Tax Subsidies for R&D Expenditures in Europe, 2023

4 min readBy:Many countries incentivize business investment in research and development (R&D) to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

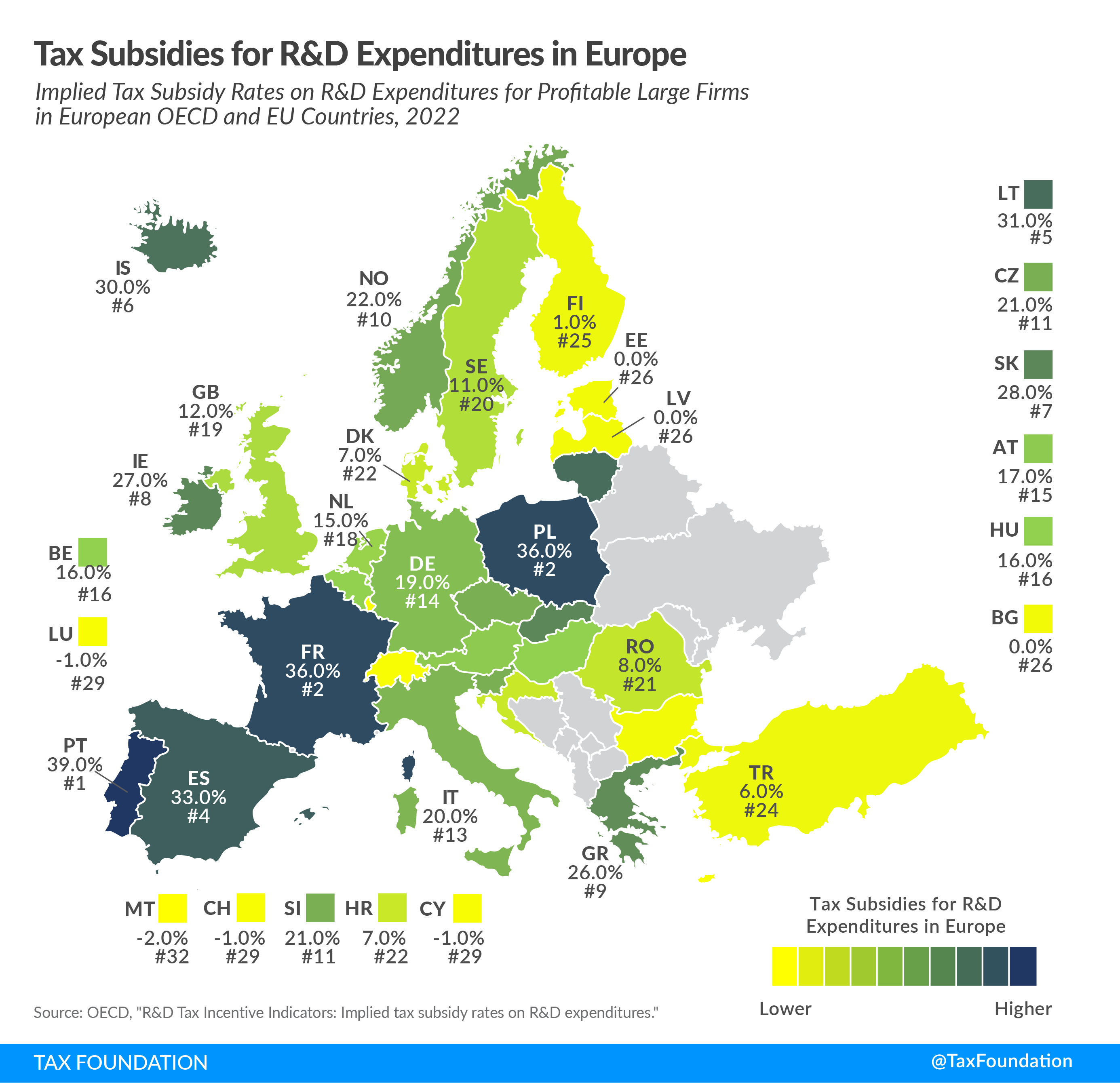

These generally take two forms, namely patent boxes—taxing income derived from intellectual property at a rate below the statutory corporate income tax rate—and taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. incentives for R&D expenditures. Today’s map will focus on the latter, showing to what degree European OECD and EU countries grant expenditure-based R&D tax relief.

The implied tax subsidy rate, developed by the OECD, is one way to measure the extent of expenditure-based R&D tax relief across countries. This implied tax subsidy rate measures the extent of the preferential treatment of R&D in a given tax system. The more generous the tax provisions for R&D, the higher the implied subsidy rates for R&D. An implied subsidy rate of zero means R&D does not receive preferential tax treatment.

The implied tax subsidy rates for large profitable firms vary significantly among countries that grant notable relief, ranging from 0.01 in Finland to 0.39 in Portugal. France and Poland provide the second most generous relief after Portugal, with an implied tax subsidy rate of 0.36.

Of the countries that grant notable relief, Finland (0.01), Turkey (0.06), Croatia (0.07), and Denmark (0.07) are the least generous. The implied tax subsidy rates of Bulgaria, Cyprus, Estonia, Latvia, Luxembourg, Malta, and Switzerland do not show any significant expenditure-based R&D tax relief.

The OECD also provides implied tax subsidy rates for loss-making firms and for small and medium-sized enterprises (SMEs). Most countries covered in today’s map provide the same expenditure-based R&D tax relief to large firms and SMEs. Only France (in the case of loss-making firms), Iceland, the Netherlands, and the United Kingdom are relatively more generous to SMEs than to large firms. Croatia and Hungary (in the case of loss-making firms) offer slightly higher relief to large firms than to SMEs.

Some countries’ R&D tax incentives include refunds and carryover provisions, changing the implied tax subsidy rates for loss-making firms relative to profitable firms. This has resulted in lower average implied tax subsidy rates for loss-making firms relative to profitable firms, both for SMEs and large firms.

| Small and Medium-Sized Enterprises | Large Firms | |||

|---|---|---|---|---|

| Country | Profitable | Loss-Making | Profitable | Loss-Making |

| Austria (AT) | 0.17 | 0.17 | 0.17 | 0.17 |

| Belgium (BE) | 0.16 | 0.15 | 0.16 | 0.15 |

| Bulgaria (BG) | 0 | 0 | 0 | 0 |

| Croatia (HR) | 0.04 | 0.03 | 0.07 | 0.05 |

| Cyprus (CY) | -0.01 | 0 | -0.01 | 0 |

| Czech Republic (CZ) | 0.21 | 0.15 | 0.21 | 0.15 |

| Denmark (DK) | 0.07 | 0.06 | 0.07 | 0.06 |

| Estonia (EE) | 0 | 0 | 0 | 0 |

| Finland (FI) | 0.01 | 0 | 0.01 | 0 |

| France (FR) | 0.36 | 0.36 | 0.36 | 0.29 |

| Germany (DE) | 0.19 | 0.18 | 0.19 | 0.18 |

| Greece (GR) | 0.26 | 0.2 | 0.26 | 0.2 |

| Hungary (HU) | 0.16 | 0.14 | 0.16 | 0.15 |

| Iceland (IS) | 0.42 | 0.42 | 0.3 | 0.3 |

| Ireland (IE) | 0.27 | 0.22 | 0.27 | 0.22 |

| Italy (IT) | 0.2 | 0.15 | 0.2 | 0.15 |

| Latvia (LV) | 0 | 0 | 0 | 0 |

| Lithuania (LT) | 0.31 | 0.25 | 0.31 | 0.25 |

| Luxembourg (LU) | -0.01 | -0.01 | -0.01 | -0.01 |

| Malta (MT) | -0.02 | -0.02 | -0.02 | -0.02 |

| Netherlands (NL) | 0.31 | 0.31 | 0.15 | 0.14 |

| Norway (NO) | 0.22 | 0.22 | 0.22 | 0.22 |

| Poland (PL) | 0.36 | 0.28 | 0.36 | 0.28 |

| Portugal (PT) | 0.39 | 0.31 | 0.39 | 0.31 |

| Romania (RO) | 0.08 | 0.07 | 0.08 | 0.07 |

| Slovak Republic (SK) | 0.28 | 0.22 | 0.28 | 0.22 |

| Slovenia (SI) | 0.21 | 0.17 | 0.21 | 0.17 |

| Spain (ES) | 0.33 | 0.26 | 0.33 | 0.26 |

| Sweden (SE) | 0.11 | 0.1 | 0.11 | 0.1 |

| Switzerland (CH) | -0.01 | -0.01 | -0.01 | -0.01 |

| Turkey (TR) | 0.06 | 0.05 | 0.06 | 0.05 |

| United Kingdom (GB) | 0.27 | 0.27 | 0.12 | 0.12 |

|

Source: OECD, “R&D Tax Incentive Indicators: Implied tax subsidy rates on R&D expenditures,” Mar. 27, 2023, https://stats.oecd.org/Index.aspx?DataSetCode=RDSUB. |

||||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe