Integrated Tax Rates on Corporate Income in Europe, 2023

4 min readBy:In most European OECD countries, corporate income is taxed twice—once at the entity level and once at the shareholder level. Before shareholders pay taxes, the business first faces corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. on its profits. Thus, when shareholders pay their layer of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , they are doing so on dividends or capital gains distributed from after-tax profits. The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. —the total tax levied on corporate income.

As an example, suppose that an Italian corporation earns $100 in profit. It must pay corporate income tax of $24, which leaves the corporation with $76 in after-tax profits. If the corporation distributes those earnings as a dividend, the income is taxed again at the individual level at a top dividend rate of 26 percent, resulting in $19.76 in dividend taxes. Thus, the final after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. is $56.24, implying that the $100 in original corporate profits faces an integrated tax rate on corporate income of 43.76 percent. (The same calculation can be done for corporate income realized as capital gains.)

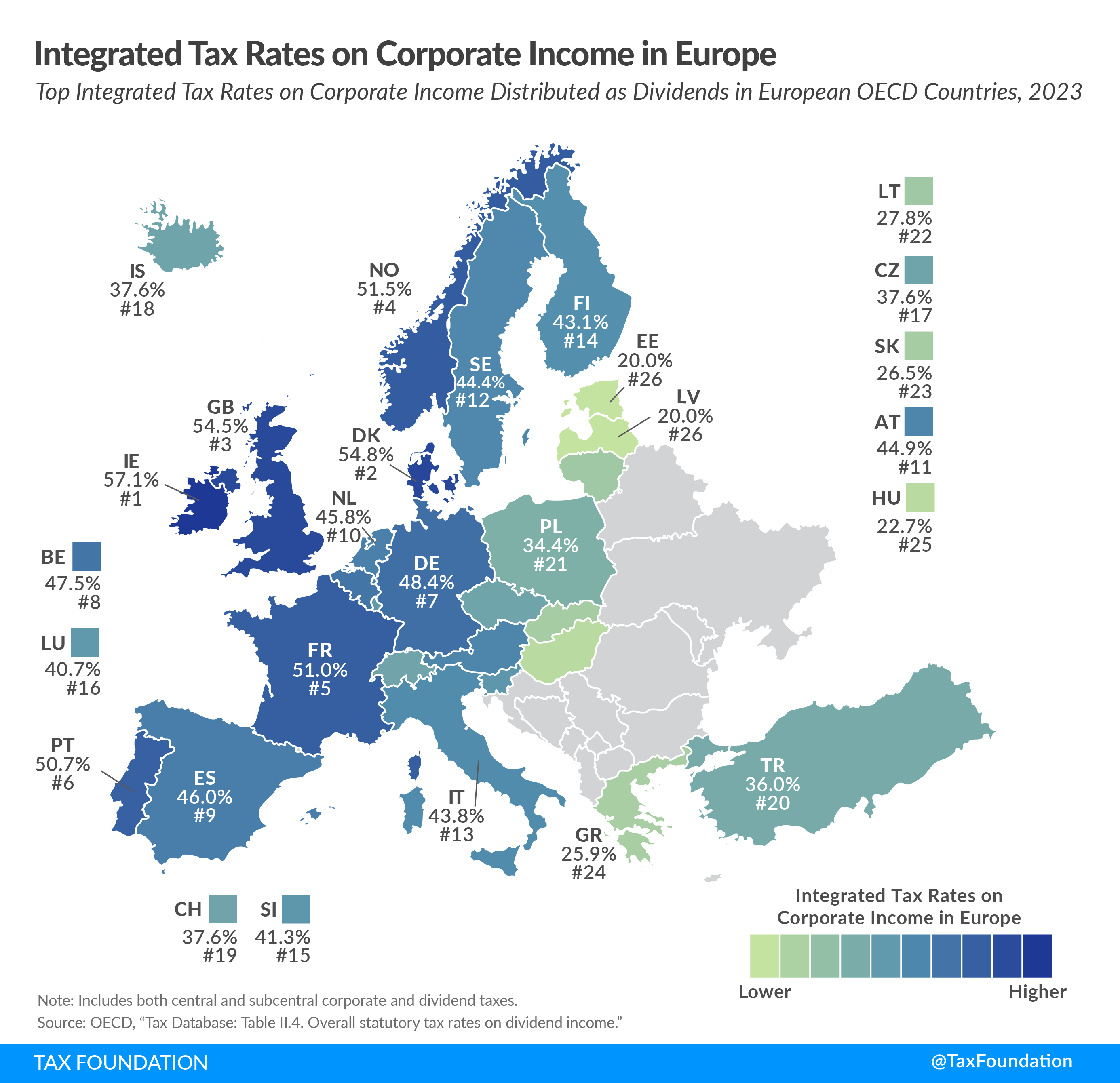

For dividends, Ireland’s top integrated tax rate was the highest among European OECD countries (57.1 percent), followed by Denmark (54.8 percent) and the United Kingdom (54.5 percent). Estonia (20 percent), Latvia (20 percent), and Hungary (22.7 percent) levy the lowest rates. Estonia and Latvia’s tax on distributed profits means that the corporate income tax is the only layer of taxation on corporate income distributed as dividends.

For capital gains, Denmark (54.8 percent), Norway (51.5 percent), and France (51 percent) have the highest integrated rates among European OECD countries, while Slovenia (19 percent), Czech Republic (19 percent), Switzerland (19.7 percent), and Turkey (20 percent) levy the lowest rates. Several European OECD countries—namely Belgium, Czech Republic, Luxembourg, Slovakia, Slovenia, Switzerland, and Turkey—do not levy capital gains taxes on long-term capital gains, making the corporate tax the only layer of tax on corporate income realized as long-term capital gains.

Double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of corporate income can lead to such economic distortions as reduced savings and investment, a bias towards certain business forms, and debt financing over equity financing. Several OECD countries have integrated corporate and individual tax codes to eliminate or reduce the negative effects of double taxation on corporate income.

| OECD Country | Statutory Corporate Income Tax Rate | Dividends | Capital Gains (a) | ||

|---|---|---|---|---|---|

| Top Personal Dividend Tax Rate | Integrated Tax on Corporate Income (Dividends) | Top Personal Capital Gains Tax Rate | Integrated Tax on Corporate Income (Capital Gains) | ||

| Austria (AT) | 24.0% | 27.5% | 44.9% | 27.5% | 44.9% |

| Belgium (BE) | 25.0% | 30.0% | 47.5% | 0.0% | 25.0% |

| Czech Republic (CZ) | 19.0% | 23.0% | 37.6% | 0.0% | 19.0% |

| Denmark (DK) | 22.0% | 42.0% | 54.8% | 42.0% | 54.8% |

| Estonia (EE) | 20.0% | 0.0% | 20.0% | 20.0% | 36.0% |

| Finland (FI) | 20.0% | 28.9% | 43.1% | 34.0% | 47.2% |

| France (FR) | 25.8% | 34.0% | 51.0% | 34.0% | 51.0% |

| Germany (DE) | 29.9% | 26.4% | 48.4% | 26.4% | 48.4% |

| Greece (GR) | 22.0% | 5.0% | 25.9% | 15.0% | 33.7% |

| Hungary (HU) | 9.0% | 15.0% | 22.7% | 15.0% | 22.7% |

| Iceland (IS) | 20.0% | 22.0% | 37.6% | 22.0% | 37.6% |

| Ireland (IE) | 12.5% | 51.0% | 57.1% | 33.0% | 41.4% |

| Italy (IT) | 24.0% | 26.0% | 43.8% | 26.0% | 43.8% |

| Latvia (LV) | 20.0% | 0.0% | 20.0% | 20.0% | 36.0% |

| Lithuania (LT) | 15.0% | 15.0% | 27.8% | 20.0% | 32.0% |

| Luxembourg (LU) | 24.9% | 21.0% | 40.7% | 0.0% | 24.9% |

| Netherlands (NL) | 25.8% | 26.9% | 45.8% | 32.0% | 49.5% |

| Norway (NO) | 22.0% | 37.8% | 51.5% | 37.8% | 51.5% |

| Poland (PL) | 19.0% | 19.0% | 34.4% | 19.0% | 34.4% |

| Portugal (PT) | 31.5% | 28.0% | 50.7% | 28.0% | 50.7% |

| Slovak Republic (SK) | 21.0% | 7.0% | 26.5% | 0.0% | 21.0% |

| Slovenia (SI) | 19.0% | 27.5% | 41.3% | 0.0% | 19.0% |

| Spain (ES) | 25.0% | 28.0% | 46.0% | 26.0% | 44.5% |

| Sweden (SE) | 20.6% | 30.0% | 44.4% | 30.0% | 44.4% |

| Switzerland (CH) | 19.7% | 22.3% | 37.6% | 0.0% | 19.7% |

| Turkey (TR) | 20.0% | 20.0% | 36.0% | 0.0% | 20.0% |

| United Kingdom (GB) | 25.0% | 39.4% | 54.5% | 20.0% | 40.0% |

| Average | 21.5% | 24.2% | 40.4% | 19.5% | 36.8% |

|

Notes: Integrated tax rates are calculated as follows: (Corporate Income Tax) + [(Distributed Profit – Corporate Income Tax) * Dividends or Capital Gains Tax]. (a) In some countries, the capital gains tax rate varies by type of asset sold. The capital gains tax rate used in this report is the rate that applies to the sale of listed shares after an extended period of time. While the integrated tax rate on dividends captures subcentral taxes, this may not be the case for all integrated tax rates on capital gains due to data availability. (b) In the Netherlands, the net asset value is taxed at a flat rate on a deemed annual return. Source: OECD, “Tax Database: Table II.4. Overall statutory tax rates on dividend income,” last updated April 2023, https://stats.oecd.org/index.aspx?DataSetCode=TABLE_II4#; PwC, “Quick Charts: Capital gains tax (CGT) rates,” https://taxsummaries.pwc.com/quick-charts/capital-gains-tax-cgt-rates; author’s calculations. |

|||||