All Related Articles

Dear President von der Leyen: President Biden Can’t Fix European Competitiveness

Focusing on the “threat” to European industry caused by the Inflation Reduction Act rather than internal tax system flaws puts the EU at risk of slower economic growth and possibly losing some of its important industrial base. It is also contrary to the EU’s geopolitical goals.

4 min read

EU Taxation: Prioritizing Geopolitics over Revenue

If the EU wants to strategically compete with economic powers like the United States or China, it needs principled, pro-growth tax policy that prioritizes efficient ways to raise revenue over geopolitical ambitions.

6 min read

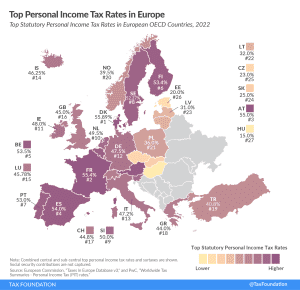

Top Personal Income Tax Rates in Europe, 2023

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

The EU’s Windfall Profits Tax: How “Tax Fairness” Continues to Get in the Way of Energy Security

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

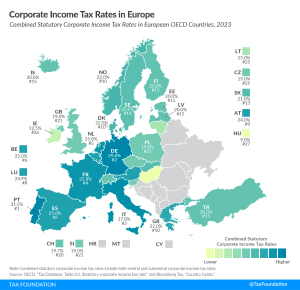

Corporate Income Tax Rates in Europe, 2023

Taking into account central and subcentral taxes, Portugal has the highest corporate tax rate in Europe at 31.5 percent, followed by Germany and Italy at 29.8 percent and 27.8 percent, respectively

2 min read

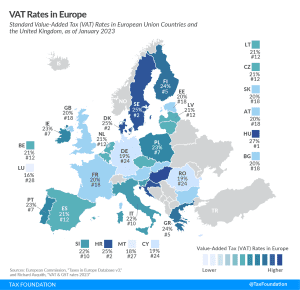

VAT Rates in Europe, 2023

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

Pursuing Delors’ Single Market: What the EU Gets Wrong About Its Economic Power and What It Means for the U.S.

Before EU policymakers rush to implement massive reforms, they should remember the goals of the Single Market, its international limitations, and the role of tax policy.

4 min read

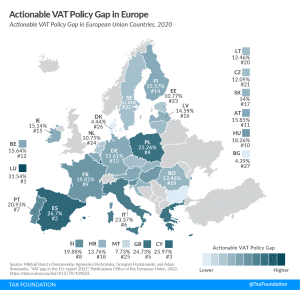

Actionable VAT Policy Gap in Europe, 2023

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

In the Shadow of T-TIP: Why Congress Should Care About EU Tax and Trade Issues in 2023

The EU’s unilateral approach with carbon taxes, faster track on the global minimum tax, and threat of renewed efforts on DSTs means that U.S. policymakers face some hard choices. Policymakers on both sides of the Atlantic should keep in mind pro-growth tax and trade principles that promote a rules-based international order and increase opportunity.

7 min read

All I Want for Christmas is EU: Understanding Tax Policy in Brussels

When it comes to international economic competition, people often frame the argument as the U.S. versus China. But across the Atlantic, nation-states in the European Union have been working hard to show the world that they deserve to be considered an economic force. Rising up to this challenge for the EU is easier said than done.