State Income Taxes and the 2024 NFL Draft Class

Here’s how much NFL players can expect to pay in state and local income taxes—to all relevant states—at multiple salary levels, by team.

7 min read

Here’s how much NFL players can expect to pay in state and local income taxes—to all relevant states—at multiple salary levels, by team.

7 min read

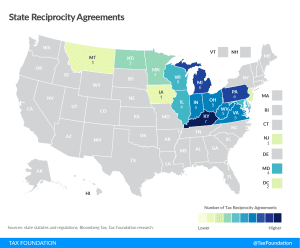

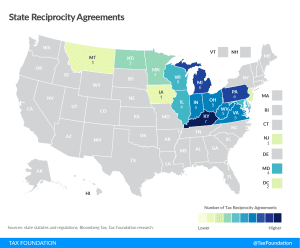

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Working from home is great. The tax complications? Not so much.

4 min read

If Alabama continues on its current path, its treatment of remote workers would be even more aggressive than that of New York—a shaky legal foundation.

6 min read

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

Spain should follow the example of Madrid, the country’s most competitive region. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

5 min read

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read

A question for policymakers to consider is how this new era of worker mobility will impact the fiscal landscape, and what changes must be made to address resulting revenue and compliance concerns.

6 min read

A rosy revenue outlook has allowed Ohio to join eight other states in providing tax relief this legislative session. The Ohio legislature agreed on a two-year budget, which includes individual income tax cuts.

4 min read

Ohio is one of a growing number of states which experienced revenue increases despite the economic slowdown from the coronavirus pandemic and is now looking to return some of that through tax relief.

5 min read

Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session, enacting three bills reducing individual tax rates, simplifying the state’s individual tax system, repealing 16 tax credits, and changing the apportionment factor for corporate income tax.

5 min read

State and local tax policy have always mattered, but the rise of remote work is bringing tax burdens and economic competitiveness to the forefront. It is a development that states cannot afford to ignore.

5 min read

Remote work is here to stay. Convenience rules can’t change that. What they can change is the decisions people make. Under this rule, those decisions may not be to Arkansas’s advantage.

4 min read

Policy changes to attract foreigners are not without benefits, but governments should carefully weigh the costs of the tax incentives against opportunities to implement broader tax reforms. A more efficient income tax system is a better objective than just focusing on incentives for foreigners to change their tax residence.

4 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

A recent Deutsche Bank analysis proposes a federal work-from-home tax (“privilege tax”), which is designed to strip away the financial benefit of remote work.

5 min read

The House Republican Study Committee released a proposal, “Reclaiming the American Dream,” which includes 118 policy recommendations to address education, labor, and welfare policy with the aim of expanding opportunity, liberty, and free enterprise for all Americans.

7 min read