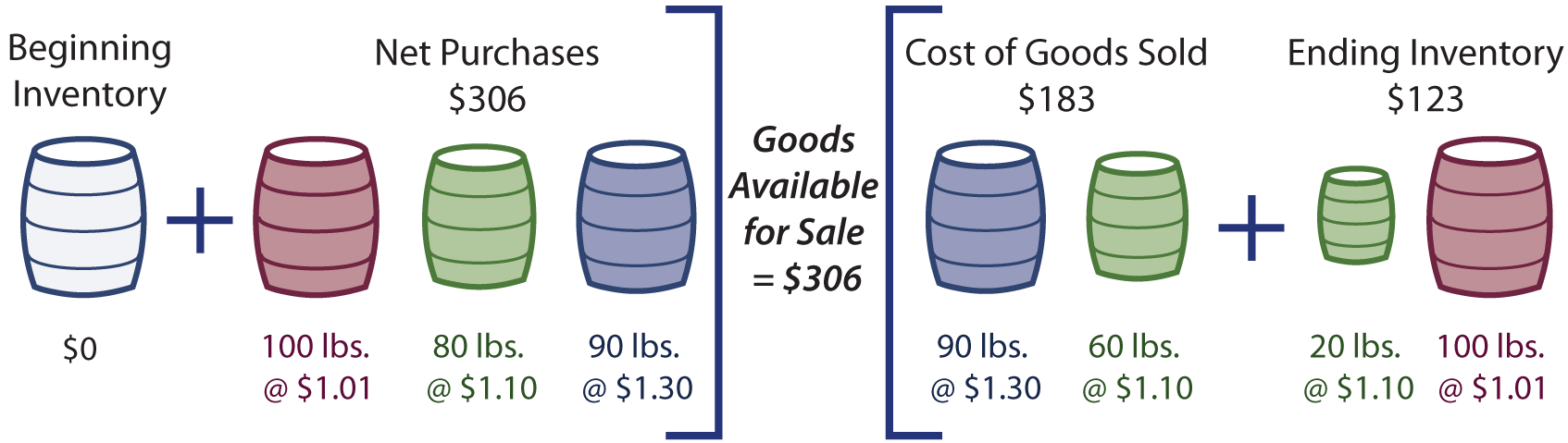

The following chart is another textbook example, illustrating the difference between the two methods and the profit/taxable income shelter which the LIFO system can provide. On the left are four barrels representing the process by which a company buys inputs needed to create goods. The right side includes sold goods as well as ending inventory (finished goods that have not been sold by the end of the period). As one can see in the LIFO example, raising the cost of goods sold reduces the amount of taxable income, even though the amount sold (in lbs.) and the amount in ending inventory are identical. Thus, LIFO treatment of inventory can provide significant tax advantages.[11] Companies using the LIFO valuation approach are most commonly those whose costs predominantly increase each year and whose inventory is generally quite large.[12]

FIRST-IN, FIRST-OUT CALCULATIONS

LAST-IN, FIRST-OUT CALCULATIONS

Source: Principles of Accounting.com

http://www.principlesofaccounting.com/chapter8/chapter8.html.

Nearly all foreign accounting standards disallow LIFO inventory accounting. To help unify U.S. and international standards and thus lower the cost of compliance, many professionals advocate for the disallowance of LIFO treatment under U.S. GAAP standards.[13]

Conclusion

For all practical purposes, U.S. corporations must keep two sets of books: one set to comply with Generally Accepted Accounting Practices and the other to comply with the Internal Revenue Code. GAAP rules are intended to promote uniform statements that accurately convey the financial history, health, and prospects of a business, while the tax code is intended to generate revenues for the government but also achieve certain public policy goals. It is only natural that these two methods frequently produce very different results.[14]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] State of Washington Office of Financial Management, Generally Accepted Accounting Principles, State Administrative & Accounting Manual, 80.20, pp. 7-17, http://www.ofm.wa.gov/policy/80.20.htm, 2009.

[2] It is also important to note that corporate financial statements are publicly available while IRS tax returns are confidential and not available for public review.

[3] Deferred income is income generated by foreign operations of U.S. corporations. It is not taxed by the IRS until it is repatriated to the domestic parent company.

[4]Sheila Shanker, “Accounting Methods: Cash Vs. Accrual,” http://smallbusiness.chron.com/accounting-methods-cash-vs-accrual-3732.html.

[5] http://www.investopedia.com/terms/d/depreciation.asp.

[6] Diane White, “Straight-Line and MACRS Method,” September 2009, http://www.suite101.com/content/straightline-and-macrs-methods-a69192.

[7]Jean Murray, “Business Tax Savings using Accelerated Depreciation,”

http://biztaxlaw.about.com/od/businesstaxes/a/acceldeprec.htm.

[8] History of Bonus Depreciation: Amended, September 2009, http://www.depreciationguru.com/2009/09/history-of-bonus-depreciation-amended/.

[9] Internal Revenue Service, “Bonus Depreciation and Increased Section 179 Deduction Under the American Recovery and Reinvestment Act,” http://www.irs.gov/businesses/small/article/0,,id=213666,00.html.

[10] Internal Revenue Service, September 2002, http://www.irs.gov/pub/irs-wd/0239032.pdf.

[11] “Inventory Valuation from a Tax Perspective, http://www.accountingtools.com/tax-inventory-valuation.

[12] Scott C. Gibson, The RMA Journal, “LIFO vs. FIFO: a return to the basics,” October 2002, http://findarticles.com/p/articles/mi_m0ITW/is_2_85/ai_n14897182/.

[13] It is worth noting that the IRS has tried to address the inventory accounting disparity by developing “Scheduling M-3 (Form 1120).” Line item 17 of part 2 attempts to address cost of goods sold disparities, also requiring the submission of Form 8916.

[14] For more comprehensive reading concerning the use and abuse of book/tax accounting, see Cecilia Whitaker’s “Bridging the Book-Tax Accounting Gap,” 115 Yale L.J. 680, 2005.

Share this article