All Related Articles

A Border Adjustment Phase-in?

5 min read

Understanding the House GOP’s Border Adjustment

What is a border adjustment? What are the mechanics of how a border adjustment works, how would one affect U.S. businesses, and what are some pros and cons of enacting one?

29 min read

FAQs about the Border Adjustment

11 min read

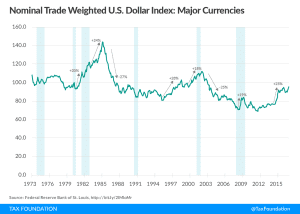

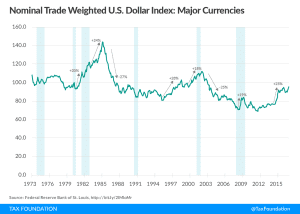

Exchange Rates and the Border Adjustment

7 min read

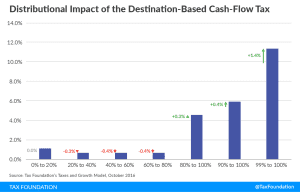

Details and Analysis of the 2016 House Republican Tax Reform Plan

According to the Tax Foundation’s Taxes and Growth Model, the plan would significantly reduce marginal tax rates and the cost of capital, which would lead to 9.1 percent higher GDP over the long term, 7.7 percent higher wages, and an additional 1.7 million full-time equivalent jobs.

15 min read