Beer Taxes in Europe, 2023

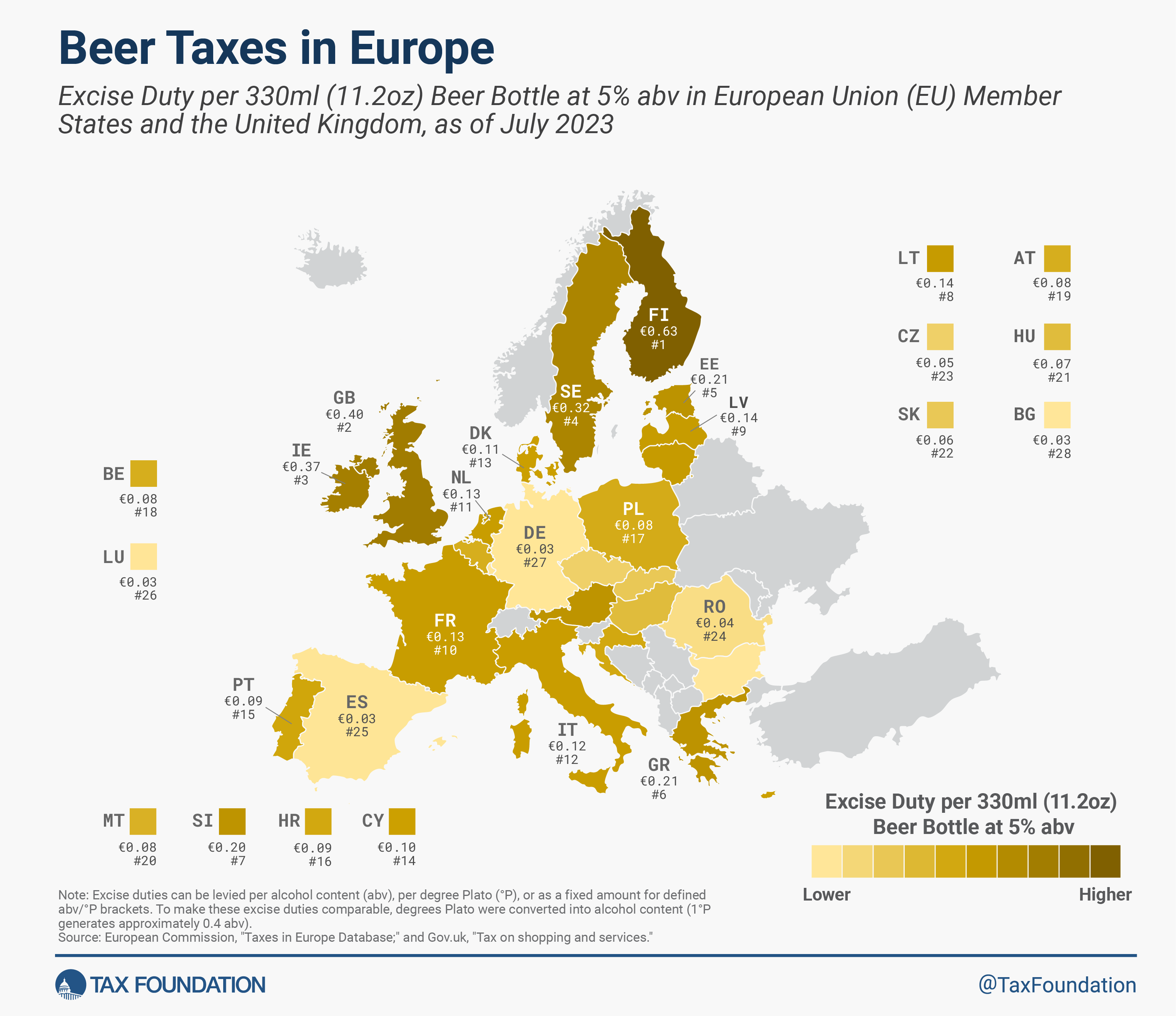

2 min readBy:As Oktoberfest celebrations kick off around the world, let’s look at how much taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. European Union (EU) countries add to the world’s favorite alcoholic beverage. EU law requires every EU country to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content. That amounts to a minimum tax of €0.03 ($0.03) for a 330ml (11.2 oz) beer bottle with 5 percent alcohol content. As this map illustrates, only a few EU countries stick close to the minimum rate; most levy much higher excise duties.

Finland, the United Kingdom, and Ireland levy the highest excise duties on beer. Finland levies a tax of €0.63 ($0.66) per 330ml beer bottle, followed by the United Kingdom at €0.37 ($0.40) and Ireland at €0.37 ($0.39) per beer.

Bulgaria, Germany, Luxembourg, and Spain each levy approximately the EU’s minimum rate of €0.03 ($0.03) per beer bottle.

The EU’s wide range of tax rates spans the range of global tax rates on beer. Finland is a high tax outlier within the EU, but its tax rate is only slightly more than half of Israel’s tax rate on beer. Conversely, Germany has the lowest tax rate on beer of any country in the OECD. Tax rates across the EU are generally higher than rates in the U.S. The minimum EU beer tax of $0.03 per 11.2 oz bottle exceeds the tax rate of the median U.S. state (Virginia at $0.02 per 11.2 oz bottle).

All European countries covered also levy a value-added tax (VAT) on beer, which is charged on the sales value of a beer bottle. The excise amounts shown in the map above relate only to excise taxes and do not include the VAT.

The diverse landscape of beer taxes across the EU highlights the significant disparities in taxation and mirrors the variation in the global treatment of beer. Cheers to a deeper understanding of the economics behind our choice brews, and may it lead to more informed discussions and decisions in the future. Prost!

Beer Taxes in Europe

Excise Duties on Beer in European Union (EU) Member States and the United Kingdom, as of July 2023

| Country | Excise Duty per 330ml (11.2oz) Beer Bottle at 5% abv | ||

|---|---|---|---|

| Euros | US-Dollars | ||

| AT | Austria | € 0.08 | $0.09 |

| BE | Belgium | € 0.08 | $0.09 |

| BG | Bulgaria | € 0.03 | $0.03 |

| CY | Cyprus | € 0.10 | $0.10 |

| CZ | Czech Republic | € 0.05 | $0.05 |

| DE | Germany | € 0.03 | $0.03 |

| DK | Denmark | € 0.11 | $0.11 |

| EE | Estonia | € 0.21 | $0.22 |

| ES | Spain | € 0.03 | $0.03 |

| FI | Finland | € 0.63 | $0.66 |

| FR | France | € 0.13 | $0.13 |

| GB | United Kingdom | € 0.40 | $0.42 |

| GR | Greece | € 0.21 | $0.22 |

| HR | Croatia | € 0.09 | $0.09 |

| HU | Hungary | € 0.07 | $0.07 |

| IE | Ireland | € 0.37 | $0.39 |

| IT | Italy | € 0.12 | $0.13 |

| LT | Lithuania | € 0.14 | $0.15 |

| LU | Luxembourg | € 0.03 | $0.03 |

| LV | Latvia | € 0.14 | $0.14 |

| MT | Malta | € 0.08 | $0.08 |

| NL | Netherlands | € 0.13 | $0.13 |

| PL | Poland | € 0.08 | $0.09 |

| PT | Portugal | € 0.09 | $0.09 |

| RO | Romania | € 0.04 | $0.04 |

| SE | Sweden | € 0.32 | $0.34 |

| SI | Slovenia | € 0.20 | $0.21 |

| SK | Slovakia | € 0.06 | $0.06 |

Source: European Commission, “Taxes in Europe Database,” accessed September, 2023, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html; and Gov.uk, “Tax on shopping and services: Alcohol and tobacco duties,” https://www.gov.uk/tax-on-shopping/alcohol-tobacco. Share this article