Exploring Excise Tax Trends

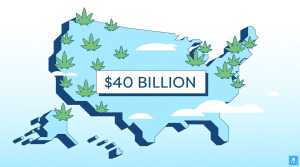

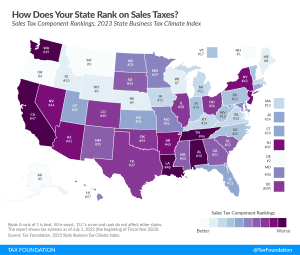

The tax base around the world is shrinking for traditional excise taxes, including taxes on tobacco, alcohol, and motor fuel. But newer excise taxes on things like carbon, cannabis, and ride-sharing are on the rise. What makes a good design for these taxes and where may excise taxes go in the future as the traditional “sin tax” base continues to shrink?