Key Findings

- Several studies have raised concerns about multinational corporations shifting income from the U.S., where the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate is relatively high, to lower-taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. countries.

- Some studies have found that corporate profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. has reduced corporate tax revenue by as much as 35 percent.

- However, these same studies suggest that conventional analyses of a corporate income tax rate reduction overstate the tax revenue losses because of income shifting by multinational corporations.

- Under an aggressive income-shifting model, a 30 percent corporate income tax rate would increase U.S. corporate income by $143 billion and increase overall tax revenue by $8 billion.

- A 25 percent corporate tax rate would increase U.S. corporate income by $278 billion while maintaining the same tax revenue as the current 35 percent rate.

- Under a more conservative estimates of income-shifting, a 30 percent corporate income tax rate would increase corporate income by $35 billion, but the overall tax revenue would decrease by $24 billion.

Introduction

Several studies have raised concerns about multinational corporations shifting income from the U.S., where the corporate income tax rate is relatively high, to lower-tax countries. These studies suggest that when the difference in corporate income tax rates between the U.S. and other countries is great, U.S. businesses’ foreign affiliates claim more income in their host countries, which results in lower U.S. tax revenues. Some studies have suggested that 35 percent of U.S. corporate tax revenue is lost due to income shifting.

As a result, some lawmakers have called for stricter tax avoidance rules on U.S. multinational corporations, such as the subpart F rules in the Internal Revenue Code.

However, these studies also suggest that lawmakers could reduce income shifting by reducing the difference between the corporate income tax rate of the U.S. and other countries. If the empirical studies on income shifting are correct and the difference between U.S. and foreign corporate income tax rates decreases, either through a decrease in the U.S. corporate tax rate or an increase in foreign corporate tax rates, then the amount of income shifting to foreign affiliates should also decrease. Then, multinational corporations would declare more of their income in the U.S., and the U.S. would collect more revenue from the corporate income tax.

The U.S. has the highest corporate income tax rate in the OECD.[1] As such, lawmakers can reduce the difference in U.S. and foreign corporate income tax rates by lowering the federal statutory corporate income tax rate. Lowering the corporate income tax rate would reduce the amount of revenue collected by the federal government but would also reduce income shifting, mitigating revenue losses by increasing the tax base. The income-shifting effect, combined with the internal growth spurred by a tax reduction, makes it more likely that a decrease in the corporate income tax rate could increase tax revenues in the long run. Under some assumptions, the income shifting alone could result in higher tax revenue.

This paper estimates the revenue impact of a federal corporate tax rate cut within an income-shifting framework. The model, which estimates corporate tax revenue, is built upon several income-shifting studies conducted over the last two decades.

Model of Income Shifting

Over the past two decades, several studies have argued that U.S. multinational corporations shift income out of the U.S. to foreign affiliates in low-tax countries.[2] Each of the studies used different techniques and data sources to estimate the increase in income reported by a foreign affiliate based on the corporate tax rate of the host country.

Almost all of these studies used a semi-elasticity approach originally introduced by Hines and Rice.[3] The semi-elasticity approach assumes that a percentage point increase in the corporate tax rate of the host country decreases the amount of income reported by the affiliate of a multinational corporation by a fixed percent. For example, Hines and Rice used aggregate multinational-corporation data to estimate that a one percentage point increase in a country’s corporate tax rate reduces income reported in that country by 2.83 percent.[4]

Due to data limitations, most of the studies do not attempt to estimate the corporate income tax revenue losses from the income shifting, but a study by Kimberly Clausing at Reed College used multinational corporations’ affiliate data from the Bureau of Economic Analysis (BEA), aggregated by country, to estimate these losses.[5] She estimated that, in 2004, U.S. multinational corporations shifted $180 billion out of the U.S.. This means that corporate tax revenue is 35 percent lower than it otherwise would have been without profit shifting.. Her results imply that the U.S. has lost $167 billion in tax revenue due to $468 billion in income shifting in 2014. If this is the case, the federal government is losing revenue nearly equal to 1% of GDP each year.

Clausing’s model hinges on the difference between the U.S.’s effective average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. (EATR) and the EATR of the foreign affiliate’s host country.[6] She finds that the greater the difference between the two tax rates, the more income is reported by the foreign affiliate of a U.S. parent. The assumption is that U.S. parent businesses are shifting income to the foreign country. If the tax rates had been the same, the additional income reported by the foreign affiliate would have been reported in the U.S. and taxed at the U.S. statutory corporate income tax rate.

Since the difference between the EATR determines the amount of income shifting, then it is possible to increase the U.S. corporate income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. by either increasing the statutory corporate income tax rate of other countries or reducing the statutory corporate income tax rate in the U.S. This suggests that reducing the U.S. federal corporate income tax rate would not reduce revenue as much as a conventional analysis would predict. A reduction in the corporate income tax rate would reduce tax revenue from the original base, but the lower rate would decrease income shifting, which would expand the base. This would mitigate the revenue losses and, in some cases, could increase tax revenue.

Conversely, increasing the corporate income tax rate would shrink the base as multinational corporations shift income to their foreign affiliates. Income shifting limits the tax revenue that can be raised from a corporate rate increase and, in some cases, a corporate rate increase could reduce overall revenues rather than increase them.

Using the income shifting model developed by Clausing, this paper develops a model to estimate the growth of the corporate income tax base as the U.S. rate is reduced and the corresponding tax revenue effects. The semi-elasticity of income shifting estimated by Clausing is used to determine the reduction in income shifting as the U.S.’s corporate income tax rate falls. The model uses 2012 country-level foreign-affiliate data from the BEA as the baseline for a change in the corporate income tax base.[7]

The EATR of affiliates’ host countries is taken from the Corporate Tax Database compiled by Oxford University, Centre for Business Taxation.[8] The U.S. EATR is calculated using Devereux and Griffith’s method while holding depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. , deductions, and credits constant.[9] In the equation, only the statutory rate changes.

Estimates of Income Shifting

If the Clausing model correctly estimates the amount of income shifting out of the U.S., then a corporate income tax rate cut to 30 percent could actually raise revenue. The table below shows estimates of income shifting and corporate tax revenue under different corporate income tax rates (Table 1). If the U.S. had cut its corporate income tax rate 5 percentage points to 30 percent in 2012, the baseline revenue from the corporate income tax would have been reduced by nearly $35 billion per year. However, a reduction in income shifting would have expanded the base by a little more than $143 billion. The expanded base would garner an additional $43 billion in annual revenue. Thus, a five point cut in 2012 would have generated $8 billion in additional revenue.

Furthermore, Clausing’s estimates show that a corporate rate cut to 25 percent would be revenue neutral due solely to income shifting. The table below shows that, if the corporate income tax rate is reduced to 25 percent, the revenue from the corporate income tax would fall by $70 billion per year, but the lower, and more competitive corporate income tax rate, would attract more income shifting to the United States and expand the base by $278 billion per year, collecting an additional $70 billion in revenue. Thus, a corporate rate of 25 percent would raise slightly more revenue ($242.6 billion) than a 35 percent corporate income tax rate ($242.3) billion.

|

Note: Tax rates are statutory corporate tax rates. Tax revenue and income estimates are in millions of 2012 dollars. Source: Author’s calculations. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Corporate Income Tax Rate |

Baseline Corporate Revenue |

Income Shifted Due to Lower Rate |

Additional Corporate Revenue Due to Income Shifting |

Total Corporate Tax Revenue |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

35% |

$242 |

$0 |

$0 |

$242 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

30% |

$208 |

$143 |

$43 |

$251 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

25% |

$173 |

$278 |

$70 |

$243 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

20% |

$138 |

$369 |

$74 |

$212 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

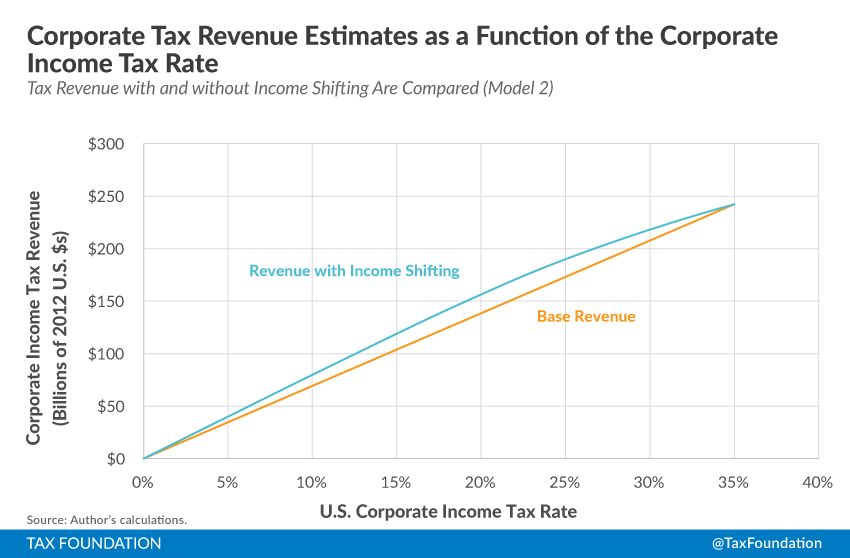

Chart 1.

Alternative Estimates of Income Shifting

In a meta-analysis of 25 income shifting studies by Heckemeyer and Overesch, the authors argue that the consensus of the literature places the semi-elasticity of income shifting far lower than the Clausing study.[10] That is to say, there is less income shifting occurring than Clausing’s estimates suggest. Using the average semi-elasticity of those studies, the model described in this paper would have a very different result.[11] A corporate income tax rate cut to 30 percent, instead of raising revenue, would only result in an additional $10 billion in tax revenue from income shifting, resulting in a net annual revenue loss of about $24 billion.

With the alternative estimates, a corporate income tax rate cut to 25 percent would not be revenue neutral (Table 2). A cut to 25 percent would only result in income shifting of approximately $67 billion, which would bring in an additional $17 billion in corporate income tax revenue. This would not be enough revenue to offset the initial $69 billion revenue loss. Thus, total corporate tax revenue would decline from $242 billion to $190 billion, a $52 billion loss of revenue.

These alternative estimates of income shifting suggest that the corporate income tax rate cuts do not pay for themselves, solely through income shifting effects. However, they still suggest that rate cuts do not reduce tax revenues as steeply as a conventional analysis would suggest.

|

Note: Tax rates are statutory corporate tax rates. Tax revenue and income estimates are in billions of 2012 dollars. Source: Author’s calculations. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Corporate Income Tax Rate |

Baseline Corporate Revenue |

Income Shifted Due to Lower Rate |

Additional Corporate Revenue Due to Income Shifting |

Total Corporate Tax Revenue |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

35% |

$242 |

$0 |

$0 |

$242 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

30% |

$208 |

$35 |

$10 |

$218 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

25% |

$173 |

$67 |

$17 |

$190 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

20% |

$138 |

$89 |

$18 |

$156 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Chart 2.

Conclusion

Multinational corporations use income shifting to mitigate the effects of corporate income taxes on their profits. Although there is little agreement on the magnitude, most scholars agree that the extent to which businesses shift income out of the U.S. is largely driven by the difference between the U.S.’s corporate income tax rate and that of other countries. This suggests that one of the drivers behind income shifting is the relatively high statutory corporate income tax rate of the U.S.

Using estimates from the academic literature, the model presented here predicts that a 25 percent corporate income tax rate collects the same amount of revenue as the current 35 percent rate or, at the very least, reduces revenue less than conventional estimates suggest.

[1] Kyle Pomerleau, 2015 International Tax Competitiveness Index, Tax Foundation, Sept. 2015, https://files.taxfoundation.org/docs/TF_ITCI_2015.pdf.

[2] Erik Cederwall, Tax Foundation Forum: Making Sense of Profit Shifting, May 12, 2015, Tax Foundation Tax Policy Blog, https://taxfoundation.org/blog/tax-foundation-forum-making-sense-profit-shifting.

[3] J.R. Hines & E.M. Rice, Fiscal Paradise: Foreign Tax Havens and American Business, 1994, The Quarterly Journal of Economics, 109(1), 149-182.

[4] Ibid

[5] K. Clausing, Multinational Firm Tax Avoidance and Tax Policy, 2009, National Tax Journal, Vol. 62, No. 4, pp. 703-725.

[6] The semi-elasticity approach assumes that one percentage point increase in the corporate income tax rate changed the amount of income declared in an affiliate by an estimated percent. In Clausing’s study, she assumes that a one percentage point difference between the U.S. and the host country changes the profits of the affiliates by 3.3%. She estimates this by regressing the difference in tax rates on the portion of sales booked as profit in the affiliates.

[7] Data is publicly available on the Bureau of Economic Analysis’s website: bea.gov/iTable/index_MNC.cfm.

[8] Data is publicly available on the Centre for Business Taxation’s website: www.sbs.ox.ac.uk/faculty-research/tax/publications/data.

[9] M.P. Devereux & R. Griffith, Evaluating Tax Policy for Location Decisions, 2003, International Tax and Public Finance, 10(2), 107-126.

[10] See J.H. Heckemeyer & M. Overesch, Multinationals’ Profit Response to Tax Differentials: Effect

Size and Shifting Channels, 2013, ZEW Discussion Papers, 13(045).

[11] The average semi-elasticity of the firm-level analyses is 0.8. The studies surveyed did not use the difference between the U.S.’s and the host countries’ effective average tax rates to estimate the semi-elasticity. These studies used the host countries’ statutory corporate income tax rate only. Thus, the difference model used to estimate the effect of lowering the U.S.’s corporate income tax rate may underestimate the actual income shifting.