All Related Articles

Simplifying Germany’s Income Tax System: A Path Toward Fairness and Efficiency

While many Scandinavians get mailed comprehensive pre-filled tax returns and only have to check whether they are correct, the average German taxpayer spends 9 to 10 hours and over €100 filing their tax return.

7 min read

The EU’s Questionable VAT Policy

In a recent survey regarding companies’ barriers to conducting business in the EU single market, VAT ranked first. Policymakers should invest in reforming VAT systems to close both compliance and policy gaps in ways that improve the overall efficiency of their tax systems.

7 min read

Transatlantic Tensions: What the German Election Could Mean for International Tax & Trade Policy

As the third-largest economy in the world, with an influential voice within EU policymaking, and the United States among its most important trading partners, Germany’s next government will play a particularly important role in deciding the direction of European tax, trade, and transatlantic policy.

6 min read

Distributed Profits Taxation Would Be a Good Role Model for the EU’s 28th Regime

In a recent speech at the Davos Economic Forum, European Commission President Ursula von der Leyen announced plans to create a single set of rules for corporate law, insolvency, labor law, and taxation, under which companies could seamlessly operate across the European Single Market.

7 min read

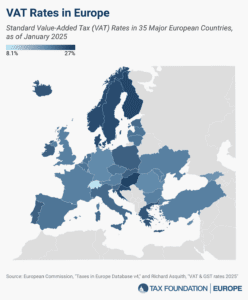

VAT Rates in Europe, 2025

More than 175 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

5 min read

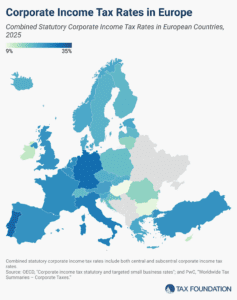

Corporate Income Tax Rates in Europe, 2025

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

Europe Needs Good Tax Policy, Not Buzzwords, to Grow Its Economy

With war continuing in Ukraine, political instability in France and Germany, and the return of Donald Trump to the White House, this could be a year of major realignment for Europe. The tax policy mindset in Brussels should shift accordingly.

Corporate Tax Rates Around the World, 2024

The worldwide average statutory corporate tax rate has consistently decreased since 1980 but has leveled off in recent years. In the US, the 2017 Tax Cuts and Jobs Act brought the country’s statutory corporate income tax rate from the fourth highest in the world closer to the middle of the distribution.

18 min read

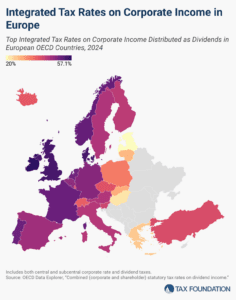

Integrated Tax Rates on Corporate Income in Europe, 2024

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

Spain’s Poorly Designed Tax Policy Hurts Its Competitiveness

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read