With several states entertaining proposals to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. the financial transactions of savers and investors who don’t even live in their states, some members of Congress see an interstate commerce question worthy of a federal response. Rep. Patrick McHenry (R-NC) and Rep. Bill Huizenga (R-MI) have reintroduced a bill, the Protecting Retirement Savers and Everyday Investors Act, first offered last year, to limit the ability of state governments to levy financial transaction taxes (FTTs).

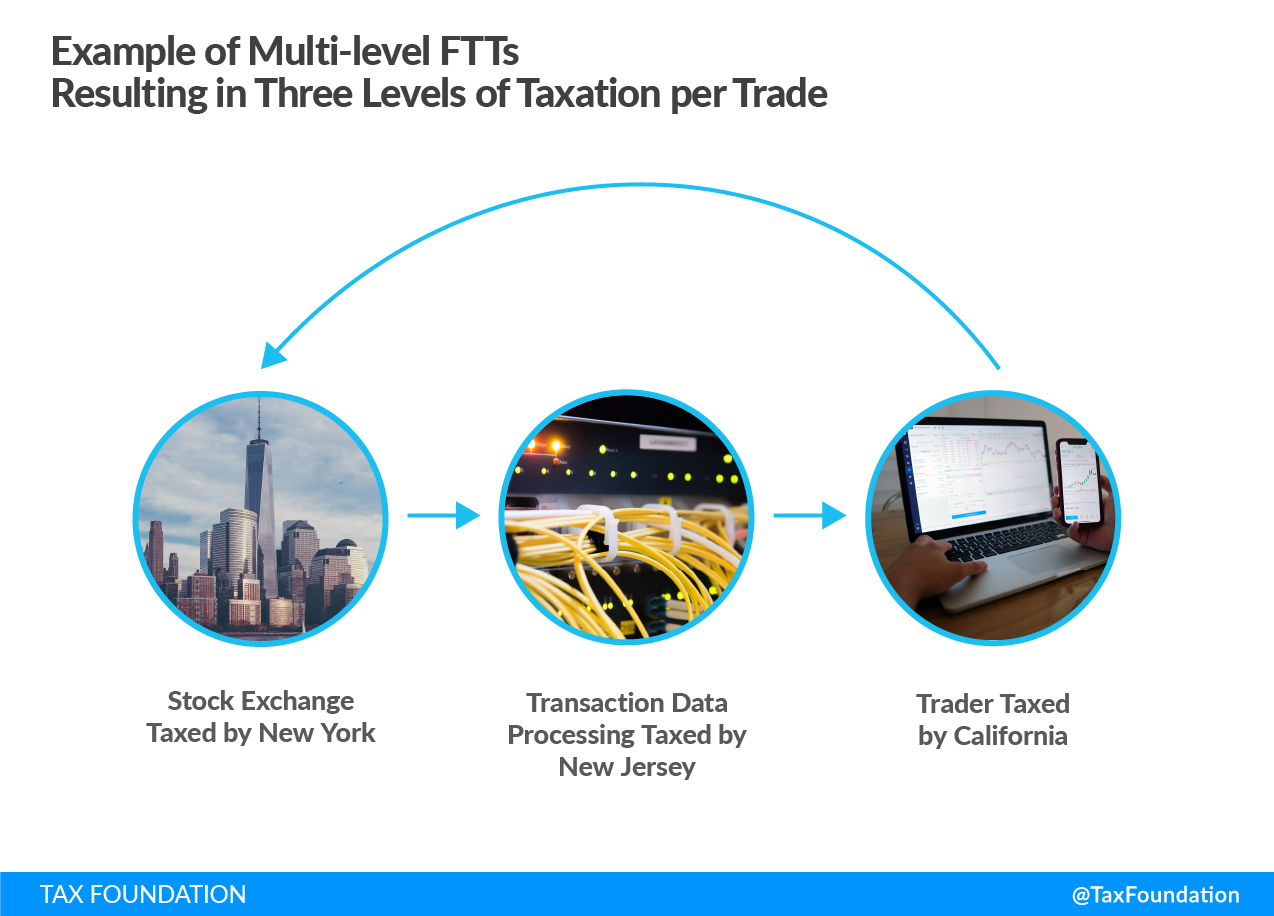

State lawmakers in a variety of states are considering state-level FTTs by either taxing data processing or stock exchanges, or taxing the trader buying and selling financial products. This could result in several taxes being levied on the same transaction (depending on the individual transaction and states’ tax design), and would certainly lead to taxes being levied on the investments of individuals who do not live in the taxing state. Imagine a California investor who purchases equities on the New York Stock Exchange, which processes the transaction at a data center in New Jersey. Imagine the cumulative levies incurred on a single transaction if California levies an FTT on the individual trader, New York levies a tax on the exchange, and New Jersey levies a tax on data processing.

This worst-case scenario, illustrated below, would be avoided if Congress passes federal legislation, such as the Protecting Retirement Savers and Everyday Investors Act, which would prohibit states from levying an FTT on residents of other states. It would do so by limiting states from levying a tax on industry participants based on transaction volume or value. In other words, this bill would prohibit, if enacted, FTTs from taxing intermediaries like stock exchanges or data processing facilities on which out-of-state investors rely. This would leave states with only one option: taxing their own residents or businesses on their investments. Such a tax would still not be wise, but it is rightly a state decision, whereas states levying taxes on transactions by out-of-state investors invites a federal response.

Taxing stock exchanges and data processing is a way of exporting the tax burden since the vast majority of the trades made on these exchanges, and processed on these servers, are conducted on behalf of residents of other states. Policymakers have an incentive to export tax burdens, as it avoids the political pressure involved when levying new taxes on constituents. Limiting tax exporting is sound policy as the taxpayers of exported tax burdens generally have no say on the tax.

Federal lawmakers have considered imposing a national FTT, with the idea generating renewed interest after the events in January when retail investors banded together to trade GameStop stock, which resulted in the value soaring at first and plummeting soon after. Superficially, a federal FTT and a state FTT share many of the same issues: they raise transaction costs, lower trading volumes, lower liquidity, lower assets value, and could potentially increase volatility. These issues are inherent to the design of an FTT at any level.

However, state-level FTTs risk running into additional problems because it is much easier to avoid a state tax than a federal tax. As a result, states that implement an FTT risk causing real harm to their economy without raising much revenue. For instance, in the case of New Jersey, the proposal is to levy a tax on transactions using “electronic infrastructure” located in the state. This would capture many of the major exchanges in New York City, as they use New Jersey-based data centers. These exchanges would either move their data centers or absorb the tax and pass it on to traders. The tax could be avoided if these servers were moved elsewhere, or if some of the trades were moved to other exchanges, like the Chicago Stock Exchange. The New York Stock Exchange and the NASDAQ could simply respond by using servers somewhere other than New Jersey, depriving the state of all the revenue associated with the tax.

In New York, some lawmakers have proposed reviving an existing tax (an FTT technically on the books that has been fully rebated since 1981), which has a rate of up to 5 cents per share (1.25 cents for stocks worth less than $5). Such a tax runs the same risk as a tax on data processing, as a New York tax would fall on New York-based exchanges, which might relocate to avoid the tax. This would be far more consequential than relocating servers out of New Jersey, as it would weaken New York City’s vital financial services sector. Some jobs would doubtless follow the exchanges; others might take advantage of geographic flexibility due to better technology and a more remote work-friendly era to relocate to some other location with lower taxes and a lower cost of living. And even with any transactions still made in New York, such a tax could see some investors pivot to instruments with a similar exposure, such as derivatives, that are not included in the tax base.

States that implement FTTs do so expecting to raise significant revenue, but the uncertainties surrounding this revenue are large—even at the federal level. An estimate by Urban Institute economist James Nunns suggest that a 0.5 percent federal FTT on stocks would reduce stock trades by as much as 85.1 percent. Since it is easier to avoid a state FTT than a federal one, the volume decline may be even more substantial for states, generating revenue well below expectation. Reduced volume does not, moreover, only affect revenue collected from the FTT; it would also offset some of that revenue by lowering state income tax revenue on capital gains.

One FTT is likely to have considerable negative effects on the financial markets, but two or three simultaneous levies would almost certainly have a detrimental impact on the efficiency of the financial markets and their ability to provide return on investment for savers, allocate capital to businesses and government, and promote risk management. The impact on the financial markets would not just be felt by wealthy investors; it would impact regular retirement savings, retail investors, and pension plans. In 2003, New York City’s Independent Budget Office estimated that an FTT at half the rate proposed last year would result in a $45 billion loss for government retirement funds.

States would be well advised to steer clear of taxes on financial transactions, but the federal government gets no say in whether a state wishes to impose such taxes on its own residents. However, federal lawmakers have an opportunity to prevent inequitable and economically damaging state taxation of nonresidents by constraining states’ abilities to tax the trades of people who do not even live there, as the Protecting Retirement Savers and Everyday Investors Act would do.

Share this article