Blog Articles

Reducing the Bias Against Long-term Investments

Other countries have shown that providing deductions in line with invested capital costs can have positive impacts both on investment and on debt bias.

7 min read

Alabama, Missouri Bills Would Exempt CARES Relief from Income Tax Calculation

Alabama and Missouri are considering excluding the CARES Act Economic Impact Payments from being taxed and exclude them from state income tax calculations.

2 min read

Gov. Hogan Vetoes Maryland Digital Advertising Tax Legislation

Gov. Hogan vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10 percent on digital advertising served to Marylanders.

3 min read

Watch: Coronavirus: A Path to Economic Recovery

What challenges should we expect to face as the U.S. economy begins to re-open? When is the right time for legislators to start focusing on long-term recovery vs. short-term needs? What policies should federal legislators pursue to clear a path to recovery?

1 min read

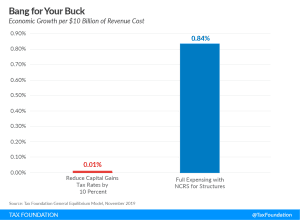

White House Considers Neutral Cost Recovery for Structures

When considering long-term policies for increasing long-run levels of investment and economic growth, full expensing and neutral cost recovery are better targeted than policies like a capital gains cut.

6 min read

Chaos to the Left of Me. Chaos to the Right of me.

The OECD recently announced that the negotiation timeline for new digital tax proposals has now been pushed back to October due to the COVID-19 pandemic, although the end-of-year deadline for the overall project is still in place.

5 min read

Reviewing the Economic and Revenue Implications of Cost Recovery Options

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth.

9 min read

Reviewing the Benefits of Full Expensing for the Post-Pandemic Economic Recovery

One of the most cost-effective policy changes would be to make full expensing of machinery and equipment permanent and extend this important tax treatment to structures as well as for firms in a net operating loss position.

7 min read

April 24th Afternoon State Tax Update

Virginia enacted a biennial budget, which includes a new excise tax on “skill games.” Meanwhile, Arizona and Connecticut announced plans to convene in special sessions later this year while Oklahoma gets the green light to use rainy day fund money to close budget gaps.

4 min read

Historic Oil Price Burns Hole in State Budgets

Alaska and North Dakota collect revenue primarily from oil-related taxes. These states must start thinking about how to plan for an era of reduced oil revenue.

5 min read

Louisiana Can Look to Tax Reform for Aid in a Post-Coronavirus Recovery

As states look for a path out of these fiscally troubling times, Louisiana has several options for aspects of its tax code to promote economic recovery and growth. The Pelican State’s federal deductibility, Corporation Franchise Tax, and sales tax structure present opportunities for beneficial tax reform in the wake of the coronavirus crisis.

3 min read

Watch: State Tax Policy and COVID-19

What could the next phase of relief look like and what role does tax policy play in ensuring the U.S. and countries around the world make a strong economic recovery?

1 min read

New Guidance on State Aid Under the CARES Act

The U.S. Department of the Treasury recently issued new guidance on allowable expenses using the $150 billion in state aid provided under the CARES Act, a point on which there has been considerable confusion.

3 min read

Senate Passes Additional Funding for Small Business Relief, But Questions Remain on the Deductibility of PPP Expenses

The sooner federal policymakers or regulators clarify tax questions about the Paycheck Protection Program (PPP), the more certainty firms will have when they accept the economic relief to keep their businesses afloat.

3 min read

Keeping it Simple: Approaching the Next Stage of Coronavirus Tax Policy

When businesses and taxpayers look to the government for relief, it is paramount that lawmakers do their best to craft transparent and coherent legislation that is the least confusing for all.

4 min read

Tax Policy After Coronavirus: Clearing a Path to Economic Recovery

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

States Should Be Allowed to Levy Sales Taxes on Internet Access

On July 1, sales taxes levied on internet access in six states—Hawaii, New Mexico, Ohio, South Dakota, Texas, and Wisconsin—will become illegal under the provisions of the Permanent Internet Tax Freedom Act (PITFA)

4 min read

A Review of Net Operating Loss Tax Provisions in the CARES Act and Next Steps for Phase 4 Relief

In addition to providing economic relief to individuals and loans to businesses struggling during the coronavirus crisis, the CARES Act changed several tax provisions to increase liquidity to ensure firms survive a large decline in cash flow.

7 min read