Blog Articles

Tax Policy Proposals for the German EU Presidency

While much of Germany’s EU presidency agenda is focused on policies to ensure economic stability and recovery from the COVID-19 pandemic, there’s a pair of tax proposals that the country is planning to develop and move forward at the EU level: a financial transaction tax and a minimum effective tax.

5 min read

Digital Tax Deadlock: Where Do We Go from Here?

We recently hosted an exclusive webinar discussion to get up to speed on recent digital tax developments and gain insight from leading international tax experts on the OECD’s BEPS project.

9 min read

Did 1986 Tax Reform Hurt Affordable Housing?

Improving cost recovery for residential structures, while not a silver bullet for solving the housing crisis, would on the margin encourage more construction that would help push rents down across the board.

4 min read

Iowa Decouples from 163(j) and GILTI, Clarifies Non-Taxation of PPP Loans

Iowa’s HF 2614, which passed both chambers of the legislature and now waits for the governor’s signature, makes several changes to the state’s tax code, which, although they will affect revenue, will encourage economic growth and make the state’s tax code more competitive.

4 min read

Montana Voters Will Decide on Recreational Marijuana

Montana could vote to legalize and tax recreational marijuana in November, bringing in an estimated $39 million by 2025, but would the move help with short-term budget issues?

4 min read

GAO Report Reveals Need to Simplify Next Round of Rebates

A new Government Accountability Office (GAO) report revealed that almost a half-million taxpayers missed their total rebate payment due to complications over disbursing funds to non-filers with eligible dependents. Administrability is just as important as rebate design and simplicity is just as important as speed.

3 min read

Improving the Tax Treatment of Residential Buildings Will Stretch Affordable Housing Assistance Dollars Further

By updating the tax code to allow developers to more fully cover their investments, construction costs will fall, which, in turn, means that federal affordable housing assistance dollars will go that much further in helping low-income tenants.

3 min read

European Countries Might Consider Scrapping the Bank Tax for Greater Financial Support

In the wake of the coronavirus crisis, some governments are seeking to cut bank taxes to enhance financial support to businesses and public investment projects.

2 min read

Three Reasons Expanding Credits Aren’t the Best Pandemic Response for the Vulnerable

While reforming certain tax credits may make sense, there are far better ways to provide individuals and families with more liquidity during this crisis.

6 min read

Why Neutral Cost Recovery Is Good for Workers

Studies have shown that accelerated depreciation helps increase wage growth. A recent report found that states that implemented accelerated depreciation in their tax codes led to a 2.5 percent increase in compensation per employee in manufacturing, relative to states that did not.

3 min read

Global Tax Relief Efforts Vary in Scope and Time Frame in Response to COVID-19

Countries around the world have implemented and continue to implement emergency tax measures to support their economies during the coronavirus (COVID-19) crisis.

5 min read

Full Expensing is Good for the Short Run and the Long Run

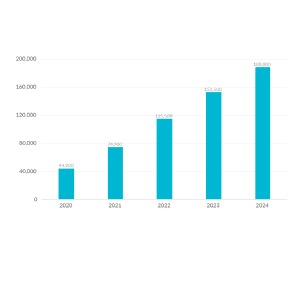

In the first year of enactment alone, we estimate the combination of full expensing and neutral cost recovery would increase full-time equivalent employment by more than 44,000 jobs. The cumulative impact by year five of the policy would be nearly 200,000 new jobs.

4 min read

Michigan Vapor Tax Bill Gets It Half-Right

In line with the nationwide trend of taxing vapor products, the Michigan Senate has passed a new 18 percent tax on vapor products. These taxes are often intended to achieve a two-fold goal: deterring youth use and raising revenue. The Michigan bill is no exception.

4 min read

CARES Act Conformity Would Promote Economic Recovery in Nebraska

Nebraska lawmakers may ultimately opt for a package that includes both property tax relief and the renewal of business incentives, but they should avoid doing so at the expense of decoupling from the CARES Act’s liquidity-enhancing provisions.

6 min read

Cautionary Notes from CBO on the Effects of Federal Investment

Based on the CBO’s assessment of the economic and budgetary effects of federal investment, lawmakers should look to spur private sector investment rather than try to enact a massive federal infrastructure bill.

5 min read

A Blow to Pillar 1

The U.S. has called for a pause in global digital tax negotiations, dealing a blow to Pillar 1 of the OECD’s international tax project. What happens next could be very harmful for the global economy.

3 min read

Answering Four Questions About How Neutral Cost Recovery Works in Practice

A neutral cost recovery system lowers the short-term cost of the policy to the federal government while providing nearly equivalent economic benefits. While neutral cost recovery is not a new idea, there are several policy questions lawmakers will want to consider when designing this system.

6 min read

States Should Conform to These Four CARES Act Provisions to Enhance Business Liquidity

As policymakers continue evaluating their evolving revenue and spending options, the importance of enacting policies that enhance business liquidity must remain at the forefront.

9 min read