All Related Articles

The High Cost of Wealth Taxes

Many developed countries have repealed their wealth taxes in recent years for a variety of reasons. They raise little revenue, create high administrative costs, and induce an outflow of wealthy individuals and their money. Many policymakers have also recognized that high taxes on capital and wealth damage economic growth.

30 min read

Understanding Full Expensing in the United Kingdom

Given the positive contribution of full expensing to economic growth and that the UK already incurred the peak-year costs due to the existing policy, it is imperative to maintain it permanently.

5 min read

The European Union’s ViDA Proposal: Ignoring Principles Does Not Make Tax Policy Fairer

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read

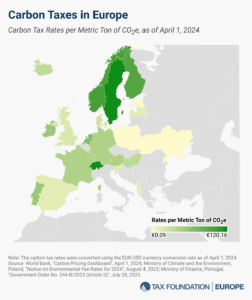

Carbon Taxes in Europe, 2024

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min read

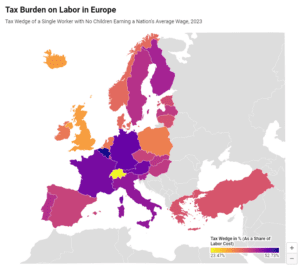

Tax Burden on Labor in Europe, 2024

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Overview and Analysis of the Impact of Marginal Taxes on High Incomes in the European Union

The recent push to increase taxes on the wealthy has gained significant traction across Europe. This report highlights the obstacles and complex interplay between tax policy and economic behavior, suggesting that simply raising tax rates on the wealthy might not yield the intended social benefits.

42 min read

A Journey Through Germany’s Tax Laws

Get ready to hit the autobahn and explore the world of German taxes! We’ll navigate the complexities of Germany’s tax structure.

New Report Identifies Challenges with Global Minimum Tax Implementation in the EU

European Union Member States are in the process of implementing the global minimum tax in line with a directive unanimously agreed to at the end of 2022.

3 min read

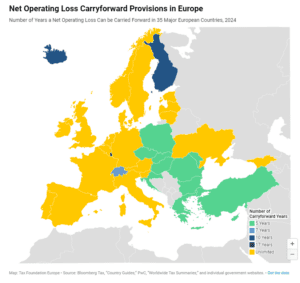

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2024

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Trade Tax Rates in Germany

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read