CFC Rules in Europe

2 min readBy:Many businesses around the world operate in more than one country, making them subject to multiple tax jurisdictions. To prevent businesses from minimizing their taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one being the so-called Controlled Foreign Corporation (CFC) rules.

CFC rules apply to certain income generated by foreign subsidiaries. For example, if a business headquartered in France (with a combined corporate income tax rate of 32.02 percent) has a subsidiary in the Bahamas (which does not tax corporate income), France in certain cases may assert the right to tax the income earned by the Bahamian subsidiary. These rules aim to disincentivize businesses from moving their income to low-tax jurisdictions, as it can still be subject to domestic tax, and thus protect the domestic tax base.

CFC rules, although complex, generally follow the same basic structure. First, an ownership threshold is used to determine whether an entity is considered a controlled foreign corporation. Most European countries consider a foreign subsidiary a CFC if one or more related domestic corporations own at least 50 percent of the subsidiary.

Second, once a foreign subsidiary is considered a CFC, there is a test to determine whether the subsidiary’s income should be taxed domestically. Most European countries determine a subsidiary taxable if the foreign tax jurisdiction levies a tax rate below a certain threshold and/or a certain share of the income is passive. Passive income includes non-traditional production activities, such as interest, dividends, rental income, and royalty income.

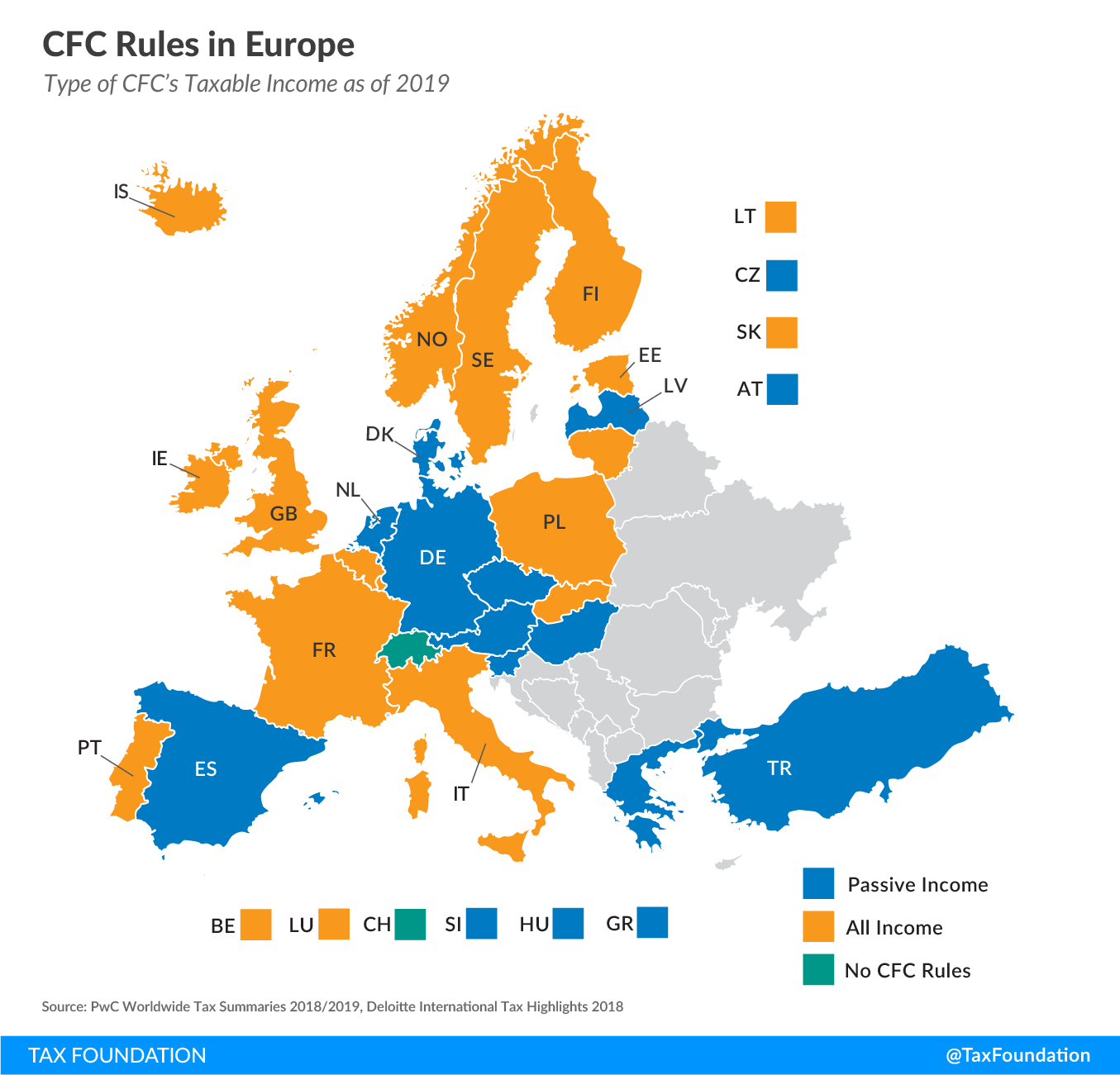

Third, once a foreign subsidiary is considered a CFC and its income is taxable domestically, a country defines what income earned by the foreign subsidiary is subject to tax. As the map below shows, this varies significantly among the European countries covered. While some countries tax only a CFC’s passive income, others tax all income of foreign subsidiaries (active and passive).

Eleven of the 27 countries covered in this map tax only a CFC’s passive income. These are Austria, the Czech Republic, Denmark, Germany, Greece, Hungary, Latvia, Netherlands, Slovenia, Spain, and Turkey.

Fifteen countries tax both active and passive income earned by a CFC. These are Belgium, Estonia, Finland, France, Iceland, Ireland, Italy, Lithuania, Luxembourg, Norway, Poland, Portugal, Slovakia, Sweden, and the United Kingdom.

Switzerland is the only country covered that has not enacted CFC rules.

A detailed report on CFC rules around the world will be published next week, followed by a series of case studies explaining how CFC rules work in the United States, China, Spain, Germany, Colombia, France, Netherlands, Japan, and the United Kingdom.

Share this article