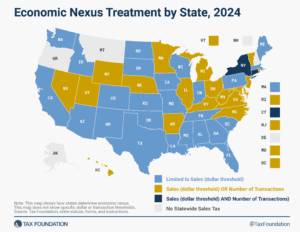

Economic Nexus Treatment by State, 2024

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read