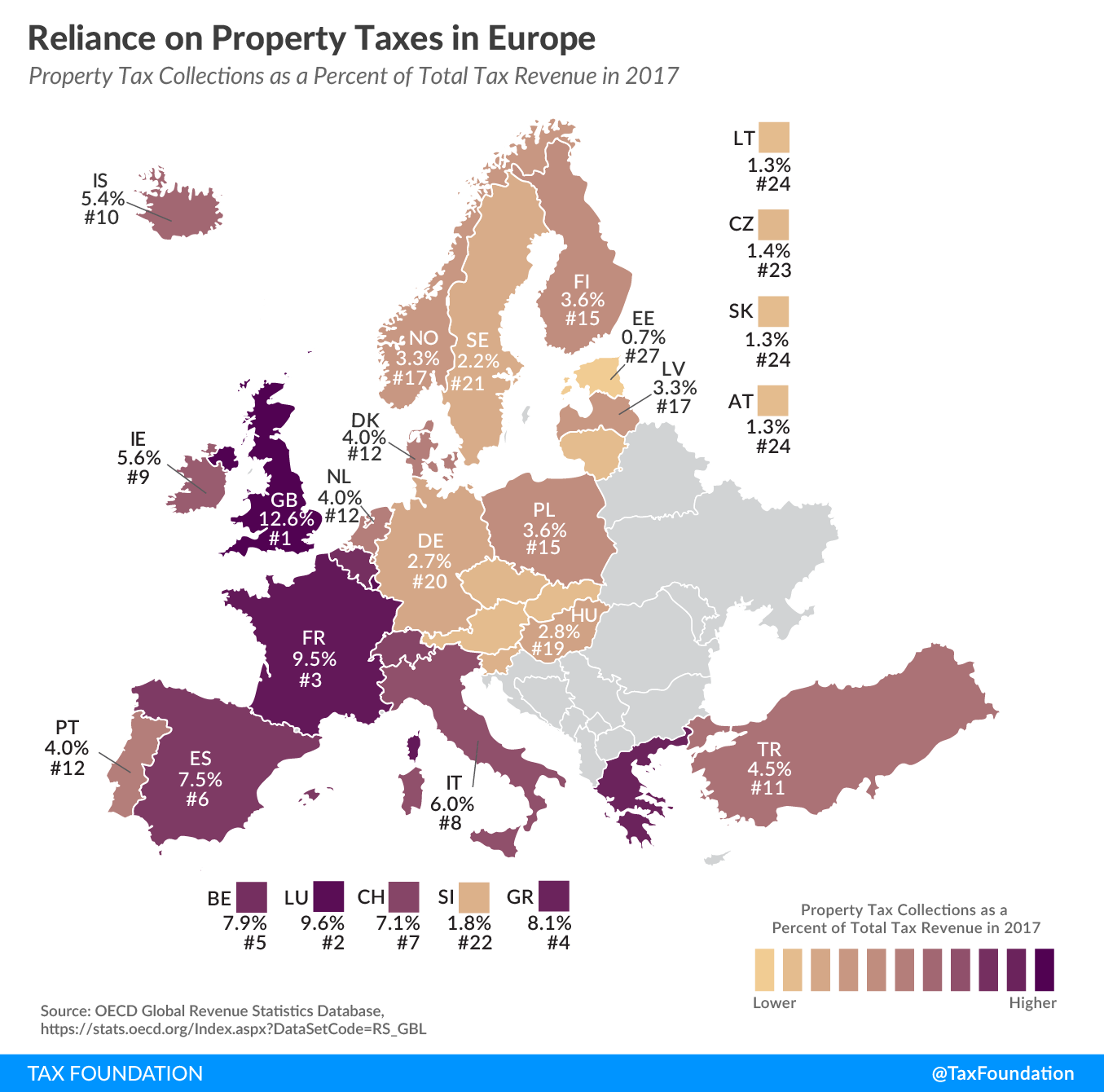

Reliance on Property Taxes in Europe

1 min readBy:A recent report compares to what extent OECD countries rely on various tax revenue sources. Today’s map looks at property tax revenue, which, compared to other taxes, accounts for a relatively small share of total taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue in Europe. In 2017, property taxes accounted for only 4.6 percent of tax revenue on average in the 27 European countries covered in this map.

Property taxes are levied on the assets of an individual or business. There are different types of property taxes, with recurrent taxes on immovable property (such as on land and buildings) the only one levied by all covered countries. Other types of property taxes include estate, inheritance, and gift taxes, net wealth taxes, and taxes on financial and capital transactions.

The United Kingdom relied the most on property taxes in 2017, at 12.6 percent of total tax revenue. Luxembourg and France were next, at 9.6 percent and 9.5 percent, respectively.

Estonia had the lowest reliance on property taxes, at only 0.7 percent of total tax revenue, with Austria, Lithuania, and the Slovak Republic all at 1.3 percent.

Note: This is part of a map series in which we examine tax revenue sources in Europe.