Recent Changes in Statutory Corporate Income Tax Rates in Europe

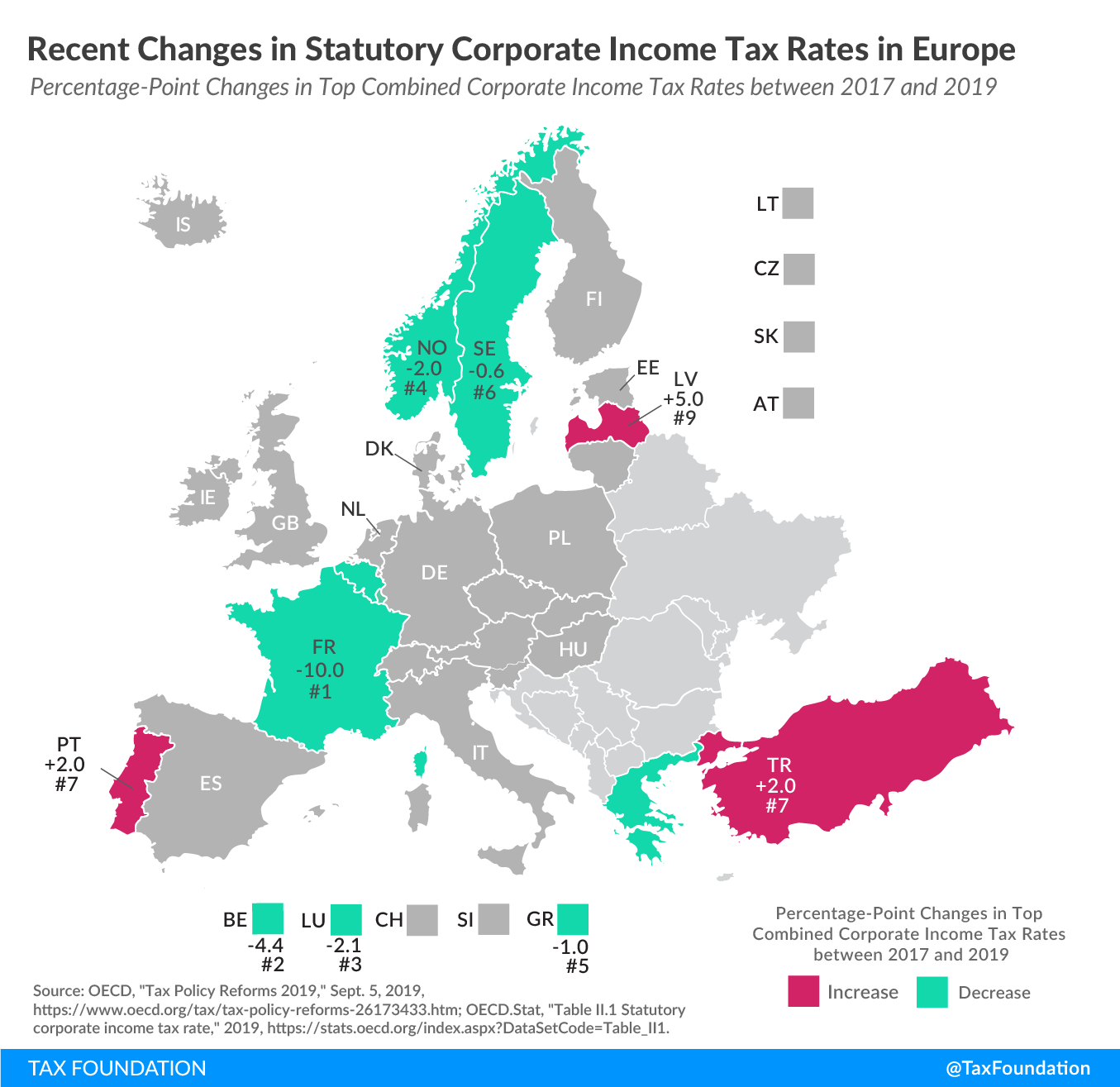

3 min readBy:Over the last two decades, corporate income tax rates have declined around the world. Today’s map shows the most recent changes in corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates in Europe, comparing how combined statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates have changed between 2017 and 2019. The average tax rate of all European countries covered has declined from 22.8 percent in 2017 to 22.3 percent in 2019.

Combined statutory corporate income tax rates capture central and subcentral corporate income tax rates. Statutory tax rates do not necessarily reflect the actual tax burden of a business as they do not capture adjustments in the tax base. Effective corporate income tax rates, on the other hand, reflect both statutory tax rates and provisions impacting the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , such as capital allowances, inventory valuation methods, or international tax rules.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeBelgium

Belgium lowered its combined statutory corporate income tax from 34 percent in 2017 to 29.6 percent in 2018. Starting in 2020, the rate will be further reduced to 25 percent. Since 2018, small and medium-sized businesses are subject to a reduced rate of 20 percent on the first €100,000 (US $118,000) in taxable profits.

France

France currently levies a standard corporate income tax rate of 33.3 percent and a 3.3 percent surcharge, resulting in a combined statutory rate of 34.4 percent. In 2017, France levied a temporary one-off surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on corporate profits of businesses with revenues exceeding €250 million (US $295 million) at a rate of 10.7 percent. This surtax was removed in 2018, reducing the combined statutory rate from 44.4 percent in 2017 to 34.4 percent in 2018. France scheduled a rate reduction to 32 percent in 2019, followed by further cuts leading to a combined rate of 25.8 percent in 2022. However, the rate decrease for 2019 has been put on hold for businesses with revenues exceeding €250 million.

Greece

In 2019, Greece reduced its corporate rate from 29 percent to 28 percent. Further tax rate reductions are scheduled, down to 27 percent in 2020, 26 percent in 2021, and 25 percent starting in 2022.

Latvia

Latvia adopted a cash-flow tax model in 2018, replacing its business income tax. Under the new model, corporate income taxes will only be collected when profits are distributed to shareholders instead of annually. Although this tax reform resulted in a corporate tax rate of 20 percent compared to a rate of 15 percent in the previous system, a cash-flow tax significantly improves the competitiveness of a tax code.

Luxembourg

Luxembourg’s combined corporate income tax rate has been reduced gradually from 27.1 percent in 2017 to 26 percent in 2018 and 25 percent in 2019.

Norway

Norway reduced its corporate tax rate from 24 percent in 2017 to 23 percent in 2018 and 22 percent in 2019.

Portugal

Portugal is one of the three European countries covered in today’s map that has increased its top combined corporate tax rate (with Turkey and Latvia). In 2018, Portugal’s state surcharge was increased from 7 percent to 9 percent on profits exceeding €35 million (US $41 million), resulting in an increase in the top combined rate from 29.5 percent to 31.5 percent.

Sweden

Sweden legislated a decrease in its corporate tax rate, from 22 percent in 2018 to 21.4 percent in 2019. A further reduction to 20.6 percent is scheduled for 2021.

Turkey

In 2018, Turkey increased its statutory rate from 20 percent to 22 percent for the years 2018, 2019, and 2020. However, the rate is scheduled to be lowered again starting in 2021.

|

Source: OECD, “Tax Policy Reforms 2019,” Sept. 5, 2019, https://www.oecd.org/tax/tax-policy-reforms-26173433.htm; OECD.Stat, “Table II.1 Statutory corporate income tax rate,” 2019, https://stats.oecd.org/index.aspx?DataSetCode=Table_II1. |

|||

| Country | 2017 Tax Rates | 2018 Tax Rates | 2019 Tax Rates |

|---|---|---|---|

| Belgium (BE) | 34.0% | 29.6% | 29.6% |

| France (FR) | 44.4% | 34.4% | 34.4% |

| Greece (GR) | 29.0% | 29.0% | 28.0% |

| Latvia (LV) | 15.0% | 20.0% | 20.0% |

| Luxembourg (LU) | 27.1% | 26.0% | 25.0% |

| Norway (NO) | 24.0% | 23.0% | 22.0% |

| Portugal (PT) | 29.5% | 31.5% | 31.5% |

| Sweden (SE) | 22.0% | 22.0% | 21.4% |

| Turkey (TR) | 20.0% | 22.0% | 22.0% |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe