In a Politico op-ed, Rep. Chris Van Hollen (MD-D) and Rep. Louise Slaughter (NY-D) point to Kansas as an example of how “’dynamic scoringDynamic scoring estimates the effect of tax changes on key economic factors, such as jobs, wages, investment, federal revenue, and GDP. It is a tool policymakers can use to differentiate between tax changes that look similar using conventional scoring but have vastly different effects on economic growth. ’ cooks the books.”

“In 2012, the Governor of Kansas enacted massive taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. cuts tilted toward the wealthy, promising that they would provide a “shot of adrenaline” for the state’s economy. He shrugged off the fiscal risks on the advice of hand-picked economists who assured him that the tax cuts would pay for themselves.”

The tax cuts didn’t pay for themselves. Instead, they left Kansas was left with a hole in the budget. (You can read about what Kansas could have done better here and here.)

This isn’t because individual tax cuts are bad for the economy; they’re just expensive. If the governor had used dynamic scoring, he would have known this.

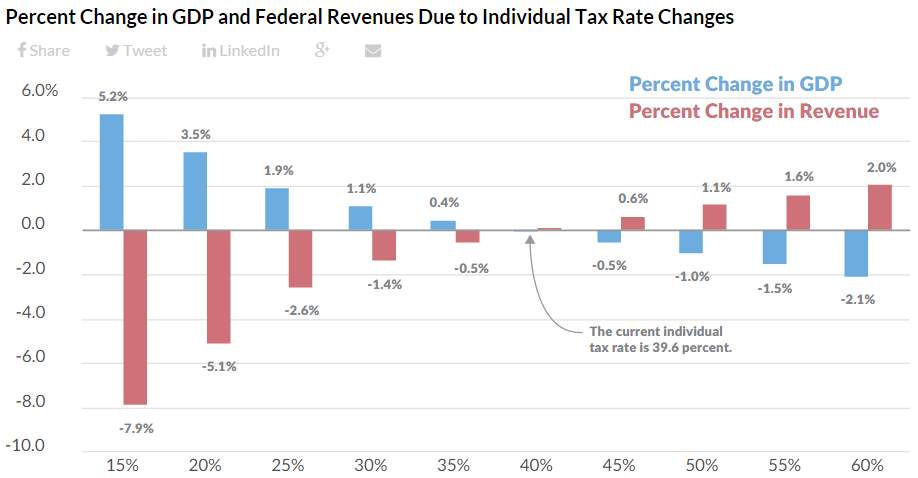

When we use our Taxes and Growth Model to evaluate individual tax cuts, we find that they lose revenue. For federal income tax changes, a cut in the top individual tax rate to 30 percent would shrink federal revenue by 1.4 percent, but give a small boost to the economy. Conversely, an increase in the top rate to 50 percent would increase revenue by 1.1 percent, though the extra revenue would come with the cost of a smaller economy.

This is the purpose of dynamic scoring. If done right, it isn’t “rigging the rules in favor of windfall tax breaks to the very wealthy and big corporations who can hire high-priced, well-funded lobbyists,” as Rep. Van Hollen and Rep. Slaughter think. It’s a tool to help policymakers evaluate the tradeoffs in public policy.

Now, every model is different—and they all come with different assumptions—but it’s time we move past unproductive rhetoric and have a real discussion about the tools we provide elected officials to help them make the best possible decisions for their constituents.

Share this article