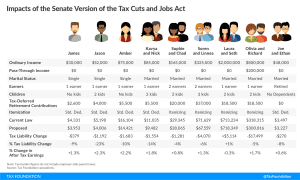

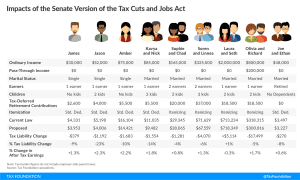

Who Gets a Tax Cut Under the Senate Tax Cuts and Jobs Act?

Here’s how the individual income tax provisions of the Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

Here’s how the individual income tax provisions of the Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

The Senate Tax Cuts and Jobs Act shares many things with its House counterpart, but also differs on several particulars. This guide consolidates all of the details of the Senate plan in one convenient location.

3 min read

The widely anticipated House Tax Cuts and Jobs Act includes hundreds of structural changes to the tax code. Here are the eight most important provisions in no particular order.

6 min read

The House Tax Cuts and Jobs act would fundamentally reform the U.S. tax code for the first time in over 30 years. Here are all the important details.

4 min read

When taking a closer look at the UK’s recent corporate tax reform experiment, it becomes clear that there was significantly more at work than just a simple rate cut. Increasing the effective marginal tax rate on new investments could have had a negative effect on wages, potentially offsetting the positive effects from the corporate rate cut.

4 min read

A cap on the state and local deduction would limit tax increases for high-income taxpayers but also raise about one-quarter the revenue as full repeal.

2 min read

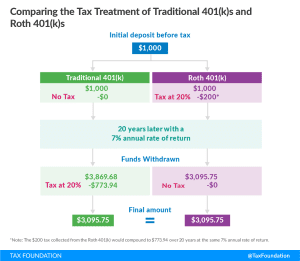

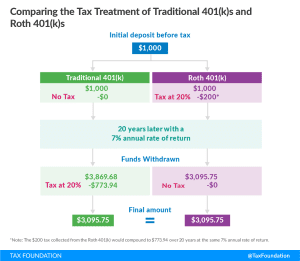

While no concrete plans for Rothification have been proposed, House GOP Republicans have kept the possibility on the table. Here’s what you should know.

4 min read

The elimination of tax expenditures is a popular way to pay for tax reform, but not all tax expenditures are equally worthy of elimination. It is important to ask, for each expenditure, whether it serves a reasonable purpose and whether it accomplishes that purpose in a reasonable way.

23 min read

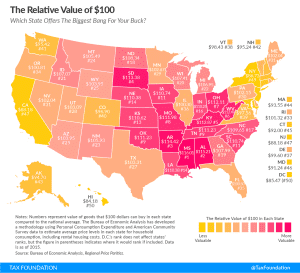

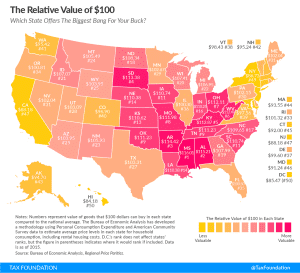

Prices for the same goods are often much cheaper in some states than others. Check out our new map to see what the real value of $100 is in your state.

3 min read