VAT Exemption Thresholds in Europe

2 min readBy:All countries covered in today’s map levy Value-Added Taxes (VAT). However, to reduce compliance and administrative costs, most countries have VAT exemption thresholds: If a business is below a certain annual revenue threshold, it is not required to participate in the VAT system. This means that small businesses—unlike businesses above that threshold—do not collect VAT on their outputs sold to customers but also cannot receive a refund for VAT paid on business inputs.

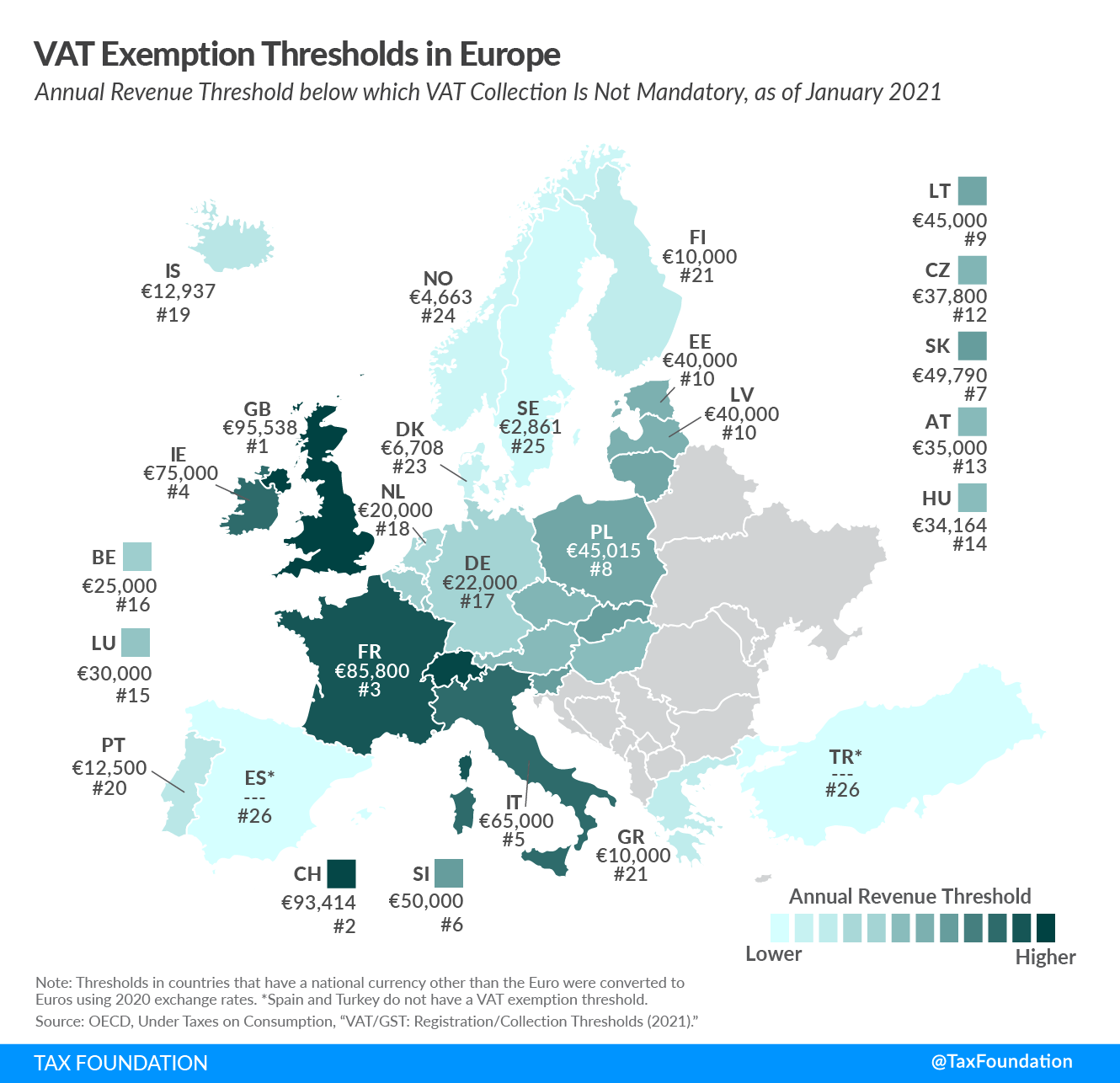

The following map looks at VAT exemption thresholds in European OECD countries.

The United Kingdom has the highest VAT exemption threshold, at €95,538 (US $109,123). Switzerland and France follow, at €93,414 ($106,698) and €85,800 ($98,001). Spain and Turkey are the only countries that do not have a threshold, meaning that all businesses are in the VAT system.

Countries around the world introduced various fiscal measures to counteract the economic distress caused by COVID-19. One measure—among many others—has been to make changes to VAT, such as delaying payments, speeding up refunds, or reducing rates. These measures can provide great relief for many businesses and in some cases for consumers as well.

However, it is important to keep in mind that due to the VAT exemption thresholds many small businesses have not benefited from the VAT changes introduced to provide relief during this crisis. For example, VAT payment extensions and interest-free late payments—such as implemented in various countries—have provided little direct relief for businesses that are below the threshold.

| Annual Revenue Threshold below which VAT Collection Is Not Mandatory | |||

|---|---|---|---|

| Country | National Currency | Euros | U.S. Dollars |

| Austria (AT) | EUR 35,000 | €35,000 | $39,977 |

| Belgium (BE) | EUR 25,000 | €25,000 | $28,555 |

| Czech Republic (CZ) | CZK 1,000,000 | €37,800 | $43,175 |

| Denmark (DK) | DKK 50,000 | €6,708 | $7,661 |

| Estonia (EE) | EUR 40,000 | €40,000 | $45,688 |

| Finland (FI) | EUR 10,000 | €10,000 | $11,422 |

| France (FR) | EUR 85,800 | €85,800 | $98,001 |

| Germany (DE) | EUR 22,000 | €22,000 | $25,128 |

| Greece (GR) | EUR 10,000 | €10,000 | $11,422 |

| Hungary (HU) | HUF 12,000,000 | €34,164 | $39,022 |

| Iceland (IS) | ISK 2,000,000 | €12,937 | $14,777 |

| Ireland (IE) | EUR 75,000 | €75,000 | $85,665 |

| Italy (IT) | EUR 65,000 | €65,000 | $74,243 |

| Latvia (LV) | EUR 40,000 | €40,000 | $45,688 |

| Lithuania (LT) | EUR 45,000 | €45,000 | $51,399 |

| Luxembourg (LU) | EUR 30,000 | €30,000 | $34,266 |

| Netherlands (NL) | EUR 20,000 | €20,000 | $22,844 |

| Norway (NO) | NOK 50,000 | €4,663 | $5,326 |

| Poland (PL) | PLN 200,000 | €45,015 | $51,416 |

| Portugal (PT) | EUR 12,500 | €12,500 | $14,278 |

| Slovak Republic (SK) | EUR 49,790 | €49,790 | $56,870 |

| Slovenia (SI) | EUR 50,000 | €50,000 | $57,110 |

| Spain (ES) | None | None | None |

| Sweden (SE) | SEK 30,000 | €2,861 | $3,268 |

| Switzerland (CH) | CHF 100,000 | €93,414 | $ 106,698 |

| Turkey (TR) | None | None | None |

| United Kingdom (GB) | GBP 85,000 | €95,538 | $ 109,123 |

|

Notes: All countries covered allow businesses below the threshold to register and account voluntarily for VAT. This gives small businesses the option to avoid the disadvantages of non-registration, but also increases their compliance and administrative costs. Thresholds in countries that have a national currency other than the Euro were converted to Euros using 2020 exchange rates. The conversion to U.S. dollars is also based on 2020 exchange rates. Source: OECD, Under Taxes on Consumption, “VAT/GST: Registration/Collection Thresholds (2021),” https://www.oecd.org/tax/tax-policy/tax-database/. |

|||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe