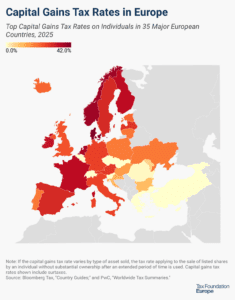

Capital Gains Tax Rates in Europe, 2025

Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

5 min read

Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

5 min read

Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

5 min read

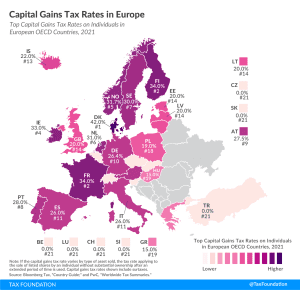

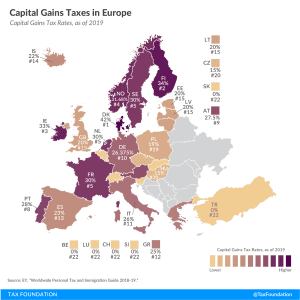

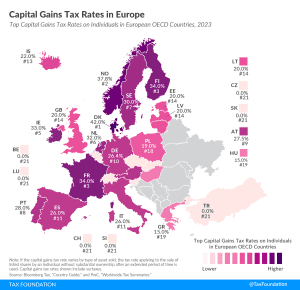

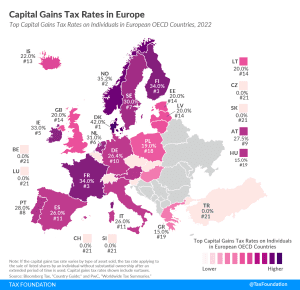

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

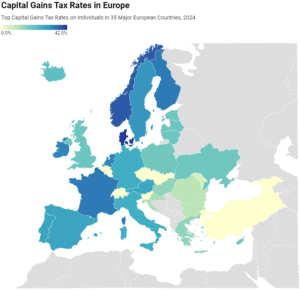

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Norway levies the second-highest top capital gains tax at 37.8 percent. Finland and France follow, at 34 percent each.

4 min read

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read